BRIEFING PAPERS

FOR ELECTED MEMBERS’

BRIEFING SESSION

Draft Only

to be held at

the Civic Centre

Dundebar Road, Wanneroo

on 28 February, 2012 commencing at 6.00pm

BRIEFING PAPERS

FOR ELECTED MEMBERS’

BRIEFING SESSION

Draft Only

to be held at

the Civic Centre

Dundebar Road, Wanneroo

on 28 February, 2012 commencing at 6.00pm

PROCEDURE FOR FULL COUNCIL BRIEFING

PRINCIPLES

A Council Briefing occurs a week prior to the Ordinary Council Meeting and provides an opportunity for Elected Members to ask questions and clarify issues relevant to the specific agenda items before council. The briefing is not a decision-making forum and the Council has no power to make decisions. The briefing session will not be used, except in an emergency, as a venue or forum through which to invoke the requirements of the Local Government Act 1995 and call a special meeting of Council.

In order to ensure full transparency the meetings will be open to the public to observe the process. Where matters are of a confidential nature, they will be deferred to the conclusion of the briefing and at that point, the briefing session closed to the public. The reports provided are the Officers’ professional opinions. While it is acknowledged that members may raise issues that have not been considered in the formulation of the report and recommendation, it is a basic principle that as part of the briefing sessions Elected Members cannot direct Officers to change their reports or recommendations.

PROCESS

The briefing session will commence at 6.00 pm and will be chaired by the Mayor or in his/her absence the Deputy Mayor. In the absence of both, Councillors will elect a chairperson from amongst those present. In general, Standing Orders will apply, EXCEPT THAT Members may speak more than once on any item, there is no moving or seconding items, Officers will address the members and the order of business will be as follows:-

Members of the public present may observe the process and there is an opportunity at the conclusion of the briefing for a public question time where members may ask questions (no statements) relating only to the business on the agenda. The agenda will take the form of:

Ø Attendance and Apologies

Ø Declarations of Interest

Ø Reports for discussion

Ø Tabled Items

Ø Public Question Time

Ø Closure

Where an interest is involved in relation to an item, the same procedure which applies to Ordinary Council meetings will apply. It is a breach of the City’s Code of Conduct for an interest to not be declared. The briefing will consider items on the agenda only and proceed to deal with each item as they appear. The process will be for the Mayor to call each item number in sequence and ask for questions. Where there are no questions regarding the item, the briefing will proceed to the next item.

AGENDA CONTENTS

While every endeavour is made to ensure that all items to be presented to Council at the Ordinary Council Meeting are included in the briefing papers, it should be noted that there will be occasions when, due to necessity, items will not be ready in time for the briefing session and will go straight to the Full Council agenda as a matter for decision. Further, there will be occasions when items are TABLED at the briefing rather than the full report being provided in advance. In these instances, staff will endeavour to include the item on the agenda as a late item, noting that a report will be tabled at the agenda briefing session.

AGENDA DISTRIBUTION

The Council Briefing agenda will be distributed to Elected Members on the FRIDAY prior to the Council Briefing session. Copies will be made available to the libraries and the Internet for interested members of the public. Spare briefing papers will be available at the briefing session for interested members of the public.

DEPUTATIONS

Deputations will generally not be heard prior to the Council Briefing session and are reserved for prior to the Ordinary Council meeting.

RECORD OF BRIEFING

The formal record of the Council Briefing session will be limited to notes regarding any agreed action to be taken by staff or Elected Members. No recommendations will be included and the notes will be retained for reference and are not distributed to Elected Members or the public.

LOCATION

The Council Briefing session will take place in the Council Chamber in the Civic Centre.

Briefing Papers for Tuesday 28 February, 2012

CONTENTS

Item 2_____ Apologies and Leave of Absence

3.1 Policy Review - City of Wanneroo Retaining Walls (Proposed LPP4.5)

Town Planning Schemes & Structure Plans

3.5 Proposed Liquor Store - DA2011/845 - 104 Kingsbridge Boulevard, Butler

3.6 Appointment of Community Representatives to the Environmental Advisory Committee

3.7 Compliments, Feedback and Complaints Policy

3.8 PT04-08/11: Anti-Social Behaviour - Rayner Drive, Landsdale

3.9 PT01-10/10: Anti-Social Behaviour - Ian Robbins Park, Alexander Heights

3.10 Application to Keep More Than Two Dogs

3.12 Tender No. 01141 - Provision of Illuminated Street Signs for a Period of Five Years

3.13 Anti Hoon Speed Hump Grant - Budget Variation

3.14 Parking Prohibitions - Roseworth Primary School

3.15 Backshall Place, Wanneroo - Partial Road Closure at Intersection With Ocean Reef Road

3.16 Benenden Avenue, Butler - Temporary Road Closure

3.17 PT01-12/11 - Request Traffic Calming Anchorage Drive, Mindarie

3.18 PT01-02/12 - Request Traffic Calming Langford Boulevard, Madeley

3.19 PT05-02/12 - Request Traffic Calming Jenolan Way, Merriwa

3.20 PT02-02/12 and PT03-02/12 - Palm Corner, Quinns Rocks - Footpath

3.21 Broadview Park, Landsdale - Limestone Wall Supporting the Pathway, Lookout and Gazebo

Corporate Strategy & Performance

3.23 Budget Principles and Parameters 2012/2013

3.24 Sale of Land for Non Payment of Rates - 38 Lakeview Street, Mariginiup

3.25 Change Valuation of Land Method

3.26 Waiver of Rates - Caravan Parks

3.27 Warrant of Payment for the Period to 31 January 2012

3.28 Financial Activity Statement for the Period Ended 31 December 2011

Governance and Executive Services

3.30 2011 Compliance Audit Return

3.32 Donations to be Considered by Council - March 2012

3.34 Review of Strategic Internal Audit Plan

Item 5_____ To Be Tabled at the Briefing

5.4 Motion on Notice – Cr Treby – Parking Controls Wanneroo Community Centre

5.5 Kingsway Regional Sporting Complex – Stage 2 Contractual Dispute (Confidential)

Item 6_____ Public Question Time

7.1 Consideration of the Sale of Lot 12 Fowey Loop, Mindarie

7.2 Review of Application to Keep More Than Two Dogs - 9 Howe Elbow, Quinns Rocks

Item 8_____ Date of Next Meeting

Agenda

Item 2 Apologies and Leave of Absence

Declarations of Interest by Elected Members, including the nature and extent of the interest. Declaration of Interest forms to be completed and handed to the Chief Executive Officer.

File Ref: 3072 – 11/118758

Responsible Officer: Director, Planning and Sustainability

Disclosure of Interest: Nil

Attachments: 2

Issue

To consider proposed Local Planning Policy 4.5 – Subdivisional Retaining Walls (LPP 4.5) for consent to advertise for public comment, in accordance with Part 8.11 of District Planning Scheme No. 2 (DPS 2). A copy of LPP 4.5 is included as Attachment 1.

Background

Nearly all ‘greenfields’ subdivisions in the City of Wanneroo incorporate some element of retaining for new lots, due to factors such as existing topography, multiplicity of surrounding landownership, and the need to coordinate finished road levels with existing surrounding roads. In those instances, Administration strives to achieve negotiated outcomes with the relevant subdividers, to reduce the extent and height of retaining walls as far as practicable. Typically, these negotiations occur after the Western Australian Planning Commission (WAPC) has granted its subdivision approval, but before the City issues its ‘clearance’ of the applicable engineering subdivision condition(s). The reason for this is that development works undertaken as part of a subdivision approval (such as earthworks, retaining walls and construction of roads etc) can occur without the need for separate planning approval.

The abovementioned approach was challenged in 2010 in State Administrative Tribunal (SAT) case DR207 of 2010 (Alessi vs City of Wanneroo). This case involved retaining walls over 4.0 metres in height, which were approved by Council and later contested by an adjoining landowner (Alessi).

The City’s existing ‘Retaining Walls’ policy (refer Attachment 2), requires retaining walls (that abut land in different ownership) to be assessed in accordance with the Residential Design Codes of WA (R-Codes). The R-Codes primarily relate to dwelling construction and associated built form provisions, but do not apply to broad acre subdivisional retaining wall heights. In the ‘Alessi’ case, the Minister determined on advice from SAT that a separate planning approval under the City’s DPS 2 was not required for subdivisional retaining walls.

Whilst this finding supported the City’s approach and decision, the case highlighted the need for the City to provide improved guidance for the assessment of subdivision retaining wall heights, rather than relying on the design provisions of the R-Codes when planning approval under DPS 2 is not even required.

Detail

LPP 4.5 is intended to replace the City’s existing ‘Retaining Walls’ policy, which was first implemented in 1999 and was last reviewed in 2004. Unfortunately this existing policy fails to provide any meaningful guidance in determining appropriate retaining wall heights when proposed as subdivisional works.

The following objectives have been developed to ensure an acceptable, yet flexible standard applies to subdivisional retaining walls:

1. Encourage the provision of level residential building sites that can be effectively serviced.

2. Retain the natural topographic features of the locality by minimising the need to import or export large quantities of fill.

3. Minimise the need for large retaining walls as part of dwelling construction.

4. Coordinate subdivisional levels with adjoining landholdings, road reserves, natural features and public open space.

5. Minimise the height and impact of subdivisional retaining walls located on the boundary of land under separate ownership.

6. Minimise the height of subdivisional retaining walls visible from a public space (road reserve, recreation reserve) and/or abutting land in separate ownership.

Proposed LPP 4.5 provides clear guidance on the appropriateness of different retaining wall heights under various circumstances and subject to certain conditions. This guidance aims to minimise the extent of retaining walls that are visible from public spaces such as road reserves and public open space and promotes the retention of soil within the proposed lots and along rear and side boundaries, where the retaining walls will ultimately be screened from public view by the future construction of a dwelling.

The policy includes Table 1, which includes a summary of the acceptable heights, performance criteria for variations to the acceptable heights and unacceptable criteria.

A maximum retaining wall height of 1.5 metre is proposed as being acceptable in the following circumstances:

· Walls abutting land in different ownership.

· Walls abutting road reserves.

· Walls abutting public open space.

· Walls abutting other public areas (drainage reserves, community purpose sites, pedestrian walkways etc).

A maximum retaining wall height of 3.0 metres is proposed as being acceptable for internal subdivision retaining walls, as this provides the greatest opportunity to accommodate level differences, whilst minimising the visible extent of larger retaining walls on adjacent roads.

Such walls would be acceptable along the rear boundary and behind the front setback line of side boundaries (note that this height would apply where the wall abuts Crown land or land in a different ownership).

Walls exceeding the ‘acceptable’ height will still be required from time to time to facilitate the subdivision of undulating land, the servicing of proposed lots or to achieve desirable built form outcomes reflective of the local character. The draft LPP 4.5 incorporates provisions for dealing with such walls and sets out performance criteria, which will need to be considered.

LPP 4.5 also incorporates a number of retaining wall criteria that are unacceptable unless exceptional circumstances exist. These include:

· Walls greater than 4.0 metres in height.

· Walls greater than the ‘acceptable height’ that in the City’s opinion do not satisfy the applicable criteria for variations in Table 1 ‘Variations of Acceptable standards’.

· Walls greater than 2.5 metres in height that abut land under separate ownership, where an objection has been received from that land owner.

Consultation

In accordance with Part 8.11 of DPS 2, it is necessary to advertise a draft policy for public comment for a period of not less than 21 days. In this instance, the policy mainly impacts on the development industry and it is suggested that an extended advertising period of 35 days should be prescribed to enable the industry to fully consider the draft LPP 4.5 and provide submissions.

Advertising would be undertaken in the following manner:

· Advertisement in a local newspaper for two consecutive weeks;

· Display on the City’s website; and

· Referral in writing to the Urban Development Institute of Australia (WA), major land developers and consulting engineers (subdivision) operating in the City.

Comment

The current ‘Retaining Walls’ policy does not provide Administration, the development industry or members of the public with adequate guidance in determining the suitability of retaining wall heights proposed as part of subdivision. The current policy focuses on ‘authorising’ the City’s Engineer to approve retaining walls up to three (3.0) metres in height and the City’s Building Surveyor to issue a Building Licence where the application complies with:

1. An approval to Commence Development.

2. The Residential Design Codes of WA where applicable, or

3. A subdivisional Retaining Wall approved by the City’s Engineer.

The current policy also requires subdivision retaining walls on a common property boundary and within 10 metres of a dwelling to be determined in accordance with the Residential Design Codes of Western Australia (R-Codes).

The review of the policy has removed the above delegation criteria and only includes appropriate planning criteria for determining retaining wall heights proposed as subdivisional works in accordance with the provisions of draft LPP 4.5.

Statutory Compliance

In accordance with Clause 8.11.3.1(a) of DPS 2, Council may resolve to prepare and adopt a local planning policy to apply to any matter related to planning and development of the district. A draft policy must be advertised for public comment for a period of not less than 21 days after which time it is to be reviewed in the context of any submissions received. Council shall then resolve to either adopt the draft policy (with or without modifications) or not proceed with the draft policy.

Strategic Implications

The proposal accords with the following Outcome Objective of the City’s Strategic Plan 2006 – 2021:

“1 Environment

1.4 Improve the quality of the built environment”

Policy Implications

Draft LPP 4.5 – ‘Subdivisional Retaining Walls’, will supersede the current ‘Retaining Walls’ policy and establish standards for the assessment and determination of applications for subdivisional retaining walls.

The draft LPP 4.5 will guide the City in assessing detailed subdivision drawings submitted in accordance with Section 170 of the Planning and Development Act 2005.

Financial Implications

The cost of advertising the draft policy is estimated to be $500, which can be met from the

Planning and Sustainability Directorate operational budget.

Voting Requirements

Simple Majority

That Council PURSUANT to Clause 8.11.3.1(a) of District Planning Scheme No. 2 ADVERTISES draft Local Planning Policy 4.5 Subdivisional Retaining Walls, as contained in Attachment 1, for public comment for a period of not less than 35 days, by way of the following, to the satisfaction of the Manager Planning Implementation:

1. An advertisement in a local newspaper for two consecutive weeks;

2. Display on the City’s website; and

3. Referral in writing to the Urban Development Institute of Australia (WA), major subdividers and consulting engineers (subdivision) operating in the City of Wanneroo.

Attachments:

|

1. |

Revised Subdivision Retaining Walls Policy (LPP 4.5) |

12/20292 |

Minuted |

|

2. |

Current Retaining Walls Policy |

12/20312 |

|

CITY OF WANNEROO Agenda OF Elected Members' Briefing Session 28 February, 2012 12

Town Planning Schemes & Structure Plans

3.2 Adoption of East Wangara Neighbourhood Centre Structure Plan No. 81 - Lots 478 Prestige Parade & 479 Vision Street, Wangara

File Ref: 2958 – 11/113964

Responsible Officer: Director, Planning and Sustainability

Disclosure of Interest: Nil

Attachments: 7

Issue

To consider submissions on the proposed East Wangara Neighbourhood Centre Structure Plan No. 81 (CSP 81) at the close of advertising, to determine the modifications required and its acceptability for final approval and forwarding to the Western Australian Planning Commission (WAPC) for endorsement.

|

Applicant |

Taylor Burrell Barnett |

|

Owner |

Landcorp |

|

Location |

Lots 478 Prestige Parade and 479 Vision Street, Wangara |

|

Site Area |

1.1052 hectares |

|

MRS Zoning |

Industrial |

|

DPS 2 Zoning |

Centre |

Background

The draft CSP 81 was lodged with the City by Taylor Burrell Barnett (TBB), on behalf of Landcorp, on 2 May 2011. The Structure Plan area comprises 1.1052 hectares of land encompassing Lots 478 Prestige Parade and 479 Vision Street, Wangara. The subject lots are located on the corner of Gnangara Road and Prestige Parade, bound by Gnangara Road to the south, industrial zoned land to the west, north and south; and rural zoned land to the north east (refer Attachment 1).

The land is zoned Industrial under the Metropolitan Region Scheme (MRS) and Centre under District Planning Scheme No. 2 (DPS 2).

On 5 August 2011, following the lodgement of draft CSP 81 by TBB, the Director Planning and Sustainability forwarded a memorandum to all Elected Members, providing the opportunity for members to request referral of the proposal to Council for consent to advertise. No such requests were received and advertising of draft CSP 81 subsequently commenced in accordance with Clause 9.5 of DPS 2 on 12 August 2011 for a period of 42 days, closing on 4 October 2011.

Following advertising of draft CSP 81, submissions were collated and a report on the matter was presented for discussion at the 6 December 2011 Council Briefing Session and included on the agenda for the 13 December 2011 Council Meeting for determination. However, the item was withdrawn from the scheduled Council Meeting at the request of the applicant in order to further address concerns relating to land use permissibility within the CSP 81 area. Administration has since undertaken further consultation with the applicant and the landowner to arrive at a revised CSP 81.

Detail

Draft CSP 81 has been prepared in order to satisfy the requirements of the ‘Centre’ zone under DPS 2 and to facilitate a commercial centre to service employees in the Wangara and Landsdale Industrial Estates.

The key elements of the draft CSP 81 are as follows:

· Lot 478 is zoned ‘Business’ and Lot 479 is zoned ‘Commercial’;

· No retail uses are to be permitted on Lot 478, while a maximum of 1,750m2 NLA retail floorspace would be permitted on Lot 479; and

· Land use permissibility for Lots 478 and 479 has been varied from the Zoning Table in DPS 2.

Attachment 2 contains the advertised version of the Part 1 Statutory Section of draft CSP 81, including the draft Structure Plan Map.

Consultation

Seven submissions were received during advertising of draft CSP 81; five of which raised no objection to the proposal and two which expressed specific concerns with the proposal. A summary of all submissions received, together with Administration’s response to each is included as Attachment 3.

In accordance with the City’s Local Planning Policy 4.2 – Structure Planning (LPP 4.2), Administration also conducted its assessment of draft CSP 81 during the advertising period. Administration’s recommended modifications arising from its assessment are included as Attachment 4.

The main issues identified in Administration’s assessment and the submissions received relate to:

· Permissibility of uses and possible land use conflicts with the surrounding industrial area; and

· Traffic impacts on the surrounding road networks.

A more detailed discussion of the abovementioned issues is provided in the Comment section of this report.

Comment

Permissibility of Uses and Land Use Conflicts

Draft CSP 81 proposes to zone the subject lots ‘Commercial’ and ‘Business’, and to apply the land use permissibility of these zones. The advertised version of CSP 81 proposed a number of land use controls (refer Attachment 2). However a number of the land uses initially proposed were considered by Administration to be sensitive to and potentially incompatible with the surrounding ‘General Industrial’ zoned area.

The Environmental Protection Authority (EPA) has prepared a Guidance Statement that recommends separation distances between industrial and sensitive land uses, to avoid conflicts between incompatible land uses.

Considering the Wangara area has historically been a general industrial area, it is of primary importance that the land use permissibility proposed by CSP 81 does not prejudice the existing and future development of the adjoining General Industrial Zone.

Lots 78 & 80 Gnangara Road, Landsdale, which are adjacent to the CSP 81 area, have approval for and are currently operating as ‘concrete batching plants’, while Lot 79 Attwell Street, Landsdale, has an approval to be used for and is currently operating as a ‘waste processing and transfer facility’. Both of these uses could potentially impact upon sensitive land uses located in CSP 81.

Under the EPA’s Guidance Statement, the separation distance for a ‘concrete batching plant’ is between 300-500m and is the shortest distance measured from the boundary of an area used for an industrial land use and the boundary of an area used by a sensitive land use. The CSP 81 area is located completely within this recommended separation distance from the ‘concrete batching plants’ operating on Lots 78 & 80 Gnangara Road, Landsdale. Attachment 5 shows the ‘Centre’ zoned land subject of CSP 81 and the surrounding ‘General Industrial’ zoned land. A ‘concrete batching plant’ use class is a discretionary ‘D’ use in the ‘General Industrial’ zone, together with other potentially hazardous industrial uses. This reinforces the industrial nature of the surrounding area, the potential for hazardous industrial land uses to impact upon the CSP 81 area and the need to ensure CSP 81 does not allow sensitive land uses or development that would be impacted upon by existing adjacent industrial operations or preclude ‘General Industrial’ development from occurring in the surrounding area in the future.

Under the EPA’s Guidance Statement, sensitive land use is defined as:

‘Sensitive land use – land use sensitive to emissions from industry and infrastructure. Sensitive land uses include residential development, hospitals, hotels, motels, hostels, caravan parks, schools, nursing homes, child care facilities, shopping centres, playgrounds and some public buildings. Some commercial, institutional and industrial land uses which require high levels of amenity or are sensitive to particular emissions may also be considered “sensitive land uses”. Examples include some retail outlets, offices and training centres, and some types of storage and manufacturing.’

Similarly, under DPS 2, a sensitive use is defined as:

‘Sensitive Use: means any use in which the people involved in that use may have reason to object to noise, dust, odour and other impacts which may arise from rural resource operations and includes, but is not limited to, residential, hospitals, schools, shops and all public establishments where food and drink is consumed.’

Though it is recognised that the definition of sensitive use under DPS 2 makes reference to ‘rural resource operations’ only, it (together with the EPA’s definition for sensitive land use) does serve to provide guidance on land use types that are considered sensitive.

Modifications to Land Use Permissibility

In the CSP 81 report that was presented at the 6 December 2011 Council Briefing Session, Administration recommended that the permissibility of a number of sensitive land uses (as defined under the EPA’s Guidance Statement and DPS 2) be amended in CSP 81 in order to reduce the potential impact and conflict with the surrounding ‘General Industrial’ area. In this way, sensitive land uses under CSP 81 were designated as either ‘A’ uses (meaning a use that is prohibited until advertising has been undertaken and Council has exercised its discretion to otherwise approve the use) or ‘X’ uses (meaning a prohibited land use). Sensitive land uses designated as ‘A’ uses included:

· Civic Building

· Consulting Room

· Drive-Through Food Outlet

· Education Establishment

· Lunch Bar

· Medical Centre

· Office

· Restaurant

· Shop

· Supermarket

· Take-Away Food Outlet

· Tavern

· Veterinary Consulting Room

Sensitive land uses designated as ‘X’ uses included:

· Child Care Centre

· Hospital

It is the land uses that were designated ‘A’ uses by Administration that were the subject of subsequent discussions and a meeting between Administration and the landowner and applicant. As a result of these discussions it was concluded that sensitive land uses would be better controlled through a ‘D’ use designation rather than an ‘A’ use designation requiring advertising. A ‘D’ use means a land use that is prohibited unless the Council has exercised its discretion to otherwise approve the use. In considering a ‘D’ use, Council may also choose to advertise that use for public comment before making its determination. As a result, land uses considered to be sensitive uses under CSP 81 (and previously recommended to Council in December 2011 as ‘A’ uses) are now proposed to be designated as either ‘D’ or ‘X’ uses, with the exception of ‘Office’, which is designated as a ‘P’ use.

With respect to premises where food and drink is sold or consumed, a ‘lunch bar’ is designated a ‘D’ use in the ‘General Industrial’ zone under DPS 2. On this basis, sensitive land uses where food and drink is sold or consumed likewise have been designated a ‘D’ use under CSP 81. Land uses where food and drink is sold or consumed include ‘drive-through food outlet’, ‘lunch bar’, ‘restaurant’, ‘shop’, ‘supermarket’, ‘take-away food outlet’ and ‘tavern’. ‘Consulting room’, ‘medical centre’, ‘veterinary consulting room’ and ‘educational establishment’ have been designated ‘D’ use permissibility in CSP 81 also, as they are land uses that Administration considers to be potentially sensitive to particular emissions from industry and discretion is required to be exercised in Council granting its approval.

Sensitive land uses that are prohibited in CSP 81 include ‘hospital’ and ‘child care centre’, as they are particularly sensitive to potential industry emissions and thus considered inappropriate and incompatible with the surrounding ‘General Industrial’ zoned land. ‘Office’ is identified in the EPA’s Guidance Statement as a potentially sensitive land use. However, Administration does not consider ‘Office’ to be a sensitive land use, given that many, if not all, nearby businesses operating in the ‘General Industrial’ zone will typically include an office component. Further, an ‘Office’ is not considered particularly sensitive to industrial emissions, such as noise and dust. As such, ‘Office’ and similarly ‘Bank’ have been designated ‘P’ (permitted) uses in the CSP 81 area; consistent with DPS 2 land use permissibility for ‘office’ and ‘bank’ in the ‘Commercial’ and ‘Business’ zones. A comparison between the permissibility of land uses in the ‘Business’ and ‘Commercial’ zones under DPS 2 and the land use permissibility now proposed by Administration (and agreed by the proponent) for revised CSP 81 is included in Attachment 6. Included as Attachment 7 is Administration’s revised CSP 81 (Part 1 – Statutory Section) showing tracked changes over the previously advertised version of the structure plan.

Traffic Impacts on the Surrounding Road Networks

A submission by the Department of Transport (DoT) raised the issue that the rezoning of Lot 478 Prestige Parade to ‘Business’ and Lot 479 Vision Street to ‘Commercial’ would result in a significant increase in traffic movements and impact the surrounding road network. Administration considers that development of the two subject lots within the CSP area is unlikely to have any significant traffic impacts on the surrounding road network, given that vehicle access to and from the subject lots, and consideration of any potential effects that the development of the CSP area may have on the traffic movements of the surrounding road network, can be addressed by a detailed area plan (DAP) and through the development assessment process. At that more detailed stage of the planning process, when the specific land uses are proposed, a traffic impact assessment can be required if necessary.

Technical Appendices

The City’s LPP 4.2: Structure Planning (LPP 4.2) requires the lodgement of Part 3 – Technical Supporting Documentation for a centre structure plan. This part of the structure plan is required to contain a number of technical reports, including the following:

· Local Environmental Impact Assessment and Management Strategy;

· Local Water Management Strategy;

· Local Engineering Infrastructure Report;

· Local Transport Strategy;

· Local Community Development Strategy; and

· Local Heritage Strategy.

These technical reports have not been included as part of the Part 3 lodged, as required under LPP 4.2. The CSP 81 area forms part of the broader Agreed Structure Plan No. 10 – East Wanneroo Cell 8 and adjoining lots to its south have already been subdivided and developed. As such, matters ordinarily dealt with by these strategies and reports have previously been addressed through earlier structure planning, scheme amendment and subdivision processes. In light of this and together with the limited extent of the structure plan, Administration considers that these reports are not required to be provided as part of this structure plan proposal.

Conclusion

Lots 478 Prestige Parade and 479 Vision Street, Wangara are zoned ‘Centre’ under DPS 2. In accordance with the provisions of DPS 2, Council may require a structure plan as a prerequisite to subdivision and development in the Centre zone. Draft CSP 81 has thus been prepared for the subject lots and submitted for the City’s consideration and approval.

Draft CSP 81 is considered to be satisfactory for final approval by the City, subject to modifications as discussed above and depicted in Administration’s tracked changes version of the Part 1 – Statutory Section of the draft CSP, included as Attachment 7. These modifications incorporate all of Administration’s recommended changes to the land use permissibilities for CSP 81.

Statutory Compliance

This Structure Plan has been processed in accordance with the requirements of DPS 2. Clause 9.6.1 of DPS 2 provides that following advertisement of a Structure Plan, Council may refuse to adopt the Structure Plan or resolve that the Structure Plan is satisfactory with or without modifications. It is recommended that draft CSP 81 be approved subject to the modifications recommended in Attachments 3 and 4, as included in Attachment 7 of this report.

Strategic Implications

The proposal accords with the following Outcome Objective of the City’s Strategic Plan 2006 – 2021:

“3 Economic

3.1 Create strategic shifts in job markets to meet future needs and demands”

Policy Implications

The proposal has been processed in accordance with the City’s Local Planning Policy 4.2 – Structure Planning.

Financial Implications

Nil

Voting Requirements

Simple Majority

That Council:-

1. Pursuant to Clause 9.6.1 of the City of Wanneroo District Planning Scheme No. 2, RESOLVES that the draft East Wangara Neighbourhood Centre Structure Plan No. 81 submitted by Taylor Burrell Barnett, on behalf of Landcorp, is satisfactory subject to the Recommended Modifications contained within Attachment 3 and Attachment 4, as included in Attachment 7, being made to the satisfaction of the Director Planning and Sustainability;

2. REFERS the East Wangara Neighbourhood Centre Structure Plan No. 81 to the Western Australian Planning Commission for approval in accordance with Clause 9.6.1 of the City of Wanneroo District Planning Scheme No. 2;

3. NOTES the Schedule of Submissions provided in Attachment 3, ENDORSES Administration’s recommended responses to those submissions and FORWARDS that Schedule to the Western Australian Planning Commission and ADVISES submitters of its decision; and

4. Pursuant to Clause 9.6.5 of the City of Wanneroo District Planning Scheme No. 2, ADOPTS the duly modified East Wangara Neighbourhood Centre Structure Plan No. 81 documents and AUTHORISES the Mayor and Chief Executive Officer to SIGN and SEAL the documents once certified by the Western Australian Planning Commission.

Attachments:

|

1. |

Site Plan |

11/117410 |

|

|

2. |

Part 1 Statutory Section |

11/117412 |

|

|

3. |

Revised summary of submissions, responses and recommended modifications |

12/15404 |

Minuted |

|

4. |

Summary of CoW Administration Comments |

11/128921 |

Minuted |

|

5. |

Revised Zoning Plan |

12/15053 |

|

|

6. |

Revised Comparison of Use Class Permissibility between DPS 2 and CSP 81 |

12/16413 |

|

|

7. |

Revised Recommended Modifications for Part 1 Statutory Section |

12/21169 |

Minuted |

CITY OF WANNEROO Agenda OF Elected Members' Briefing Session 28 February, 2012 47

3.3 Adoption of Amendment No. 2 to the Draft East Wanneroo Cell 9 - East Landsdale Local Structure Plan No. 57

File Ref: 3290-02 – 12/11303

Responsible Officer: Director, Planning and Sustainability

Disclosure of Interest: Nil

Attachments: 6

Issue

To consider the submissions received during public advertising of Amendment No. 2 to the draft East Wanneroo Cell 9 – East Landsdale Local Structure Plan No. 57 (LSP 57) relating to Lot 165, Kingsway, Landsdale.

|

Applicant |

Greg Rowe & Associates |

|

Owner |

Mr & Mrs Bennett |

|

Location |

Lot 165 Kingsway, Landsdale |

|

Site Area |

2.0362 Hectares (ha) |

|

MRS Zoning |

Urban |

|

DPS 2 Zoning |

Urban Development |

|

Draft LSP 57 Zoning |

Residential R20/30 |

Background

Council, at its meeting on 30 June 2009, resolved to adopt draft LSP 57 (Item PS09-06/09). Draft LSP 57, among other matters, depicts a portion of “Public Open Space (POS) 12” and a portion of the proposed 18-metre (m) wide Higher Order Access Street (road) entirely on Lot 165, Kingsway, Landsdale. The extent of POS proposed on Lot 165 is 14,495m2.

On 24 August 2010, the Western Australian Planning Commission (WAPC) adopted draft LSP 57 subject to a number of modifications. Council, at its meeting of 16 November 2010, resolved to not agree to the draft LSP 57 as adopted by the WAPC mainly due to the modification requiring the pedestrian access ways between Cell 9 and East Wanneroo Cell 5 (Landsdale Gardens Estate), to be replaced with vehicular access (Item PS02-11.10).

Following Council’s decision of 16 November 2010, the owners of Lot 165 Kingsway, under sub-clause 9.12.3 of the District Planning Scheme No. 2 (DPS 2), appealed to the State Administrative Tribunal (SAT) requesting a review of the Council’s decision to locate the POS area and a portion of the 18m wide road entirely on their property. Attachment 1 contains an extract of draft LSP 57 depicting the POS on Lot 165 and the 18m wide road on its western and southern boundary. Lot 165 contains a residence and its appurtenant uses. At the SAT’s invitation, Council reconsidered the matter at its meeting of 5 April 2011 and resolved to defer its decision to enable a review of the options on the location of the POS area (Item CR01-04/11).

On 2 May 2011, Greg Rowe and Associates, representing the owners of Lot 165 Kingsway, Landsdale, submitted an application to the City requesting an amendment to draft LSP 57. The proposed amendment not only related to Lot 165, but also to the adjoining Lots 163 and 164 Kingsway, Landsdale. The details of the proposal are as follows:

1. To modify the road layout by moving a portion of the 18m wide road entirely on Lot 164 along its eastern boundary;

2. To reduce the extent of POS on Lot 165 from 14,498m2 to 10,687m2 by excluding the area occupied by the existing residence and its immediate surrounds;

3. The draft LSP 57 makes provision for a POS area of 3,793m2 on Lot 163, which forms part of “POS 11”. The total extent of ‘POS 11’ is 5,814m2 and includes a part of Lot 128 Kingsway. No POS is proposed on Lot 164. It is proposed to provide an additional POS of 1,049m2 on Lot 163 and a new POS area of 2,762m2 on Lot 164 in order to compensate for the POS area deleted from Lot 165. The additional POS equates to 3,811m2 (14,498m2 - 10,687m2); and

4. To zone the northern portion of Lot 165 measuring 7,781m2 in area (accommodating the existing residence and its immediate surrounds) as ‘Residential’ with a density coding of R20/30.

Attachment 2 contains a map depicting the proposed amendment and a concept plan of the proposed residential area by proposing ten (10) R20 lots.

On 2 June 2011, the Director, Planning and Sustainability (DPS) forwarded a memorandum to all Elected Members, providing the opportunity for members to request referral of the proposal to Council for consent to advertise. No such requests were received and, as such, advertising of the amendment proposal commenced on 24 June 2011 in accordance with Clause 9.5 of DPS 2.

The Amendment was advertised for public comment for a period of 42 days by means of an on-site sign, a notice on the City’s website and letters to the affected and adjoining landowners. The submission period commenced on 24 June and closed on 5 August 2011. The City received 19 submissions of which 18 supported the proposal and one from the owners of Lot 164 Kingsway, Landsdale, raising objections to the proposal. The City also received a 97-signature petition supporting the amendment proposal tabled by Cr Treby at the 23 August 2011 Council meeting with a further 15-signature petition supporting the proposal presented by Cr Blencowe at the same meeting.

The main issues raised by the objectors are as follows:

· How would the proposed relocation of the 18m wide road entirely on Lot 164 Kingsway benefit the owners of Lot 164?

· Strong reservation about the POS, which has now been allocated to the northern portion of their land. What are the cost sharing arrangements between all participating landowners?

· In the event the road is planned and constructed on their property, how would they be compensated for the loss of lots?

A summary of the submissions and Administration’s responses are contained in Attachment 3.

As the owners of Lots 164 and 165 were not in favour of locating a portion of the 18m wide road within their land, Administration proposed an alternative proposal as shown in Attachment 4. On 4 October 2011, the DPS, under delegated authority considered Administration’s alternative proposal and resolved to readvertise it inviting comments only from the owners of Lots 164 and 165 Kingsway, Landsdale and from the Public Transport Authority (PTA) and the Department of Education (DoE). As the 18m wide road was identified as a Bus route, it was necessary to seek the PTA’s comments.

On 11 October 2011, the DPS advised Elected Members of his decision to readvertise the proposal.

Detail

The details of the alternative proposals are as follows:

· Modify the road layout, by deleting the portion of the 18m wide road affecting either Lot 164 or 165 and reduce the width of the road between Kingsway and the northern east-west road shown on Lot 164 to 15 metres. Retain the width of the road along the southern boundary of ‘POS 12’ and PS site and up to Alexander Drive at 18m to accommodate on-street parking bays required for ‘POS 12’, the PS and the Local Centre;

· Reduce the extent of a portion of ‘POS 12’ on Lot 165 from 14,498m2 to 11,413m2 by excluding the existing residence and the immediate surrounds;

· Provide additional POS of 1,049m2 on Lot 163 and create a new POS of 2,036m2 on 164 in order to compensate for the POS area deleted from Lot 165, which equates to 3,085m2 (14,498m2 - 11,413m2); and

· Zone the northern portion of Lot 165 measuring 7055m2 in area and accommodating the existing residence and the immediate surrounds as ‘Residential’ with a density code of R20/30.

As a result of the proposed amendment, the Structure Plan, the Residential Coding Plan, the Zoning Plan, the Road Hierarchy Plan, the Public Open Space Plan and the POS schedule and the Bus Route Map of the draft LSP 57 will required to be amended accordingly.

Consultation

The alternative proposal prepared by Administration was advertised for a period of 21 days by means of writing only to the owners of Lots 164 and 165 Kingsway, Landsdale and to the PTA and DoE. The submission period closed on 7 November 2011. While the owners of Lots 164 and 165 supported the proposal, DoE did not support the proposal and requested the 18 metre road be reinstated, as shown on the original LSP 57. DoE also provided an alternative proposal, which is discussed in the Comment section of this report. PTA did not make any comments.

Comment

Attachment 5 contains an alternative proposal submitted by DoE. The salient features of this proposal are as follows:

1. Reinstating the 18-metre wide road within Lot 164, Kingsway, Landsdale along its eastern boundary. Entry to this road will be via Lot 165, Kingsway as per the provisions of the draft LSP 57;

2. Locating a portion of another 18-metre wide road within the PS site. In the draft LSP 57, this road was located on Lot 169, Kingsway (refer Attachment 1).

3. Reduction in the possible Residential Zone within Lot 165;

4. Proposing club and change rooms within Lot 165 abutting the 18m wide road; and

5. An indicative layout of the school footprint.

DoE has provided the following advice supporting its alternative proposal:

· To re-instate 18m wide road to the west of the ‘POS 12’ as shown on the original LSP 57 to facilitate direct access to the proposed club and change rooms and open space as well as allowing continuous circulation around the school site in an anti-clockwise direction for the provision of safe student drop-off;

· To reconfigure the proposed Residential Zone at the northwest portion of the Lot 165 to reduce its impact on ‘POS 12’ and therefore to reduce its impact on the school site and the oval; and

· The DoE’s ability to fully develop the school site is also compromised by the road to the east of the site, which has been reconfigured to permit the retention of an existing building, further reducing the width of the site.

Based on the alternative proposal submitted by DoE, the City has prepared a plan to determine the extent of the proposed residential zone on Lot 165 and the extent of ‘POS 11’ and ‘POS 12’ as shown on Attachment 6. The total extent of the proposed Residential Zone on Lot 165 is 5,017m2. The following POS analysis demonstrates no loss of POS area as a result of the amendment proposal.

a. As per the current POS Schedule:

|

POS |

Lot |

Area (m2) |

POS Area (m2) |

Credited Area (m2) |

Total Credited Area (m2) |

|

11 |

128 163

|

2,021 3,793

|

5,814

|

2,021 3,793

|

5,814 |

|

12 |

165 166 |

14,498 19,690 |

34,188 |

14,498 19,690 |

34,188 |

|

|

|

|

|

Total |

40,002 |

b. As per the proposed amendment, the proposed POS distribution is as follows:

|

POS |

Lot |

Area (m2) |

POS Area (m2) |

Credited Area (m2) |

Total Credited Area (m2) |

|

11 |

128 163 |

2,021 4,842 |

6,863 |

2,021 4,842 |

6,863 |

|

12 |

165 166 |

13,449 19,690 |

33,139 |

11,413 19,690 |

33,139 |

|

|

|

|

|

Total |

40,002 |

As the alternative proposal submitted by DoE affects Lot 164, Administration discussed the alternative proposal with the owners of Lot 164 who have advised that as this option does not propose a POS area within Lot 164, they would be supportive of locating the 18m wide road on their property.

It is recommended that Amendment No. 2 to the draft LSP 57 as shown on Attachment 6 be considered satisfactory and the Structure Plan, the Residential Coding Plan, the Zoning Plan, the Road Hierarchy Plan, the Public Open Space Plan and the POS schedule and the Bus Route Map of draft LSP 57 be amended accordingly.

Adoption of Amendment

The final adoption of amendment No. 2 to LSP 57 is subject to the provisions of clause 9.7.1 of DPS 2. Clause 9.7.1 provides that:

“…An amendment to a draft Structure Plan may be advertised by the Council at its discretion, however, the Council should not sign and seal the amendment, prior to the substantive Structure Plan being signed, sealed and certified by the Council and the Commission…”

Council considered LSP 57 at its meeting on 16 November 2010 where it was decided not to support the plan on the basis that Council did not agree with certain modifications requested by the WAPC, particularly in relation to through-roads between LSP 57 and the existing Landsdale Gardens Estate immediately to the west.

Therefore, as LSP 57 has not been finalised, Amendment No. 2 cannot itself be finalised. The amendment can, however, be supported by Council subject to the modifications recommended being made. Council may also decide that it is prepared to sign and seal the amendment subject to the substantive LSP 57 being signed, sealed and certified by the Council and the WAPC.

Conclusion

The City has received a request to amend the draft LSP 57 by rezoning and recoding a portion of Lot 165 Kingsway to Residential R20/30; relocating a portion of the 18m wide Higher Order Access Road onto Lot 164 and proposing additional POS areas on Lots 163 and 164.

During the public comment period the owners of Lot 164 objected to the proposal. Administration suggested an alternative proposal, which was advertised by way of inviting comments from the owners of Lots 164 and 165 Kingsway, Landsdale and from the PTA and DoE. The alternative proposal deleted a portion of the 18-metre wide road. The DoE requested the reinstatement of this road by locating it on Lot 164. The owners of Lot 164 are supportive of locating the road within Lot 164 as shown on Attachment 6. It is recommended that the revised proposal, as depicted in that attachment, be considered satisfactory and that Council amend the Structure Plan, the Residential Coding Plan, the Zoning Plan, the Road Hierarchy Plan, the Public Open Space Plan and the POS schedule and the Proposed Bus Route plan of the draft LSP 57 and forward the amendment proposal to the WAPC for its consideration.

Statutory Compliance

This Structure Plan Amendment has been processed in accordance with the requirements of DPS 2. If the proponent of Amendment No. 2 (being the owner of Lot 165) is aggrieved by Council’s decision then they have the right to use the current SAT proceedings in an attempt to further advance their proposal.

Strategic Implications

The proposal accords with the following Outcome Objective of the City’s Strategic Plan 2006 – 2021:

“2 Social

2.1 Increase choice and quality of neighbourhood and lifestyle options”

Policy Implications

Nil

Financial Implications

Nil

Voting Requirements

Simple Majority

That Council:-

1. Pursuant to Clause 9.6.1 of the City of Wanneroo District Planning Scheme No. 2 RESOLVES that Amendment No. 2 to the East Wanneroo Cell 9 – East Landsdale Draft Local Structure Plan No 57 as shown on Attachment 6 to this report is SATISFACTORY subject to the following amendments:

Part 1 – Statutory Planning Section

a) The Structure Plan, the Residential Coding Plan, the Zoning Plan, the Public Open Space Plan and the Road Hierarchy Plan by depicting the road pattern as shown on Attachment 6 to this report;

b) The Local Structure Plan, the Residential Coding Plan and the Public Open Space Plan by depicting the Public Open Space disposition as shown on Attachment 6 to this report;

c) The Zoning Plan by zoning 5,017m2 area of Lot 165, Kingsway, Landsdale ‘Residential’ as shown on Attachment 6 to this report;

d) The Residential Coding Plan by recoding the proposed Residential Zone on Lot 165, Kingsway, Landsdale ‘Residential 20/30’; and

e) The POS schedule as follows:

|

POS |

Lot |

Area (m2) |

POS Area (m2) |

Credited Area (m2) |

Total Credited Area (m2) |

|

11 |

128 163 |

2,021 4,842 |

6,863 |

2,021 4,842 |

6,863 |

|

12 |

165 166 |

13,449 19,690 |

33,139 |

13,449 19,690 |

33,139 |

Part 2 – Explanatory Report

‘Figure 21 – Proposed Bus Route’ by modifying the bus route to accord with the road network shown on Attachment 6;

and SUBMITS three copies of the modified amendment document to the Western Australian Planning Commission for its adoption and certification;

2. Pursuant to Clause 9.6.5 of the City of Wanneroo District Planning Scheme No. 2, ADOPTS Amendment No. 2 to the East Wanneroo Cell 9 – East Landsdale Local Structure Plan No 57 following adoption of the structure plan amendment by the Western Australian Planning Commission;

3. Pursuant to Clause 9.7.1 of the City of Wanneroo District Planning Scheme No. 2 AUTHORISES the Mayor and Chief Executive Officer to SIGN and SEAL the amended documents after the substantive East Wanneroo Cell 9 – East Landsdale Local Structure Plan No. 57 being signed, sealed and certified by Council and the Western Australian Planning Commission; and

4. ENDORSES Administration’s responses and recommendations contained in Attachment 3 in respect of those submissions and ADVISES the submittors of its decision.

Attachments:

|

1. |

Lot 165 (474) Kingsway - A-1 |

12/14236 |

|

|

2. |

LOt 165- A-2 |

12/14240 |

|

|

3. |

Lot 165 - A-3 |

11/109101 |

Minuted |

|

4. |

Lot 165 - A-4 |

12/14237 |

|

|

5. |

LOt 165 - A-5 |

12/14241 |

|

|

6. |

LOt 165 - A-6 |

12/14247 |

Minuted |

CITY OF WANNEROO Agenda OF Elected Members' Briefing Session 28 February, 2012 62

Development Applications

3.4 Development Application - Proposed Mobile Telecommunication Facility - Lot 51 (20) Uppill Place, Wangara (DA2011/999)

File Ref: DEV11/1329 – 11/141371

Responsible Officer: Director, Planning and Sustainability

Disclosure of Interest: Nil

Attachments: 3

Issue

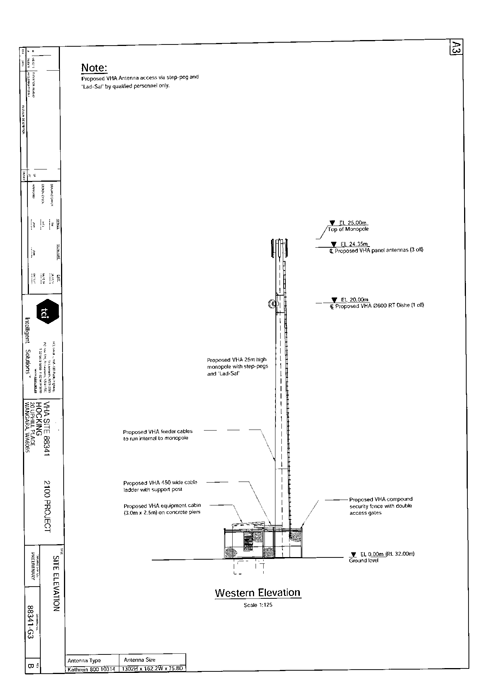

To consider a development application for planning approval of a 25 metre high telecommunication monopole and ground level equipment shelter at Lot 51 (20) Uppill Place, Wangara.

|

Applicant |

Planning Solutions (Aust) Pty Ltd |

|

Owner |

Roka Zora Vlahov |

|

Location |

Lot 51 (20) Uppill Place, Wangara |

|

Site Area |

1.1349 Hectares |

|

DPS 2 Zoning |

Service Industrial |

Background

The application has been made to introduce wireless network coverage to the rapidly developing Pearsall neighbourhood and the Wangara area. The subject lot is situated in Wangara, abutting Ocean Reef Road to the north, in proximity to its intersection of Wanneroo Road. The location is illustrated on Attachment 1 and is on a cleared, vacant part of this Industrial property.

This property is currently used for both a residential and an industrial purpose. The subject lot currently contains a dwelling (constructed in 1962, prior to the development of industry in its immediate surrounds), an outbuilding and a warehouse.

Detail

Plans for the proposed 25 metre monopole and equipment shelter are included as Attachment 2. Three panel antennae and one dish will be attached to the monopole, the antennae proposed at a height of 24.35 metres and the dish proposed at a height of 20 metres. The applicant has advised that the installation will comply with the Australian Communications and Media Authority’s requirements for electromagnetic radiation (EMR) exposure levels.

Consultation

The development application was advertised for public comment for a period of 28 days by means of an onsite sign, an advertisement in the Wanneroo Times newspaper, the City’s website and letters to landowners within 500 metres of the proposed development.

The submission period closed on 19 December 2011, with nine submissions received at the closing date. A summary of submissions, all of which object to the proposal, and Administration responses are provided in Attachment 3.

The main issues raised during the advertising period and following detailed assessment by Administration relate to the following:

· Loss of amenity resulting from the visual appearance of the proposed telecommunications infrastructure;

· Loss of property or rental value that could potentially result from the installation of the proposed telecommunications infrastructure; and

· Concerns of health implications resulting from EMR, emanating from the proposed telecommunications infrastructure.

A more detailed discussion of the major issues considered in the assessment of the application is provided in the Comment section.

Comment

Most landowners that objected to the proposal are located in Pearsall, on the opposite (northern) side of Ocean Reef Road, with the remainder being owners of an adjoining business in Wangara, and residents in Woodvale and Wanneroo.

The monopole structure is designed to reduce its visual impact by its relatively slim appearance. Many of the comments received during the consultation process expressed concern regarding the visual impact of the proposed monopole, particularly affecting views enjoyed by properties on Zingarello Street and Archer Street. Administration’s response is that the proposed monopole is not proposed at a natural high point in the local landscape and its height is therefore required to provide the coverage sought by the telecommunication carrier. In this context, the slimline design of the monopole is intended to, and in consideration of its design, limit its prominence and visibility as far as practicable. The monopole is proposed at a level considerably lower than the objector’s residing on Zingarello Street and Archer Street, with those streets being approximately 15 metres to 21 metres higher than the subject site.

The City is not responsible for regulating, testing or otherwise managing electromagnetic radiation (that is the Commonwealth Government’s responsibility), and the applicant’s advice that emissions meet Australian standards should be noted.

The City’s Mobile Telephone Base Station Policy (refer to policy implications below) stipulates a 500 metre buffer to sensitive land uses, including dwellings. Achieving the 500 metre buffer prescribed by Council’s policy is always difficult in residential neighbourhoods.

In terms of compliance with the City’s abovementioned Policy, the proposed telecommunication facility would be situated approximately 137m from the nearest Residential zoned land (on the north side of Ocean Reef Road). Approximately 300 dwellings exist within a 500 metre radius of the site of the proposed facility.

Administration sought further information from the applicant in terms of mobile telecommunication coverage in the area, to ascertain whether the proposed facility could be relocated to another property elsewhere in Wangara (in order to achieve a 500m separation distance from dwellings). Whilst these investigations revealed that many properties do exist in the Wangara industrial area that would achieve a 500m separation distance from dwellings (generally located south of Prindiville Drive and east of Pappas Street), the applicant has advised that properties in those areas are either outside the proposed coverage catchment and, in the case of existing telecommunication facilities located in those areas, the existing monopoles are already at capacity and cannot accommodate additional carriers. In view of this, if the proposed monopole were to be relocated elsewhere in Wangara to achieve a 500m separation distance from dwellings, it would need to be of a different design and construction (most likely significantly taller than the current proposal and therefore more visible) to provide the coverage sought in this instance.

Administration does not consider that would be a desirable outcome in terms of reducing impacts of such facilities on the visual amenity of the locality.

State Planning Policy 5.2 – Telecommunications Infrastructure (SPP 5.2) does not prescribe a separation distance from the dwellings, on the basis that the greatest demand for mobile telephone services is generated in residential areas.

So long as issues such as EMR and visual amenity can be addressed, there is scope to support mobile base stations which do not comply with the City’s policy. In this case, it is considered that the visual impact of the proposal will not be detrimental to the amenity of the locality. Further, the proposal will need to comply with applicable Australian standards in terms of EMR.

Statutory Compliance

Telecommunications Infrastructure is a ‘D’ (discretionary) use class in the Service Industrial Zone under District Planning Scheme No. 2.

Strategic Implications

The proposal accords with the following Outcome Objective of the City’s Strategic Plan 2006 – 2021:

“3 Economic

3.3 Provision of timely and coordinated regional infrastructure”

Policy Implications

An assessment of the proposal against the City’s Mobile Telephone Base Station Policy is provided in the Comment section of this report.

Financial Implications

Nil

Voting Requirements

Simple Majority

That Council:-

1. Under the provisions of clause 6.9.1 of the City of Wanneroo District Planning Scheme No 2, GRANTS planning approval to the application submitted by Planning Solutions Pty Ltd on behalf of Vodafone, to erect a 25 metre monopole and equipment shelter for a mobile telephone base station on Lot 51 (20) Uppill Place, Wangara, in accordance with the plans included as Attachment 2, and subject to the following conditions:

a) A schedule of colours and materials being submitted to the City to the satisfaction of the Manager Planning Implementation, prior to the issue of a building licence, demonstrating that the pole and equipment shelter will complement the surrounding locality as far as practicable;

b) No development or fencing (other than landscaping) shall be permitted on land required for future road or associated purposes;

c) No earthworks shall encroach onto the Ocean Reef Road reservation; and

d) No vehicle access shall be permitted onto the Ocean Reef Road reserve; and

2. ADVISES the submittors of its decision.

Attachments:

|

1. |

Attachment 1 - Location Plan - Lot 51 (20) Uppill Place, Wangara |

12/9908 |

|

|

2. |

Attachment 2 - Plans of the Proposed Telecommunications Infrastructure - Lot 51 Uppill Place, Wangara |

12/17605 |

Minuted |

|

3. |

Summary of Submissions - DA for Telecommunications Infrastructure at Lot 51 (20) Uppill Place, Wangara (V2) |

12/14370 |

|

CITY OF WANNEROO Agenda OF Elected Members' Briefing Session 28 February, 2012 73

File Ref: DEV11/1141 – 12/3928

Responsible Officer: Director, Planning and Sustainability

Disclosure of Interest: Nil

Attachments: 4

Issue

To consider a development application for a proposed Liquor Store at Lot 9031 (No.104) Kingsbridge Boulevard, Butler.

|

Applicant |

Connolly Boulevard Pty Ltd |

|

Owner |

Connolly Boulevard Pty Ltd |

|

Location |

(Lot 9031) No.104 Kingsbridge Boulevard, Butler |

|

Site Area |

3553m2 |

|

DPS 2 Zoning ASP 27 Zoning |

Urban Centre |

Background

The subject property is located on Kingsbridge Boulevard, Butler and is situated approximately 960 metres from Marmion Avenue to the West, and adjoins Connelly Drive to the East and Kingsbridge Park to the North (Attachment 1). Lot 9031 is zoned ‘Urban’ under the City’s District Planning Scheme Number 2 (DPS 2) and ‘Centre’ under Agreed Structure Plan No.27 (ASP 27). A subsequent Butler-Jindalee District Structure Plan No. 39 (DSP) identified a ‘Local Centre’ comprising retail NLA of 950m2 on the subject property.

An application for development approval for a shopping centre was submitted to the City on 4 January 2010. The application was conditionally approved at a Council Meeting held 27 July 2010 (Item PS05 -07/10). This approval nominated a total retail net lettable area (NLA) of 900m2, comprising two retail tenancies of 791m2 and 109m2 (As shown in Attachment 2) with adjoining common stock room, cool room, and a delivery area on the ground floor. A mezzanine level includes a plant room, staff room and toilet facilities. The total floorspace of the centre is 1255m2.

An application was submitted to the City on 30 August 2011 for development approval for a Liquor Store utilising the shopping centre floorspace. This application is the subject of this report.

The subject site is zoned ‘Centre’ Zone’. In accordance with the provisions of DPS2, no development shall be commenced or carried on land zoned ‘Centre’ until a further Structure Plan has been prepared and adopted. Subclause 9.11.2 states that if Council is required to consider an application in respect to a development before a further Structure Plan has been prepared and adopted, then Council shall do so considering the interests of orderly and proper planning and concern for the amenity of the locality in the short, medium and long term. The current proposal has been assessed in accordance with the requirements of Clause 9.11.2.

Detail

The proposal incorporates the reconfiguration of the shopping centre, and inclusion of a liquor store which comprises 114m2, with additional coolroom and storage area of 35m2.

The revised ground floor layout is contained in Attachment 3. The reconfiguration will result in no increase in Net Lettable Area, and no additional car parking bay requirement.

The operating hours as nominated in the application are 8.00am to 10.00pm Monday to Saturday, and 10.00am to 10.00pm on Sundays.

Consultation

Public consultation was undertaken for a period of 21 days by way of an advertisement placed in the Wanneroo Times, a sign erected on site, and letters to immediately adjoining landowners. At the conclusion of the comment period, nine written submissions were received, all objections to the proposal. A summary of submissions received and Administration’s responses are contained in Attachment 4.

The main issues raised during the advertising period and following detailed assessment by Administration relate to:

1. Anti-social behaviour

2. Land use conflict

3. Duplication of services – the proximity of other liquor outlets

4. Traffic generation and access

A more detailed discussion of the major issues considered in the assessment of the application is provided in the comment section.

Comment

Issue 1 – Anti-social behaviour

Concerns have been raised, in all submissions received, that the use of the site as a liquor store will attract anti-social behaviour to the locality, and that the use is not suitable in such proximity to a school, parks, and residences.

Response

The proposed liquor store will provide for the sale of alcoholic products, and in itself is unlikely to lead to anti-social behaviour. Whilst the proposed operating hours for the liquor store would provide a longer period of casual surveillance of the area, it is considered in this instance and given the proximity of residences that reduced hours of business may be appropriate to reduce the potential impact of noise and traffic. It is recommended therefore that the operating hours should conclude at 8:30pm in the evenings.

Issue 2 – Land Use Conflict

The proposed site is located in close proximity to two parks and two schools. Submissions received raised issues that the location of the liquor store near these community facilities would have an adverse impact on the users.

Response

It is not uncommon for commercial uses (including liquor stores) to be located within close proximity of community facilities and educational establishments. No evidence has been provided that supports the view that adverse impacts will arise where commercial and community uses are in close proximity to one another.

Issue 3 – Duplication of Services: the proximity of other liquor stores

Concerns were raised regarding the number of liquor stores within the locality and that there is no need for an additional outlet.

Response

The City does not have the ability to regulate the number of commercial premises within an area, as this is largely regulated by market forces. In addition, premises dealing with the sale of alcohol are further regulated by the Department of Racing, Gaming and Liquor who undertake further assessment of such proposals to determine the need prior to granting liquor licences.

Issue 4 – Traffic Generation and Access

Concern was raised by two submissions about traffic generation from the site, and proximity of entrances to the roundabout on Connelly Drive and Kingsbridge Boulevard.

Response

Traffic impacts were addressed in a report (Item PS 05 – 07/10) for the application for a Shopping Centre presented to council meeting held 27 February 2010. The proposal for a change of use only for a Liquor Store within the shopping centre, has no additional impact on volume of cars and access/egress, or for additional carbays as the floorspace is simply being reconfigured.

Conclusion

The proposal is capable of being approved, and despite objections it is a suitable use which is supported.

Statutory Compliance

This application has been assessed in accordance with Clause 9.11.2 the City of Wanneroo’s District Planning Scheme No. 2 in relation to Structure Plans 27 and 39, which refer to a Centre Zone.

Strategic Implications

The proposal accords with the following Outcome Objective of the City’s Strategic Plan 2006 – 2021:

“1 Environment

1.3 Minimise impact of development on the environment”

Policy Implications

Nil

Financial Implications

Nil

Voting Requirements

Simple Majority

That Council APPROVES the development application submitted by Connolly Boulevard Pty Ltd in accordance with the provisions of the City of Wanneroo District Planning Scheme No. 2, for a Liquor Store to be part of a proposed Shopping Centre at Lot 9031 (No.104) Kingsbridge Boulevard, Butler as shown on plans received 30 August 2011 subject to:

1. The Liquor Store approval shall be aligned with the previous Shopping Centre approval period which lapses 28 July 2012, and conditions 1-25 inclusive applied to the shopping centre;

2. Operating hours shall be limited to 8.00am to 8.30pm Monday to Saturday, and 10.00am to 8.30pm on Sundays; and

3. The total retail lettable area shall not exceed 900m2 for the proposed Shopping Centre, and Liquor Store. For the purposes of this condition, retail uses are those listed in the ‘Planning Land Use Category 5 shop/retail by WA Standard Land Use Classification’ as outlined in Appendix 4 of the Western Australian Planning Commission’s Statement of Planning Policy No.9 – Metropolitan Centres Policy Statement for the Perth Metropolitan Region, dated 17 October 2000.

Attachments:

|

1. |

Location Plan |

12/14359 |

|

|

2. |

Attachment 2 - Site Layout : Shopping Centre |

12/14366 |

|

|

3. |

Attachment 3 - Proposed Floor Plan : Liquor Store |

12/14371 |

|

|

4. |

Table of Submissions |

12/4933 |

|

Summary of Submissions – Proposed Liquor Store: 104 Kingsbridge Boulevard, Butler

|

No |

Name of Submittor |

Summary of Submission |

Administration Comment |

|

1.0

|

A and L Atkins 10 Aldreth Kane, Butler

|

Objection: · The proposal will result in increased anti-social behaviour in the area. · The proposal will result in a land use conflict with proximity to schools, parks, and children. · There are other liquor stores located within the vicinity of the subject site. |

Noted The issues raised are discussed in the body of the report. |

|

2.0 |

B and A Batten 6 Aldreth Lane, Butler |

Objection: · There are other liquor stores located within the vicinity of the subject site. |

Noted The issues raised are discussed in the body of the report. |

|

3.0

|

Adrian Price and Linda Koen 26 Woodstock Way, Butler

|

Objection: · The proposal will result in increased anti-social behaviour in the area. · The proposal will result in a land use conflict with proximity to schools, parks and children. · There are other liquor stores located within the vicinity of the subject site. |

Noted The issues raised are discussed in the body of the report. |

|

4.0 |

D.Pitt 1 Chorley Avenue, Butler |

Objection: · The proposal will result in increased anti-social behaviour in the area. · The proposal will result in a land use conflict with proximity to schools, parks and children. · There are other liquor stores located within the vicinity of the subject site. · The proposal will result in increased traffic generated from the premises and increased burden on the road network. |

Noted The issues raised are discussed in the body of the report. |

|

5.0 |

B and A Gudgeon 12 Moorlinch Street, Butler

|

Objection: · The proposal will result in increased anti-social behaviour in the area. · The proposal will result in a land use conflict with proximity to schools, parks and children. · There are other liquor stores located within the vicinity of the subject site. |

Noted The issues raised are discussed in the body of the report. |

|

6.0 |

J. Yap 1 Chorley Avenue, Butler

|

Objection: · The proposal will result in increased anti-social behaviour in the area. · The proposal will result in a land use conflict with proximity to schools, parks and children. · The proposal will result in the devaluation of surrounding properties. |

Noted The first two issues raised are discussed in the body of the report.

The property values due to the proposed land use are speculative and are not a valid planning consideration.

|

|

7.0 |

C. Coyte (Address not given)

|

Objection: · The proposal will result in increased anti-social behaviour in the area. · The proposal will result in a land use conflict with proximity to schools, parks and children. · There are other liquor stores located within the vicinity of the subject site. |

Noted The issues raised are discussed in the body of the report.

|

|

8.0

|

A.Wood (address not given)

|

Objection: · The proposal will result in increased anti-social behaviour in the area. · The proposal will result in a land use conflict with proximity to schools, parks and children. · There are other liquor stores located within the vicinity of the subject site |

Noted The issues raised are discussed in the body of the report. |

|

9.0 |

Silka (Address not given)

|

Objection: · The proposal will result in increased anti-social behaviour in the area. · The proposal will result in a land use conflict with proximity to schools, parks and children. |

Noted The issues raised are discussed in the body of the report.

|

CITY OF WANNEROO Agenda OF Elected Members' Briefing Session 28 February, 2012 82

Other Matters

File Ref: 1441 – 11/140234

Responsible Officer: Director, Planning and Sustainability

Disclosure of Interest: Nil

Attachments: Nil

Issue

To consider the appointment of community representatives to the Environmental Advisory Committee (EAC).

Background

In accordance with Section 5.11 of the Local Government Act 1995 (the Act), following the 2011 Local Government Elections, Council sought nominations for community representatives on its various advisory committees, including the EAC.

The main role of the EAC is to provide a forum for community participation in the preparation of the City’s environmental policies, strategies and other such matters referred to it by the City.

The EAC’s Terms of Reference provide for a maximum of 15 members, comprised of three elected members and a maximum of 12 community representatives. Council’s appointed elected member delegates to the EAC are Cr Guise and Cr Smithson. Cr Gray is the appointed deputy delegate. Currently none of the community representative positions are filled.

Detail

Only two community representative nominations were received for appointment to the EAC, from John Kelly, a resident of Woodvale and Kevin McLeod, a resident of Madeley.

Comment

Mr Kelly has been a community representative of the EAC since September 2005 and has provided advice and input into the preparation of the City of Wanneroo Local Biodiversity Strategy and Local Water Management Strategy as well as the Yellagonga Integrated Catchment Management Plan, Gnangara Sustainability Strategy and the Koondoola Regional Bushland Management Plan. He has extensive knowledge in various environmental issues and has attended local and state environmental seminars.

Mr McLeod has been a community representative of the EAC since April 2009 and has links to both the Yellagonga Advisory Committee as well as Friends of Yellagonga. He has attained environmental experience through his involvement with these groups, including working within the Friends of Yellagonga nursery to propagate plants used in rehabilitation projects within the Yellagonga Regional Park. He has also provided input into research projects for the University of Western Australia and Curtin University regarding the Oblong Turtle (Chelodiona oblonga).

Based on the experience and knowledge of the two community representative nominations, combined with the Councillor delegates, Administration feels that there is sufficient representation for the EAC to act effectively. This situation will be reassessed in the future should additional community members express an interest in joining the EAC.

Statutory Compliance

Pursuant to the Local Government Act 1995, Section 5.10(1)(a) requires, by absolute majority, a committee to have its members appointed by the local government.

Strategic Implications

The proposal accords with the following Outcome Objective of the City’s Strategic Plan 2006 – 2021:

“4 Governance

4.2 Improve community engagement”

4.2.1 Encourage community participation in the decision making process

Policy Implications

Nil

Financial Implications

Nil

Voting Requirements

Absolute Majority

That Council by ABSOLUTE MAJORITY APPOINTS to the City of Wanneroo Environmental Advisory Committee Mr John Kelly and Mr Kevin McLeod as community representatives.

CITY OF WANNEROO Agenda OF Elected Members' Briefing Session 28 February, 2012 84

City Businesses

File Ref: 2409 – 12/15065

Responsible Officer: Director, City Businesses

Disclosure of Interest: Nil

Attachments: 1

Issue

To consider the attached Compliments, Feedback and Complaints Policy at the Ordinary Council Meeting scheduled for 6 March 2012.

Background

The City’s current Complaint Handling Procedure was endorsed in 2003 at the Ordinary Council Meeting on 12 August 2003 (Resolution CEO2-08/03). The City has been using this procedure as a basis for operational complaint handling since this time.