BRIEFING PAPERS

FOR ELECTED MEMBERS’

BRIEFING SESSION

Draft Only

to be held at

the Civic Centre,

Dundebar Road, Wanneroo

on 18 June, 2013 commencing at 6.00pm

BRIEFING PAPERS

FOR ELECTED MEMBERS’

BRIEFING SESSION

Draft Only

to be held at

the Civic Centre,

Dundebar Road, Wanneroo

on 18 June, 2013 commencing at 6.00pm

Briefing Papers for Tuesday 18 June, 2013

CONTENTS

L.2 Integrated Planning & Reporting Framework

L.3 Amendment No. 122 to District Planning Scheme No. 2 - Northern Coastal Growth Corridor Development Contributions 462

Late Items Agenda

File Ref: 5509 – 13/59592

Responsible Officer: Director, Corporate Strategy and Performance

Disclosure of Interest: Nil

Attachments: 4

Issue

To consider adoption of the City’s Draft 2013/2014 Budget.

Background

In recent years, the Council had adopted a series of Budget Principles to apply prudent financial management practices in guiding the development of the Annual Budget and Long Term Financial Plan (previously referred to as Strategic Financial Management Plan). As the City has been currently undertaking extensive work with regard to the newly introduced Integrated Planning & Reporting Framework (IPRF) requirements, these Principles were maintained during the Budget development process. In addition, the following key economical parameters were recognised as part of the budget development:

- Forecast 2013/2014 CPI 2.5%

- Estimated growth in service requirement 4.0%

- Interest Rate on Investments 3.5%

In terms of working towards the adoption of the budget, a consistent approach to that of the previous year was taken, however as a separate report would also be presented to Council relating specifically to the IPRF, with the Long Term Financial Plan (LTFP) being a major component, this aspect will no longer be included as part of the Annual Budget report.

A series of Budget Workshops were arranged to involve and engage Elected Members as key stakeholders in the budget development process. The Workshops focused on discreet elements of the budget as outlined below:

· Budget Workshop 1 – Capital Works Program - Tuesday 12 March 2013

· Budget Workshop 2 – Operating Budget - Tuesday 9 April 2013

· Budget Workshop 3 – Preliminary Budget - Tuesday 14 May 2013

In considering the Budget, it is also timely to consider Regulation 34(5) of the Local Government (Financial Management) Regulations 1996, which requires a local government to adopt a percentage or value, calculated in accordance with Australian Accounting Standards, to be used in statements of financial activity for reporting material variances. For 2012/2013 the Council adopted 10% for the reporting of variances and the same percentage is proposed for 2013/2014.

Detail

In developing the 2013/2014 Budget, consideration has been given to the wider international economic context which remains quite uncertain and relatively weak in most leading countries like USA, China, India and most part of Europe. Australia’s domestic growth is expected to be quite modest and stable whilst inflation is anticipated to be in the range of 2-3% in the 2013/2014 financial year supported by the record low interest rate environment (cash rate is currently 2.75%).

At a local level for the City, this is being reflected as lower investment income potential, slightly slower than anticipated growth, delivering lower revenue growth and an unpredictable climate moving forward. Accordingly, a cautious approach has been taken in forecasting Revenues and activity levels for Wanneroo.

In conjunction with the Annual Budget development, Administration has continuously monitored the City’s financial performance for 2012/2013 to determine end of year forecasts and funding capacity for 2013/2014. This process has identified that the current 2012/2013 end of year Actual (Estimate) position will be an operational improvement of $6.172 million over that proposed in the original Adopted Budget, with the major contributor to this better than expected result being a 50% advance payment of 2013/2014 Financial Assistance Grants at approximately $3.006 million. This forecast result leaves the City in a stronger financial opening position for 2013/2014; however, a corresponding reduction of the early grant payment is reflected in the Operating Grants budget for 2013/2014 (neutral impact over two years).

The following documents provide a comprehensive outline of the proposed 2013/2014 Budget:

· 2013/2014 Annual Budget Overview (Attachment 1)

· 2013/2014 Statutory Budget (Attachment 2)

· 2013/2014 Capital Works Program (including carry forwards) (Attachment 3)

· 2013/2014 Schedule of Fees and Charges (Attachment 4)

The City of Wanneroo Budget has experienced continuous growth and this is primarily due to the following two factors:

1. Growth in the population and service area (expansion of service);

2. Community expectation and needs; and

3. Cost factor movements, such as Consumer Price Index (CPI), inflation or labour cost movements (increase to cost of service).

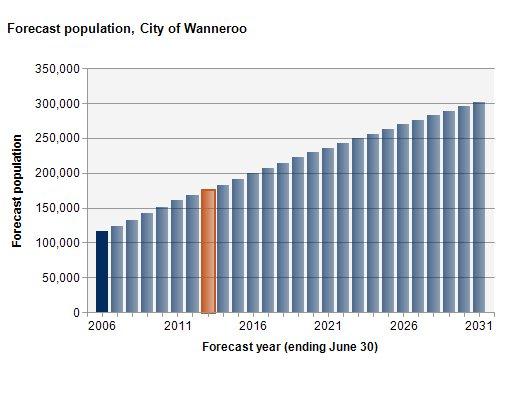

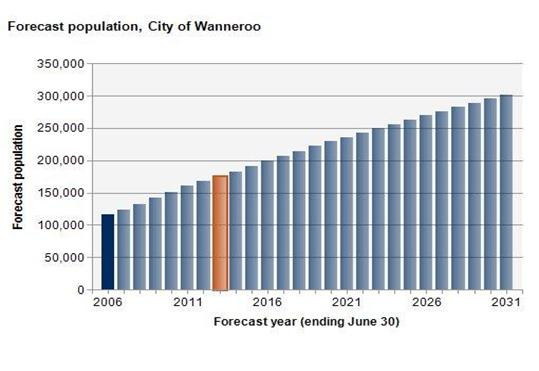

The City's population forecast estimates a population at 30 June 2013 of 175,081, up from 167,647 the previous year (7,434 or 4.43%).

The population growth in 2012/13 has been slightly lower than the above projection, with the following table reflecting growth statistics to end May and a projection to end June:

|

|

Actual 1/07/12 |

Actual 31/05/13 |

Forecast 30/0613 |

% Incr. |

|

New Lots Created |

68,250 |

2,742 |

2,991 |

4.4% |

|

Residential Development completed |

58,622 |

1,974 |

2,153 |

3.7% |

|

Population Increase |

167,647 |

5,646 |

6,200 |

3.7% |

The 2012/13 Budget was developed on the basis of a 4% growth factor, with an improvement to 5% being factored into 2013/14 in the Long Term Financial Plan. In terms of rate revenue, the 4% growth has been achieved in 2012/13, however on current trend, 4% has been maintained for 2013/14.

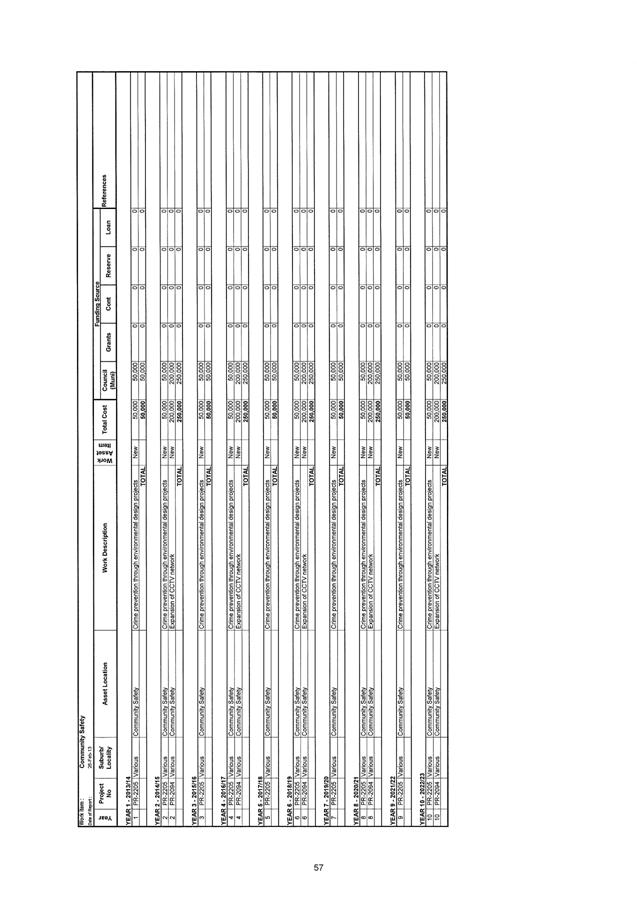

The development of the 2013/2014 Operating Budget recognises a steady improvement in the City's financial position and an opportunity to continue building on the essential services our residents rely on, with the health and wellbeing of the Wanneroo community continuing to be supported through the Community Development Budget, whilst priorities have been placed on the community safety initiatives, maintenance and upgrade of existing assets as well as provision for the development of new community buildings and sporting facilities in various locations.

Operating Budget Overview

Attachment 2 provides the detailed Annual Budget, with the Statement of Comprehensive Income (Nature and Type) reflecting the following totals in respect to the Operating position.

|

|

2012/2013 Adopted Budget $ Million |

2013/2014 Budget $ Million |

Increase $ Million |

Increase % |

|

Operating Income |

138.286 |

149.805 |

11.519 |

8.3 |

|

Operating Expenditure |

140.595 |

151.383 |

10.788 |

7.7 |

Comments relating to increases in the Operating Expenditure are:

· Employee Costs $4.449 million (+7.4%)

Reflects increase in the establishment through the endorsed Workforce Plan, together with standard annual increments to pay rates endorsed in the various Collective agreements.

· Materials and Contracts $3.192 million (+7.8%)

Reflect CPI adjustments and ongoing expansion in asset maintenance costs and responsibilities.

· Utility Charges $0.512 million (+6.9%)

Forecasted increase in Electricity, Gas and Water charges, together with growth factor for new assets and expansion of street lightning network.

· Depreciation on Non-Current Assets $2.629 million (+9.7%)

Increase in Depreciation associated with the City’s continuously expanding asset base. This increase when compared to 2012/2013 Revised Budget reduces to 4.8% ($1.287 million) in recognition of adjustments during the current financial year.

Administration Overhead Costs

During Budget Workshop 3, Elected Members requested Administration to provide benchmark details (ratios/graphs) on the administrative overhead costs of the City compared to total cost as part of the budget adoption material. Administration has researched and compiled the information below based on the 2009/10 to 2011/12 actual financials comparing to Cities of Perth, Joondalup, Swan and Stirling together with the ratio for the City for Budget 2013/14.

Selected Councils Annual Ratio Comparison for 2009/2010 to 2011/2012

It should be noted that based on the Local Government Accounting Manual issued by the Department of Local Government, all local governments' administrative overhead costs are described as Governance costs which include administration and operation of facilities and services to members of council and all costs that related to the tasks of assisting Elected Members and ratepayers on matters which do not concern specific council services or programs. As reflected by the ratios comparison, the City continuously maintains a very low administrative overhead ratio from 2009/10 to Budget 2013/14, at the range of 3.68% to 4.70%.

Fees and Charges

The Schedule of Fees and Charges for 2013/2014 is included as Attachment 4 for adoption by Council and to be effective from early in the new financial year (28 July or as soon as practicable). Details of all changes from those in 2012/2013 have been highlighted in the schedule.

Rate and Rubbish Charges

In developing the Rating strategy, Administration has endeavoured to retain equity and fairness in the process, by ensuring that the setting of the Minimum Rate and calculation of the Rate-in-the-Dollar only recovers an amount (referred to as the Budget Deficiency), which is considered essential to the running of Council activities as reflected in the long term financial plan.

Based on the level of Budget Deficiency, the Rate increase has been calculated on an average 5.5% increase. As per previous years the Domestic Refuse Collection service will form part of the normal activities of Council and be included as part of the General Rates, which ensures that the full benefit can be obtained from the State Government’s Pensioner Rate Rebate Scheme.

It should be noted that properties rated on an Unimproved Value (UV) basis are revalued annually, whereas Gross Rental Values (GRV) are revalued every three years (next review for 2014/2015). Where a revaluation has a significant impact on the category, an adjustment can be made to the Rate-in-the-Dollar to minimise the revaluation impact. This has not been necessary for the 2013/2014 Budget period.

In accordance with the requirements of Section 6.36(1) of the Local Government Act 1995, a notice was published on 21 May 2013 detailing proposed Differential and Minimum Rates for 2013/2014.

Due to a requirement to ensure no more than 50% of rates in any one category are minimum rated, on further modelling, it has been necessary to reduce the proposed Minimum Rate for GRV Residential Vacant. The following table demonstrates a comparison between the 2012/2013 Rates and the proposed Rates for 2013/2014. The City’s detailed Rate Setting Strategy is included in Attachment 2 - Annual Budget Overview.

|

Rate in the Dollar (cents) |

Minimum Rate $ |

||

|

GRV Category |

2012/2013 |

2013/2014 |

2012/2013 |

2013/2014 |

|

Caravan Parks & Park Homes Improved |

7.3520 |

7.7564 |

344 |

362 |

|

Commercial Improved |

7.1227 |

7.5144 |

1,076 |

1,135 |

|

Community Groups – Major Improved** |

7.8778 |

8.3111 |

228 |

240 |

|

Community Groups – General Improved |

3.7222 |

3.9269 |

228 |

240 |

|

Community Groups – Surf Club Improved |

1.9436 |

2.0505 |

228 |

240 |

|

Industrial Improved |

5.9959 |

6.3257 |

1,076 |

1,135 |

|

Industrial Improved – Storage Unit Lesser Minimum |

n/a |

n/a |

538 |

567 |

|

Residential Improved |

7.3530 |

7.7574 |

1,095 |

1,155 |

|

Rural and Mining Improved |

8.0397 |

8.4819 |

1,086 |

1,145 |

|

Commercial Vacant |

6.0865 |

6.4213 |

1,076 |

1,135 |

|

Industrial Vacant |

3.9192 |

4.1348 |

1,076 |

1,135 |

|

Residential Vacant |

10.2772 |

10.8424 |

665 |

668 |

|

Rural and Mining Vacant |

7.5130 |

7.9262 |

730 |

770 |

|

Rate in the Dollar (cents) |

Minimum Rate $ |

||

|

UV Category |

2012/2013 |

2013/2014 |

2012/2013 |

2013/2014 |

|

Commercial Improved |

0.2465 |

0.2597 |

1,076 |

1,135 |

|

Community Groups – Major Improved** |

0.2417 |

0.2550 |

228 |

240 |

|

Community Groups – General Improved |

0.1172 |

0.1237 |

228 |

240 |

|

Industrial Improved |

0.2304 |

0.2420 |

1,076 |

1,135 |

|

Residential Improved |

0.3135 |

0.3304 |

1,095 |

1,155 |

|

Rural and Mining Improved |

0.3130 |

0.3211 |

1,086 |

1,145 |

|

Commercial Vacant |

0.2613 |

0.2757 |

1,076 |

1,135 |

|

Industrial Vacant |

0.2577 |

0.2719 |

1,076 |

1,135 |

|

Residential Vacant |

0.3618 |

0.4296 |

665 |

701 |

|

Rural and Mining Vacant |

0.3280 |

0.3410 |

730 |

770 |

** = Sporting Clubs and Major Event Providers.

The City will also be responsible for collecting the Emergency Services Levy (ESL) on behalf of the Fire and Emergency Services Authority (FESA), which is determined each year by the Minister and is classified into five categories to reflect the level of emergency service response that is available in different areas. The City of Wanneroo levies the ESL for four of the categories in conjunction with the annual Rates charges.

The City also administrates the rebate to pensioners and seniors under the Rates and Charges (Rebates and Deferments) Act 1992 which are funded by the State Government.

For 2012/2013 Council approved the waiver of Council Rates (excluding the Emergency Services Levy) for land occupied by City of Wanneroo community groups. The same waiver is proposed for 2013/2014 for the groups listed below with the value of Rates revenues to be waived approximately $0.050 million:

|

- AJS Motorcycle Club of WA Inc |

|

- Kingsway Football & Sporting Club Inc |

|

- Kingsway Olympic Sports Club |

|

- Quinns Mindarie Surf Lifesaving Club Inc |

|

- Quinns Rocks Sports Club |

|

- Tiger Kart Club Inc |

|

- Wanneroo Agricultural Society |

|

- Wanneroo Amateur Football Club Inc, Wanneroo Cricket Club, Wanneroo Junior Cricket Club Inc & Wanneroo Junior Football Club (Wanneroo Showgrounds Clubrooms) |

|

- Wanneroo BMX Club |

|

- Wanneroo City Soccer Club Inc |

|

- Wanneroo Districts Cricket Club Inc (indoor facility) |

|

- Wanneroo Districts Cricket Club Inc & Wanneroo Districts Hockey Association Inc |

|

- Wanneroo Districts Netball Association |

|

- Wanneroo Districts Rugby Union Football Club Inc |

|

- Wanneroo Horse & Pony Club |

|

- Wanneroo Junior Motocross Club Inc |

|

- Wanneroo Racing Pigeon Club |

|

- Wanneroo Shooting Complex Inc |

|

- Wanneroo Sports & Social Club |

|

- Wanneroo Tennis |

|

- Wanneroo Trotting & Training Club Inc |

|

- Yanchep Golf Club |

|

- Yanchep Sports Club Inc |

|

- Yanchep Surf Lifesaving Club Inc |

The City commenced a review of its Rating Strategy during 2012/13. This review will continue in 2013/14, taking into account outcomes from the Integrated Planning process, impacting on the LTFP. It is proposed this will be workshopped with Council during 2013/14 and available for consideration for the 2014/15 Rating period and beyond.

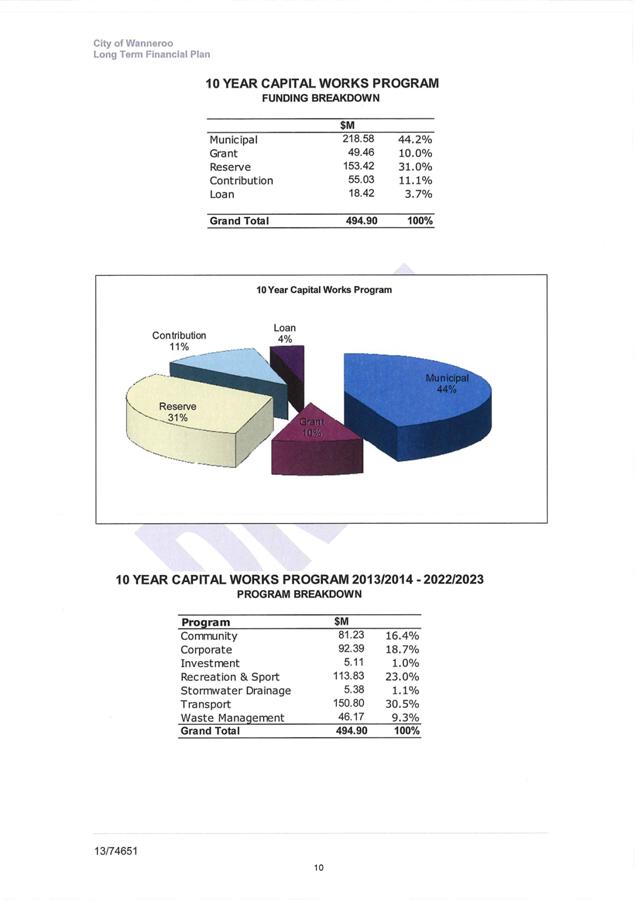

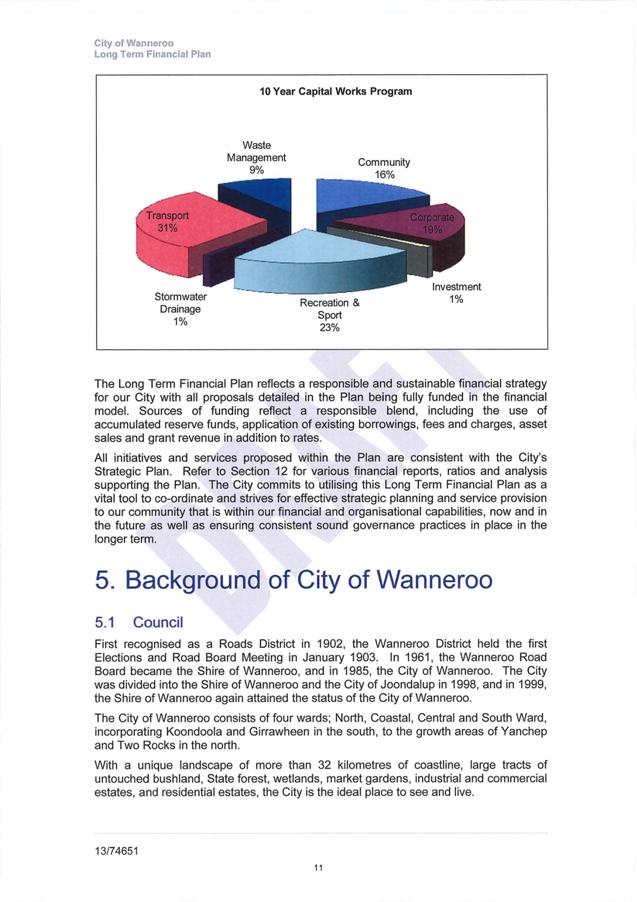

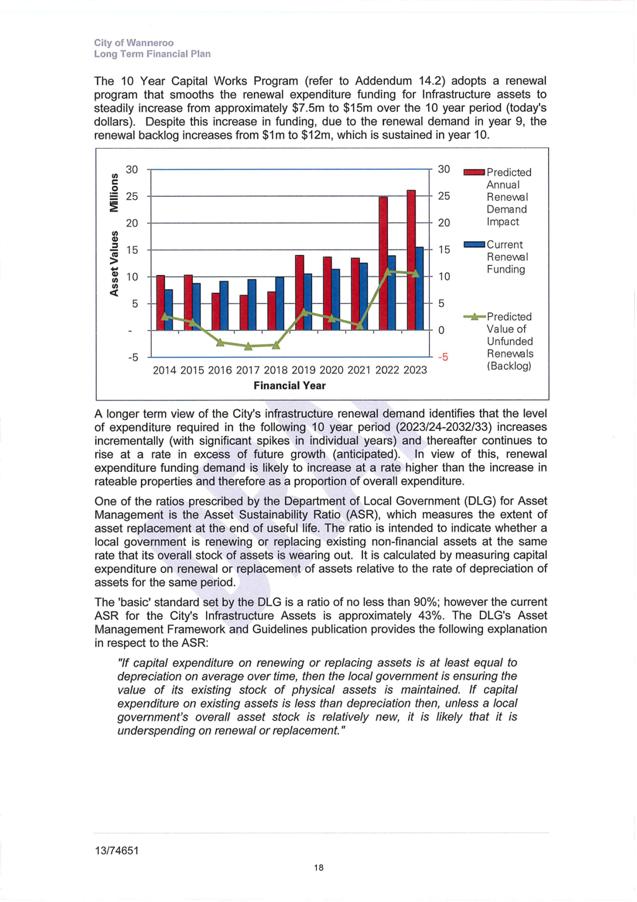

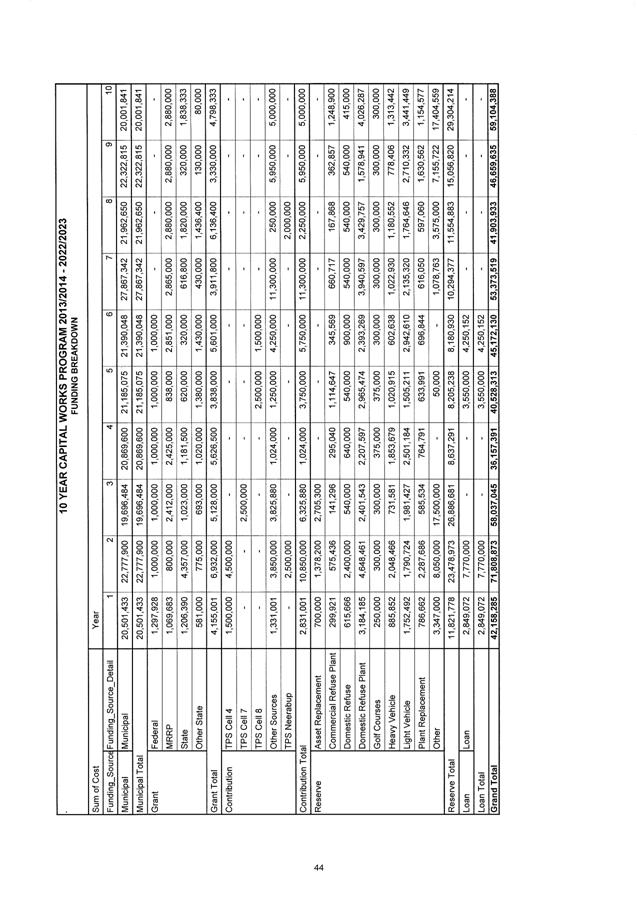

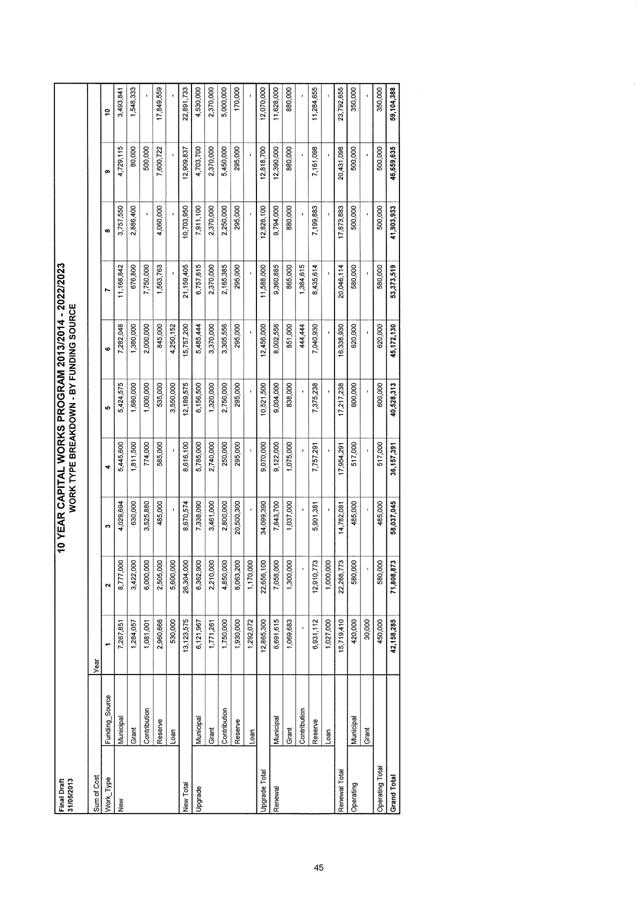

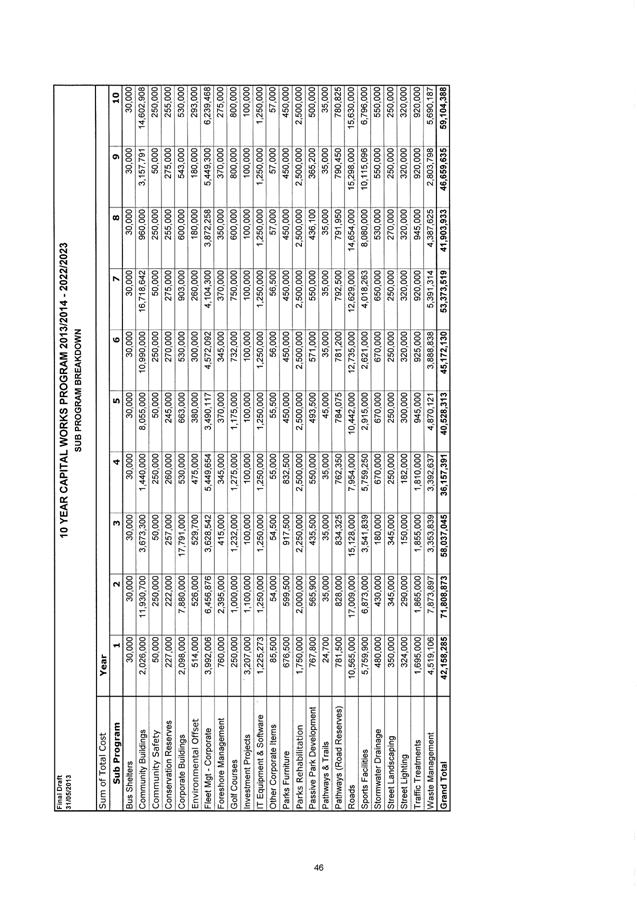

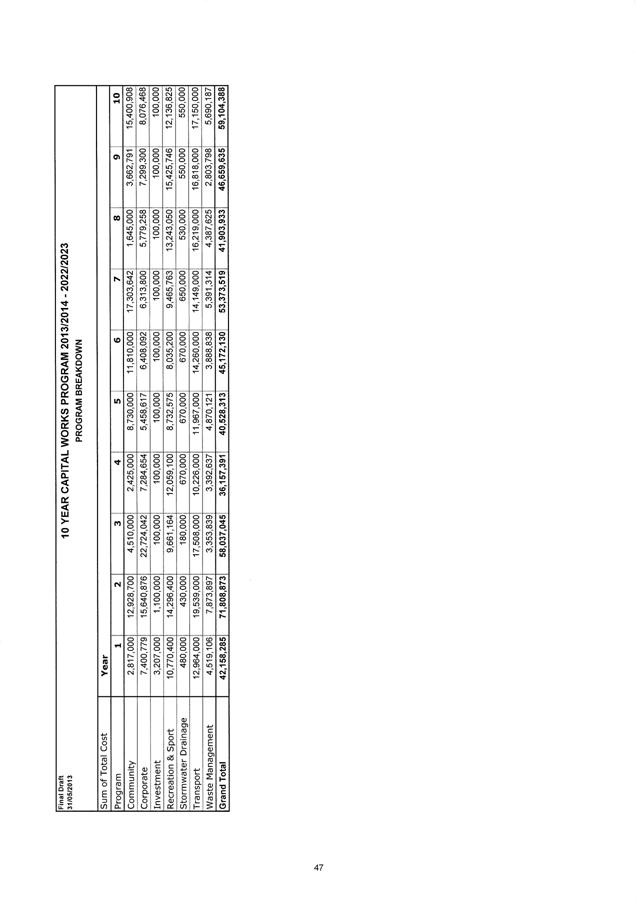

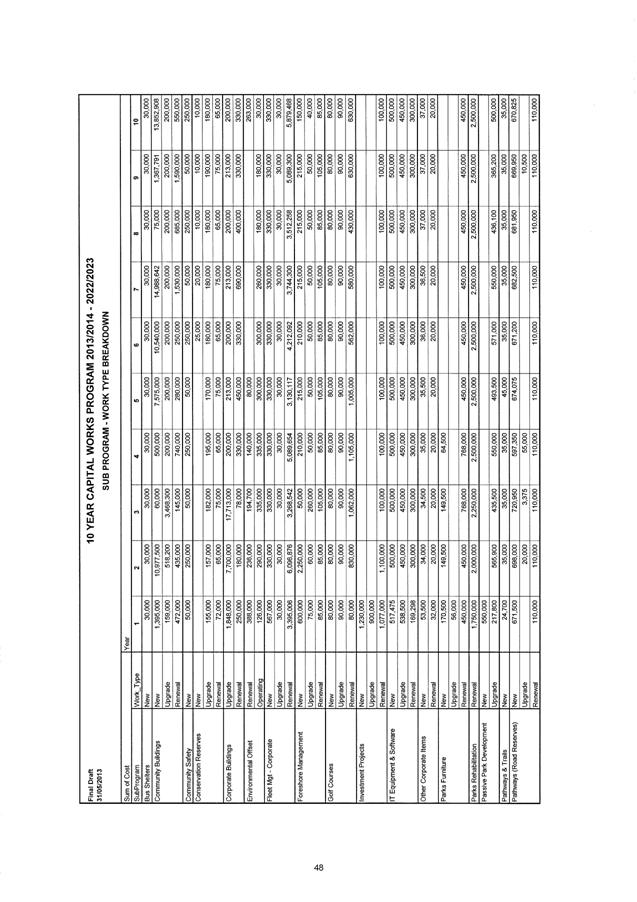

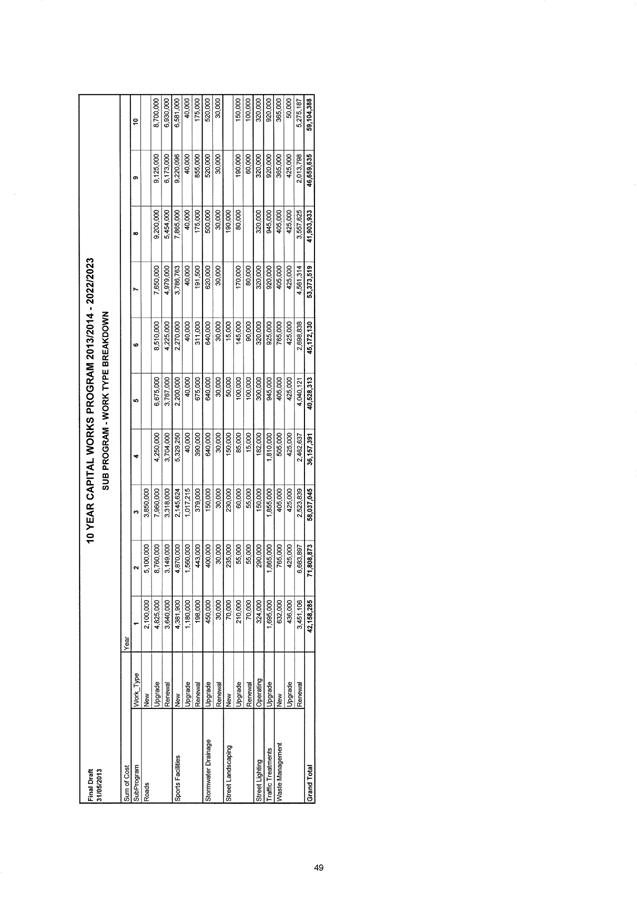

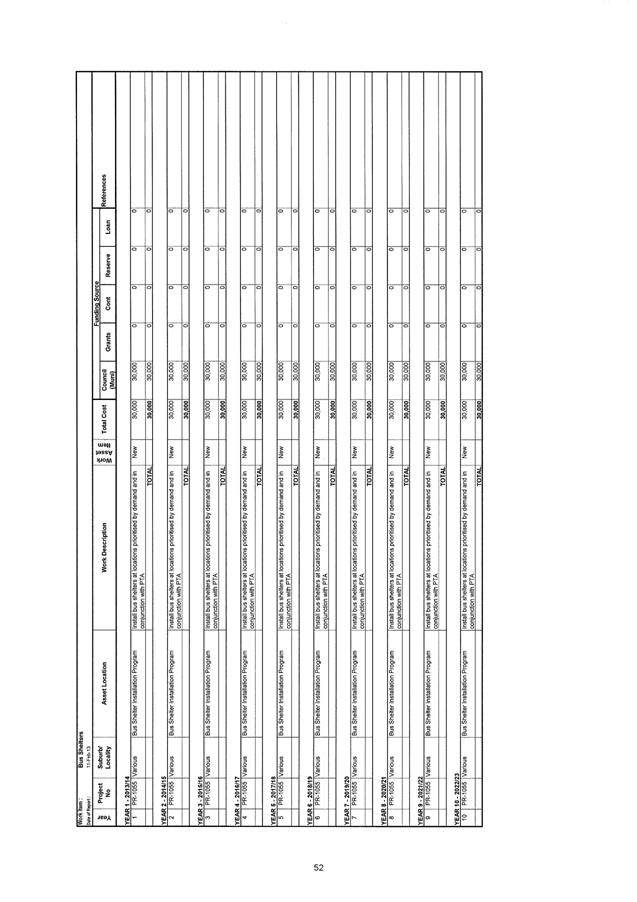

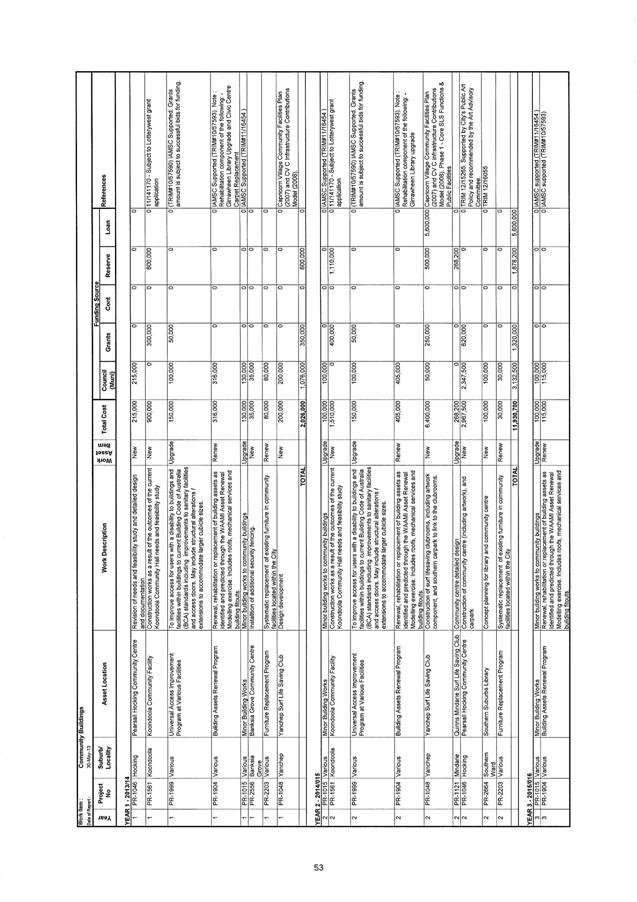

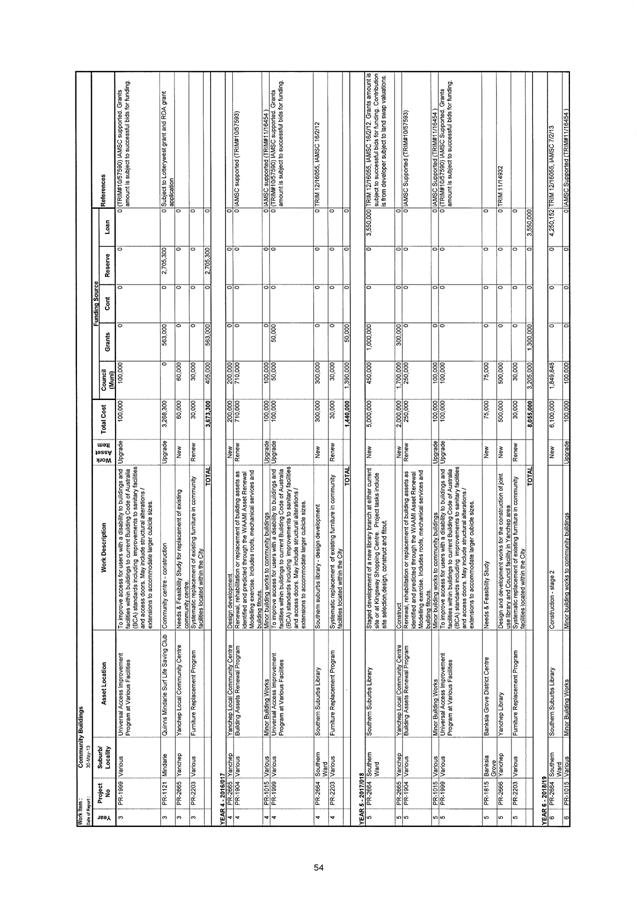

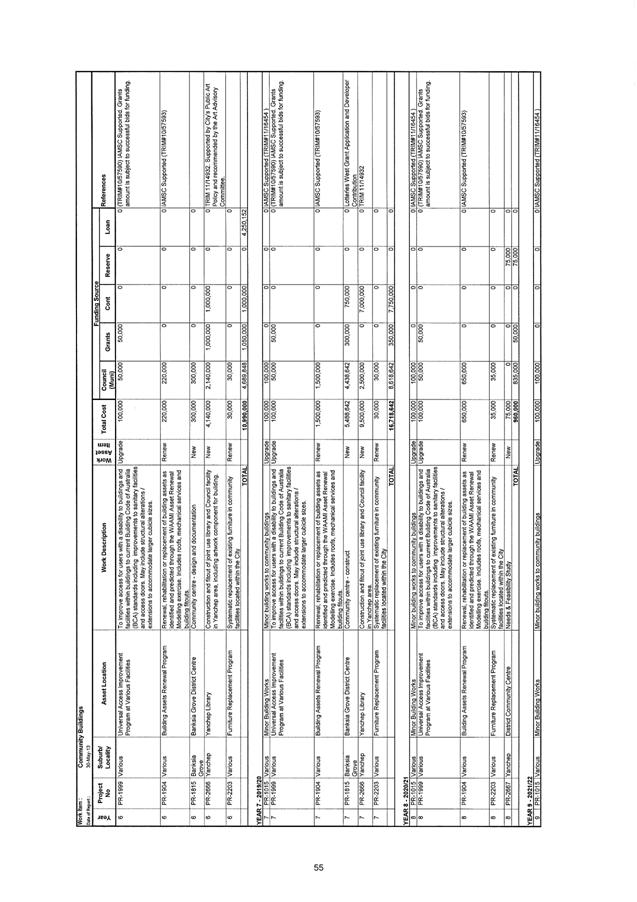

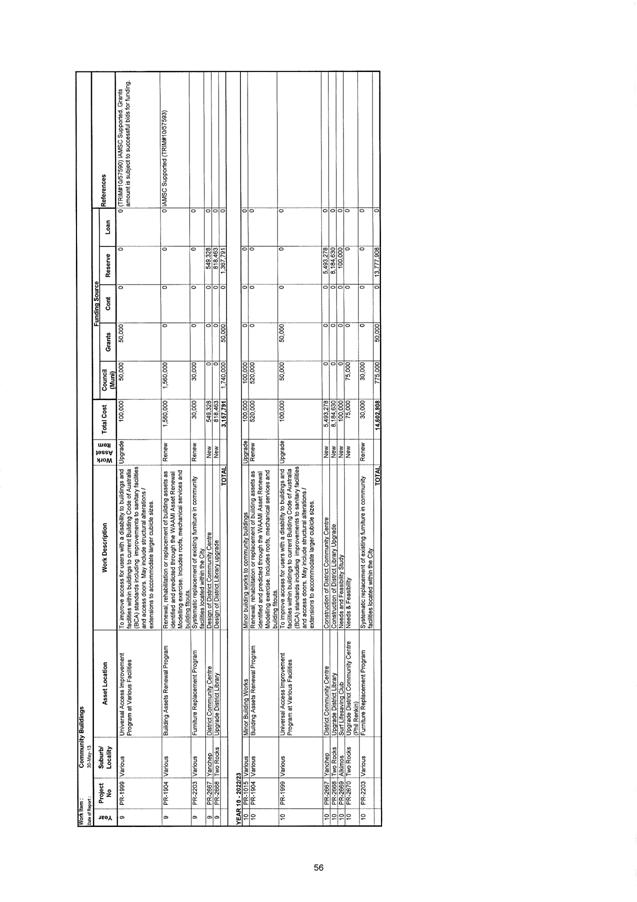

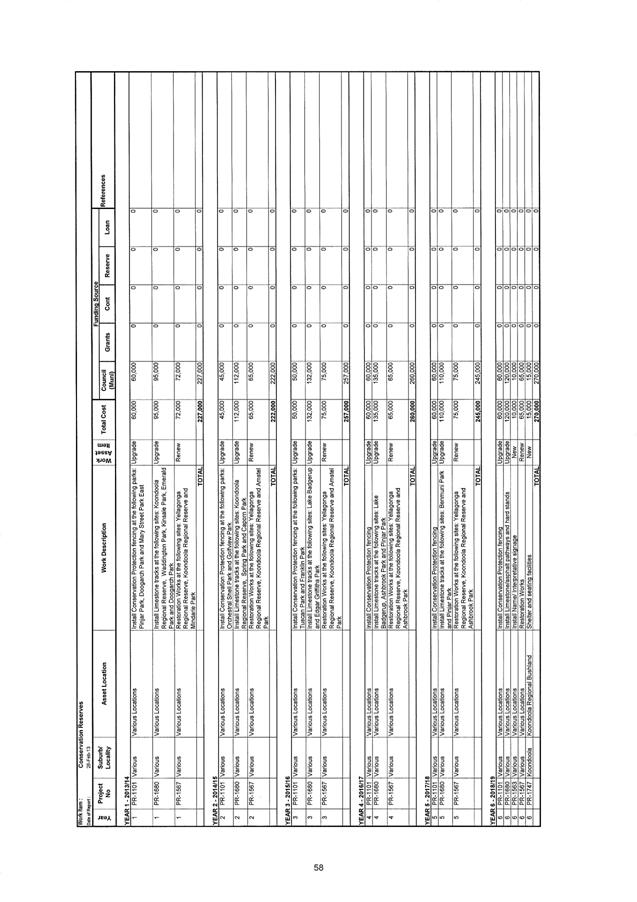

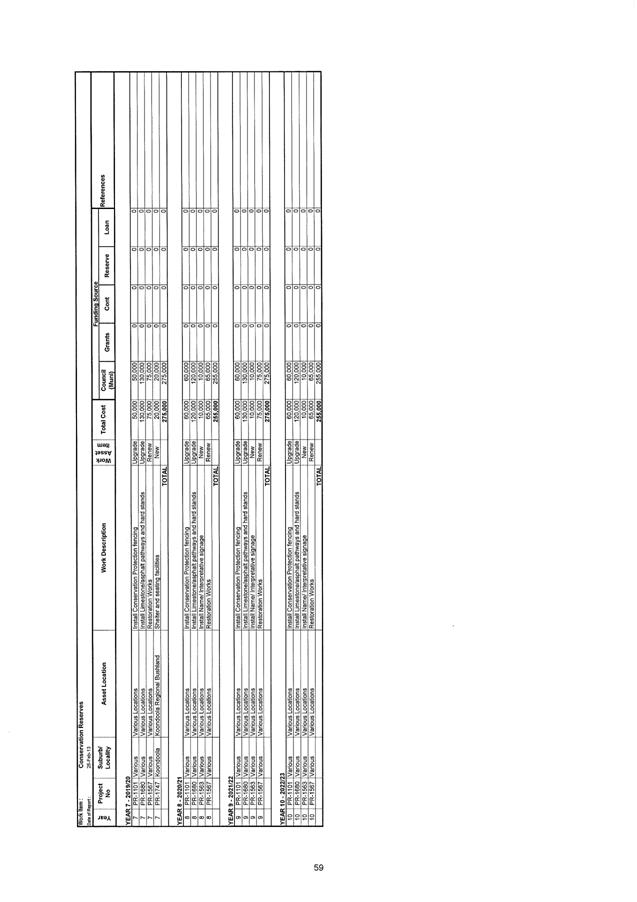

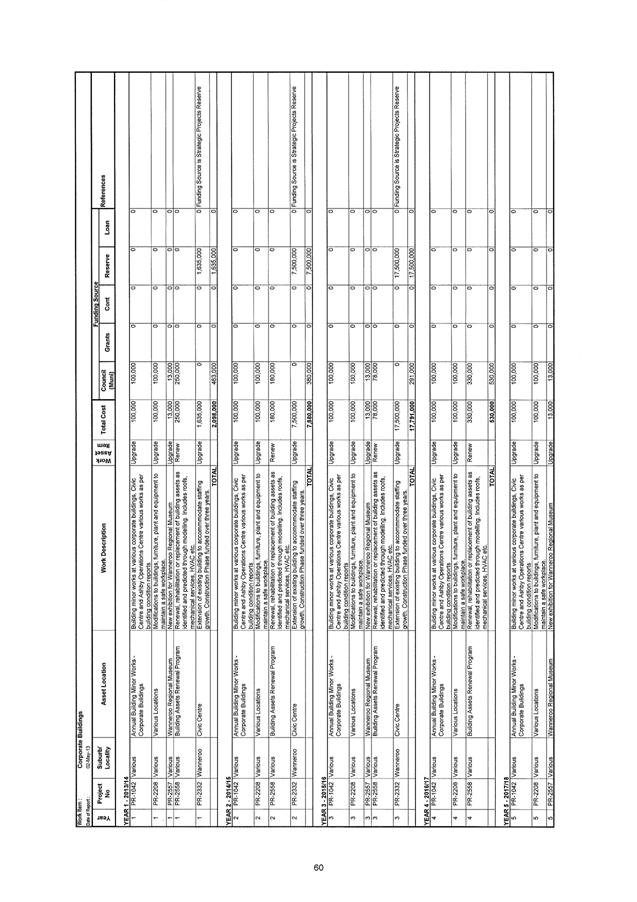

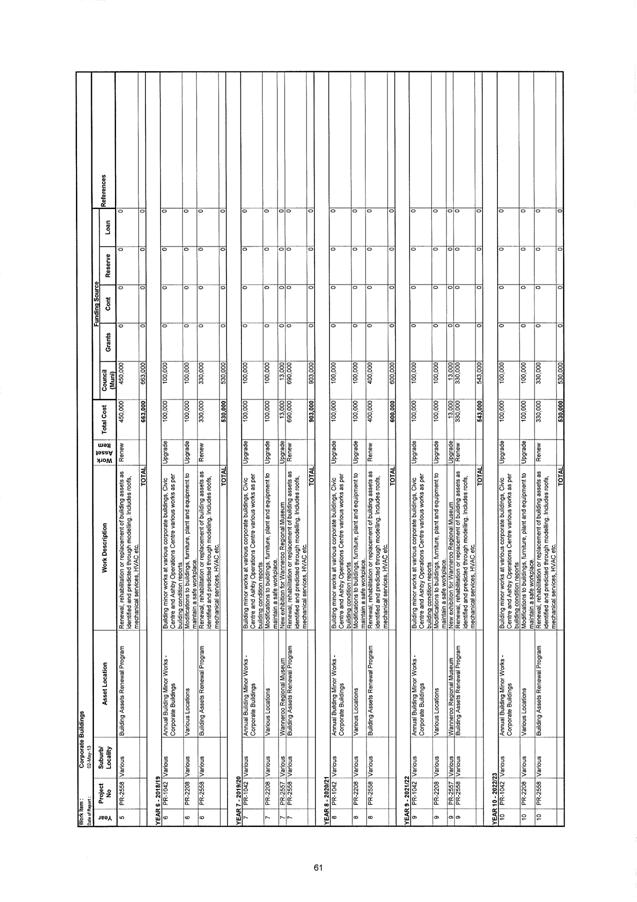

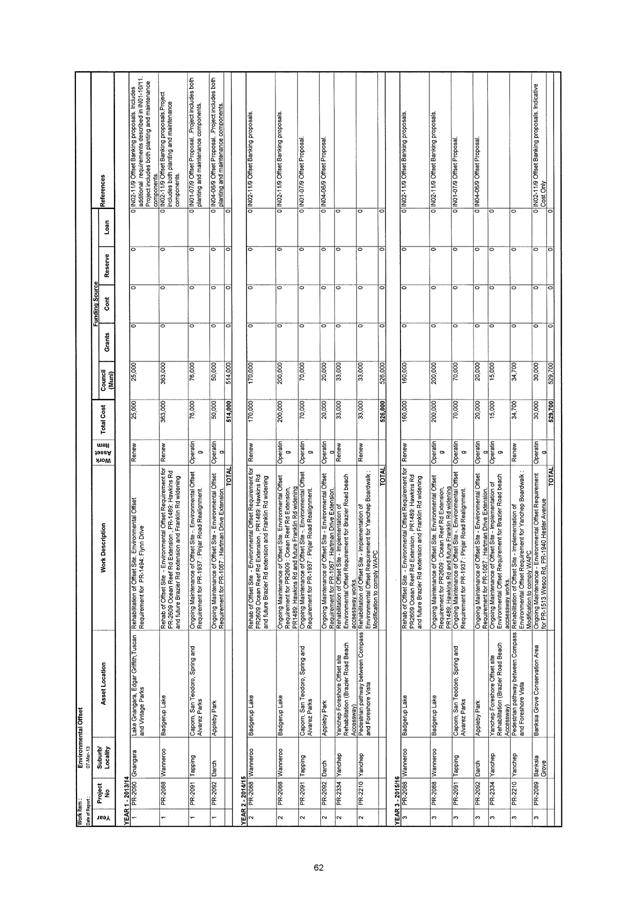

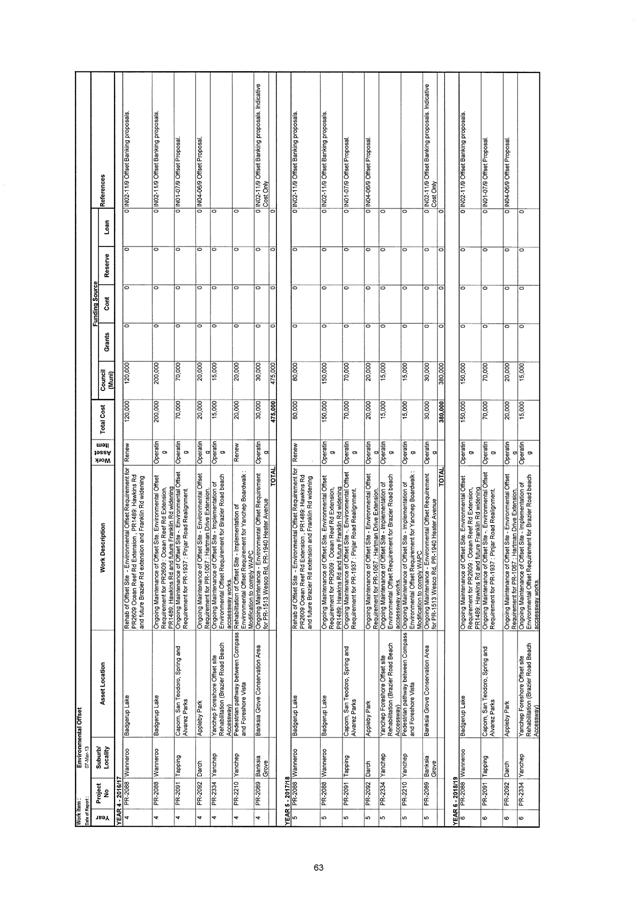

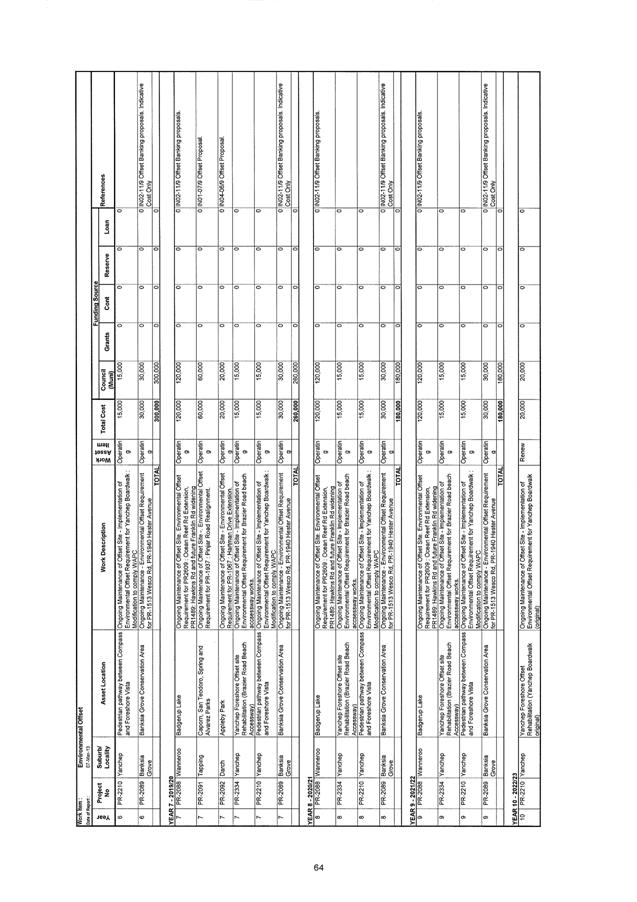

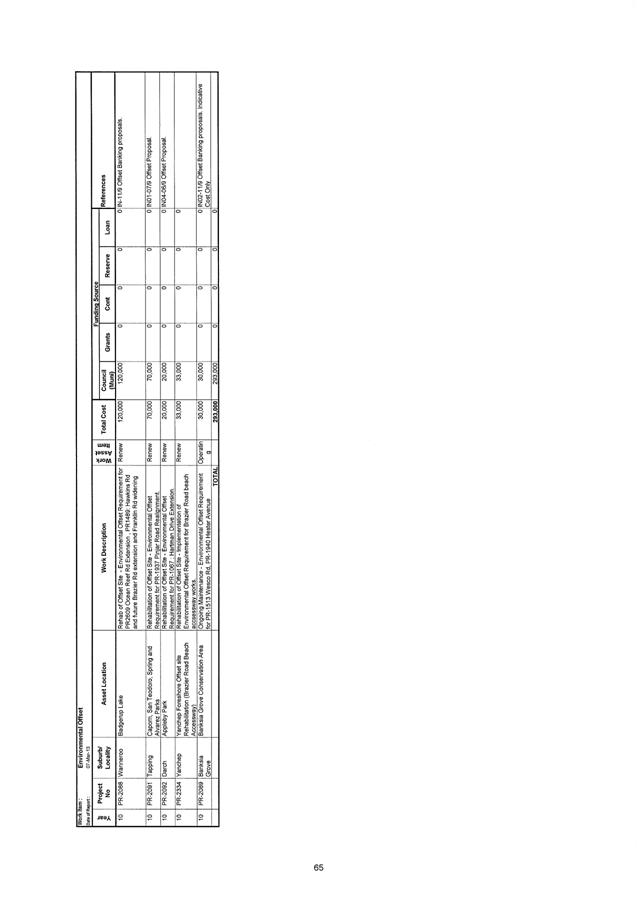

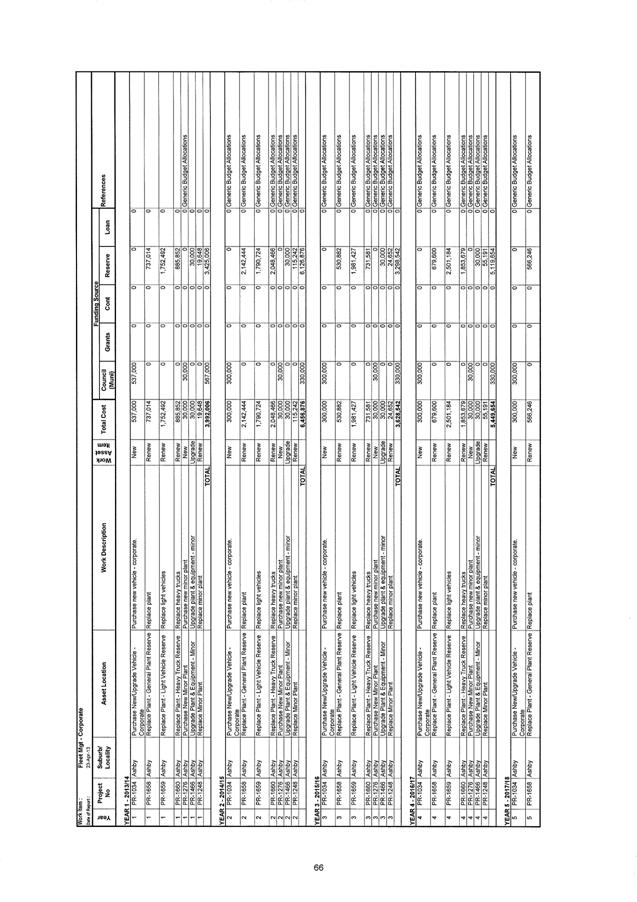

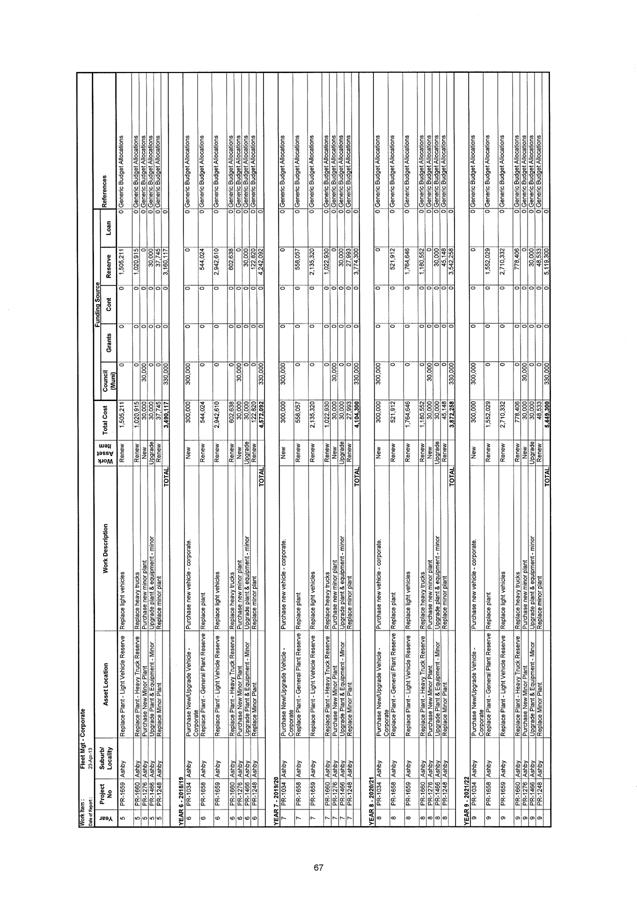

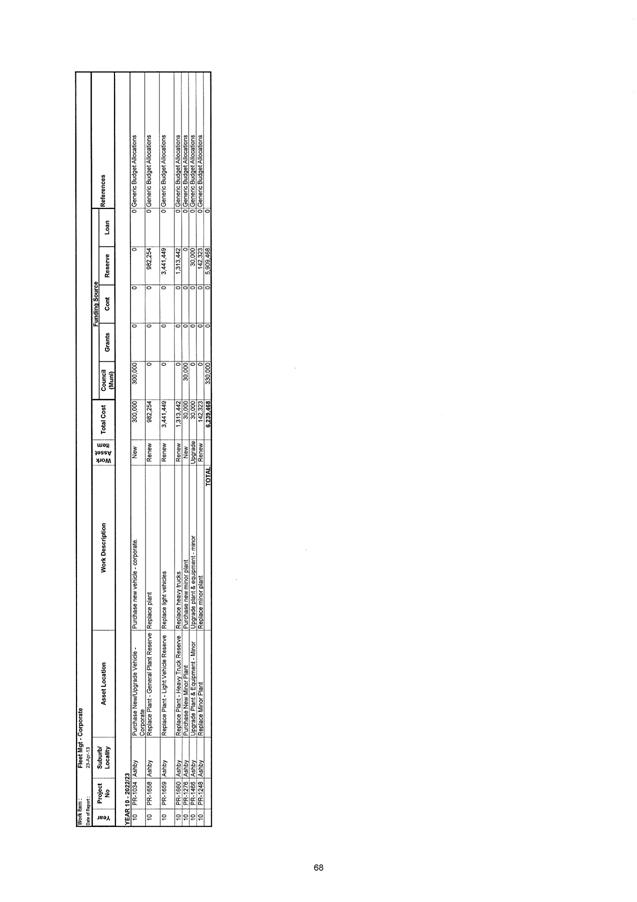

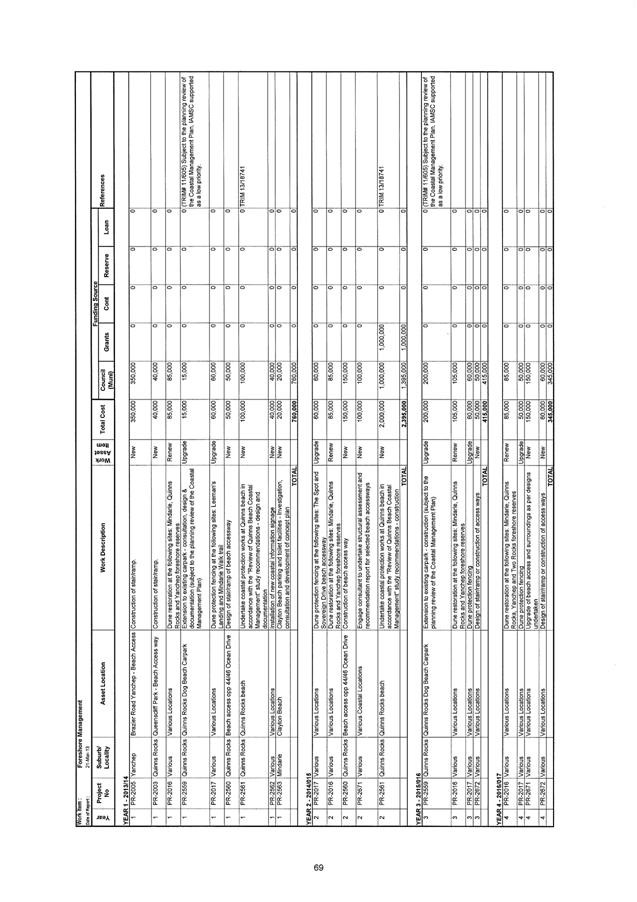

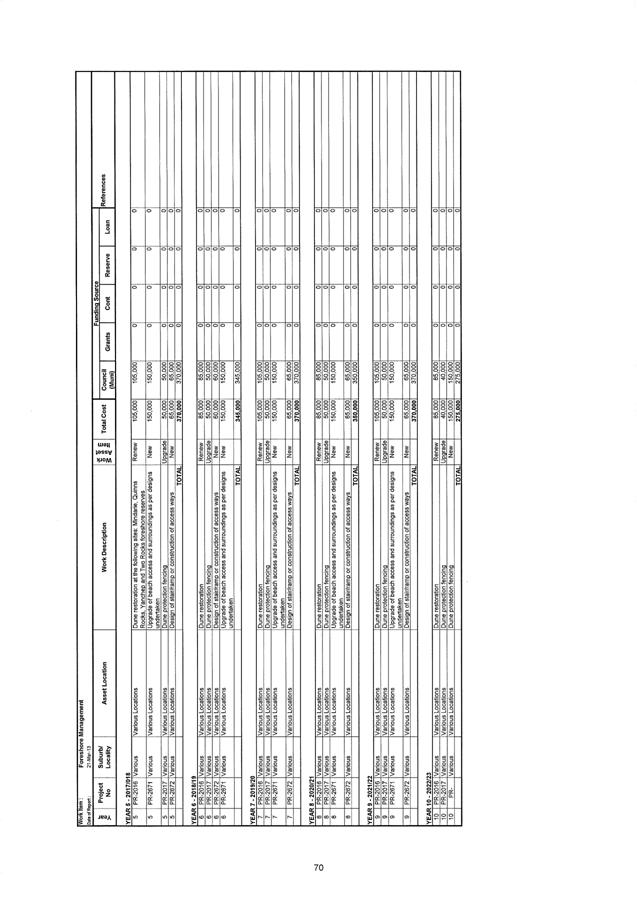

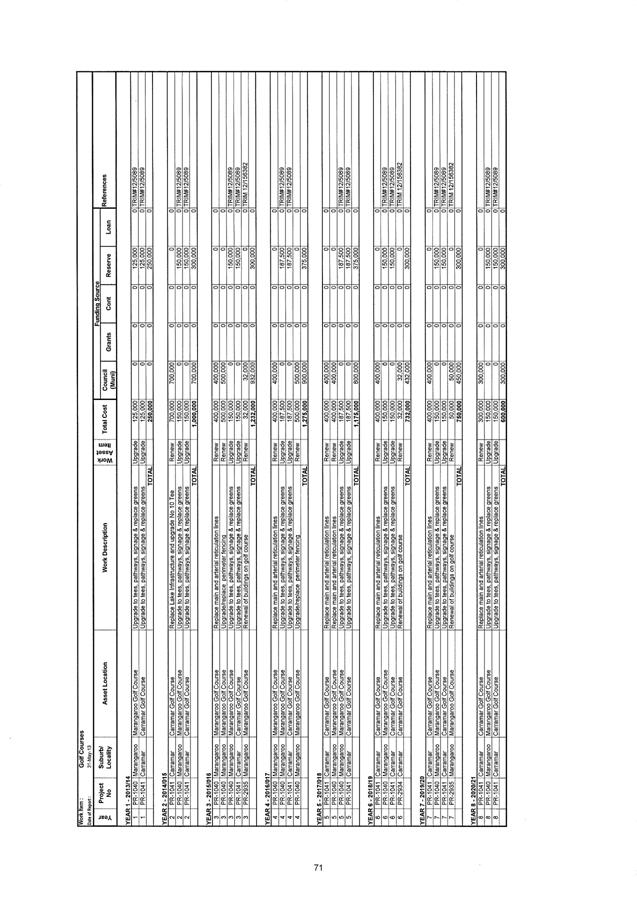

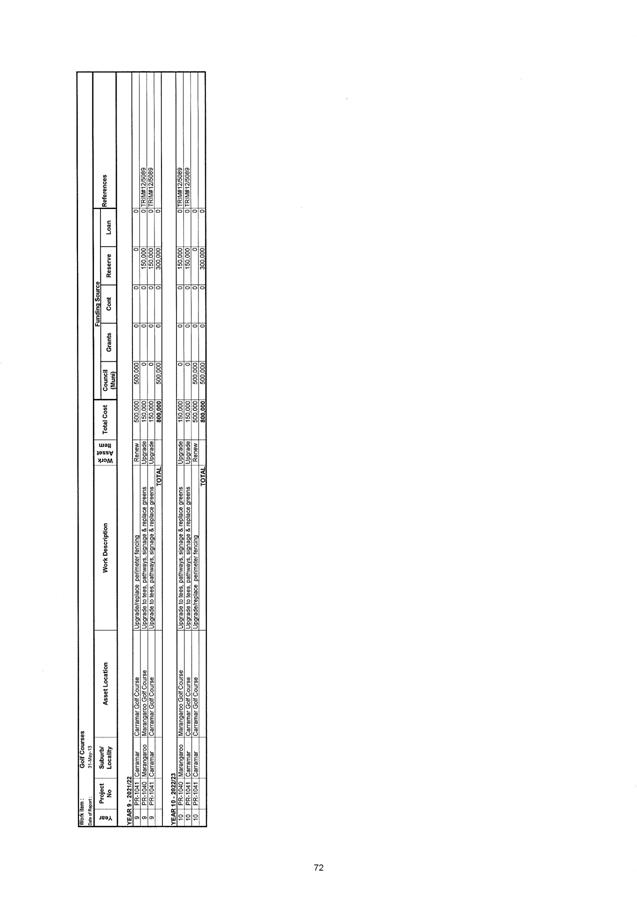

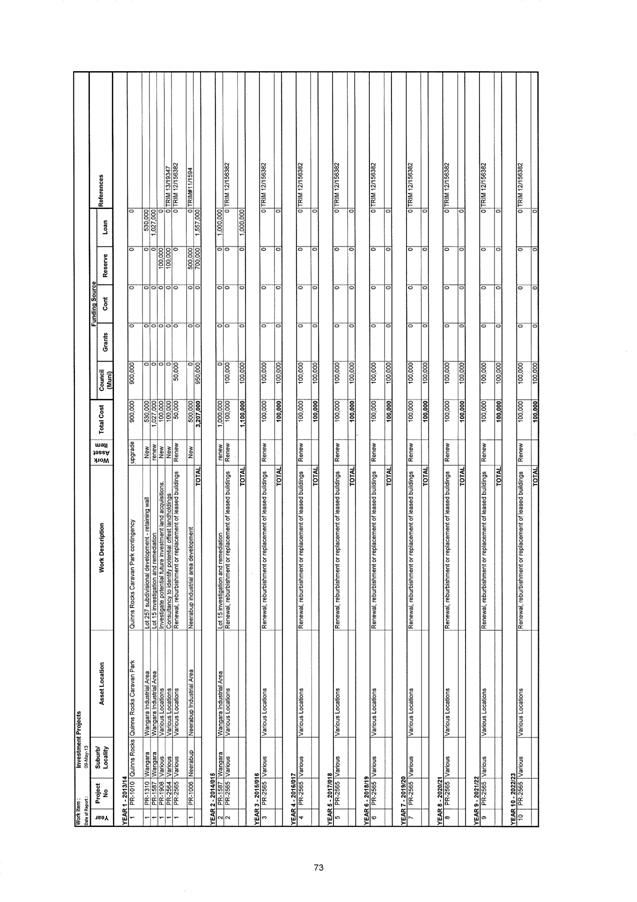

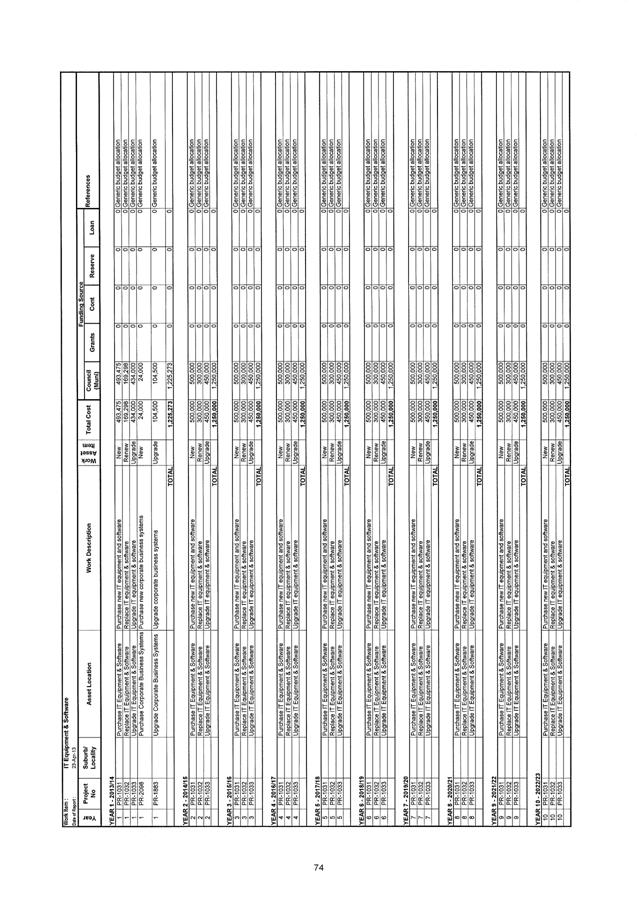

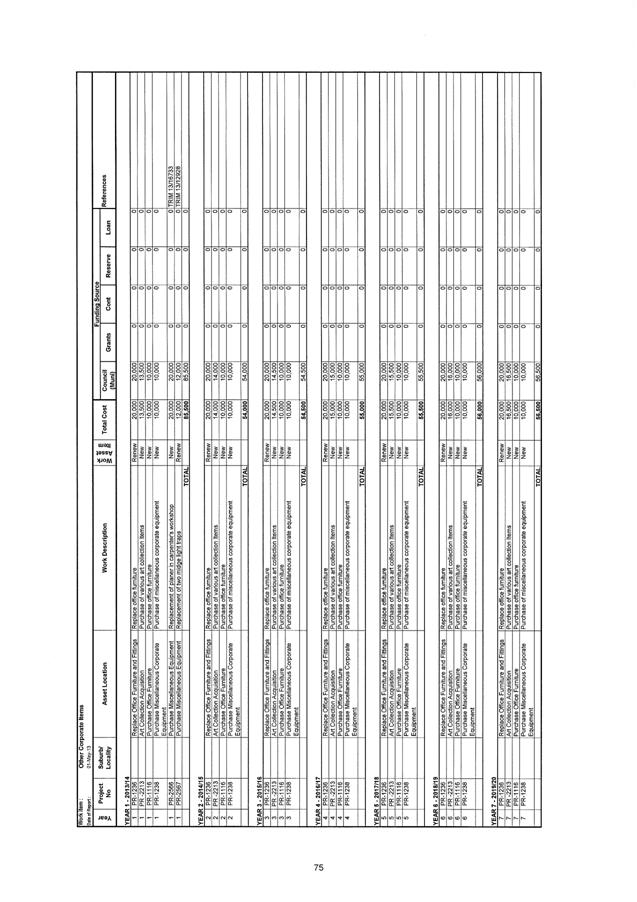

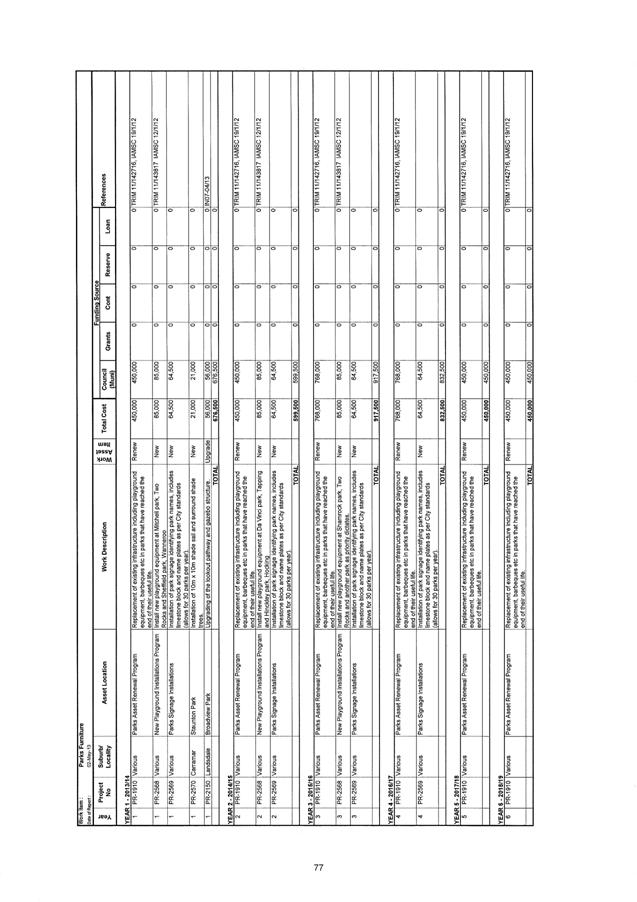

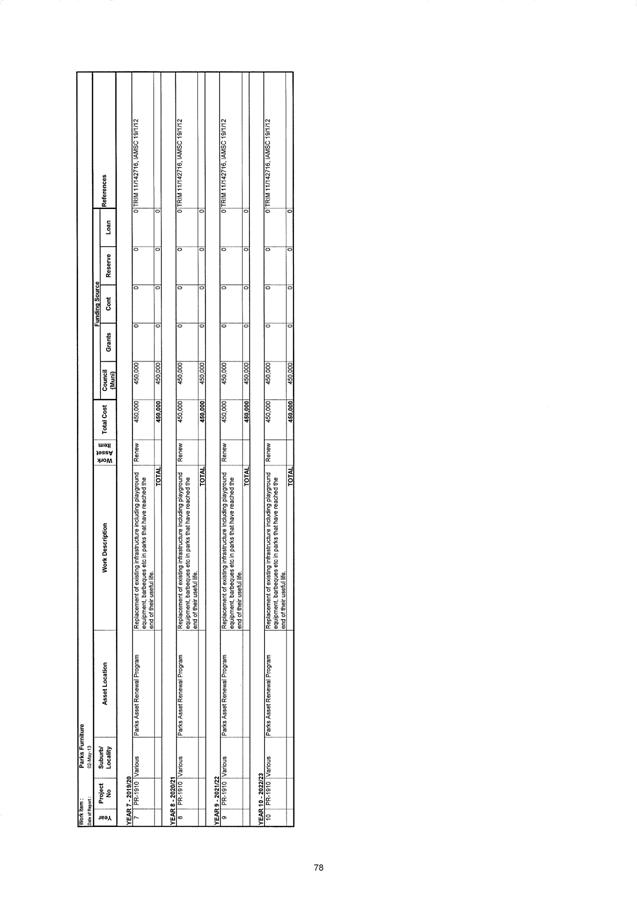

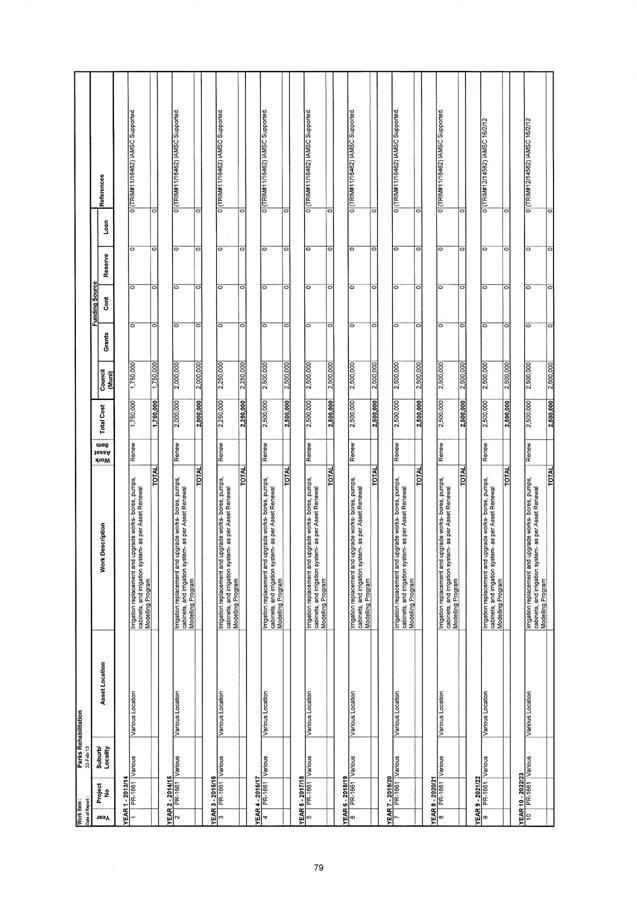

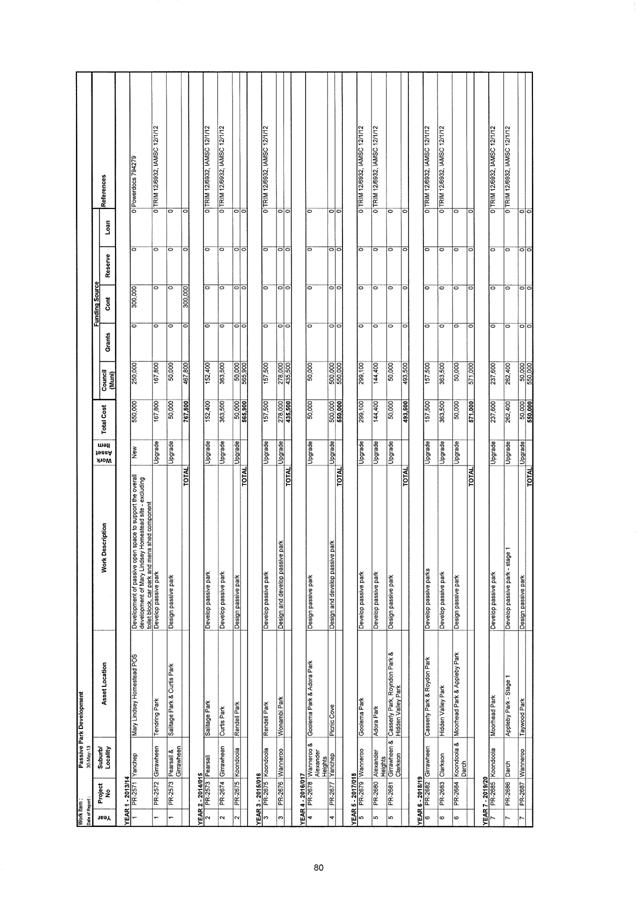

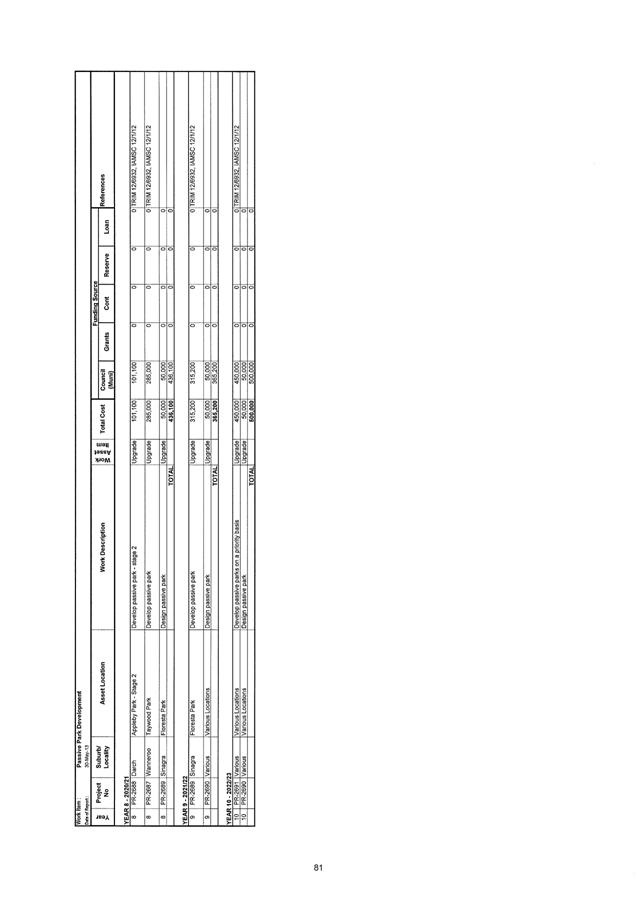

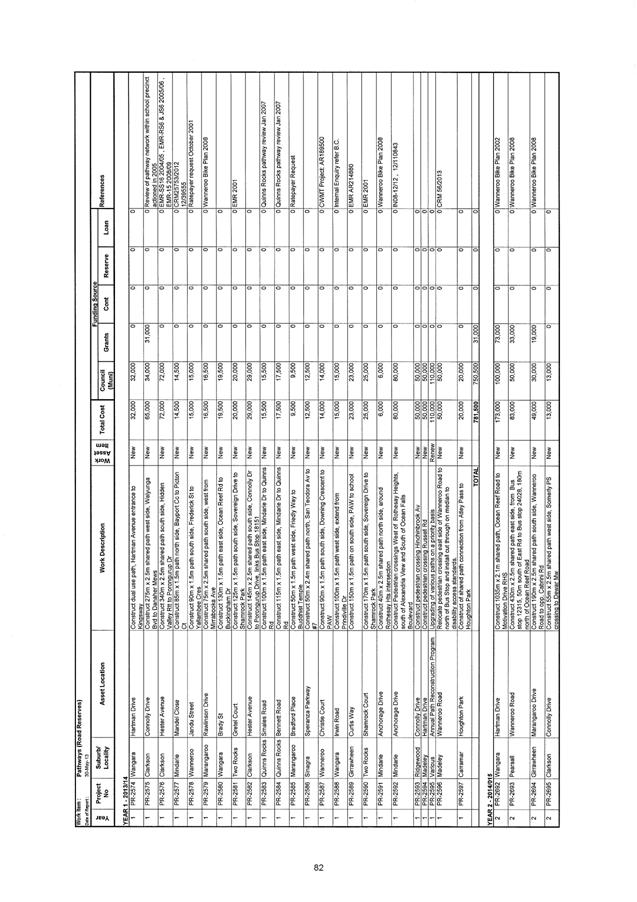

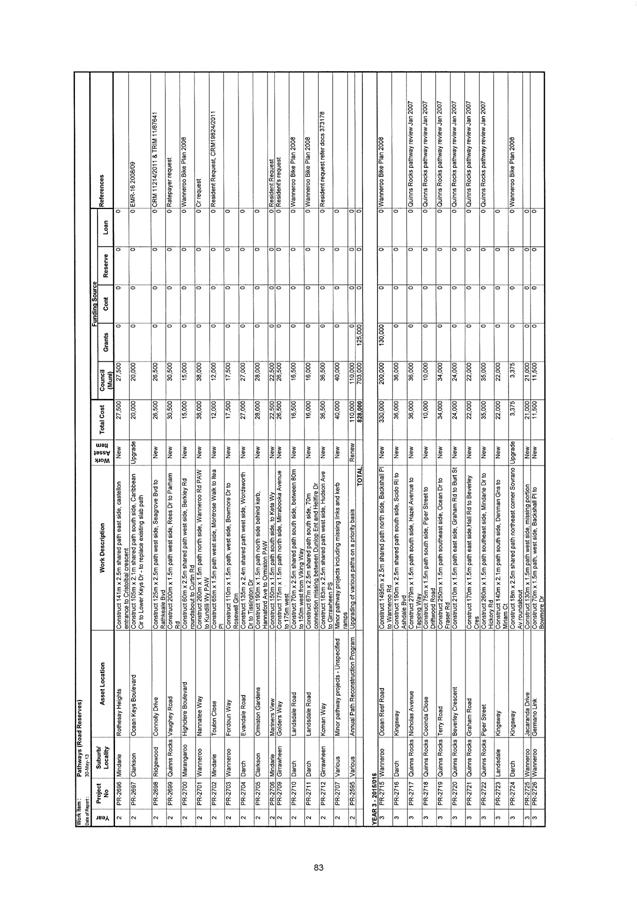

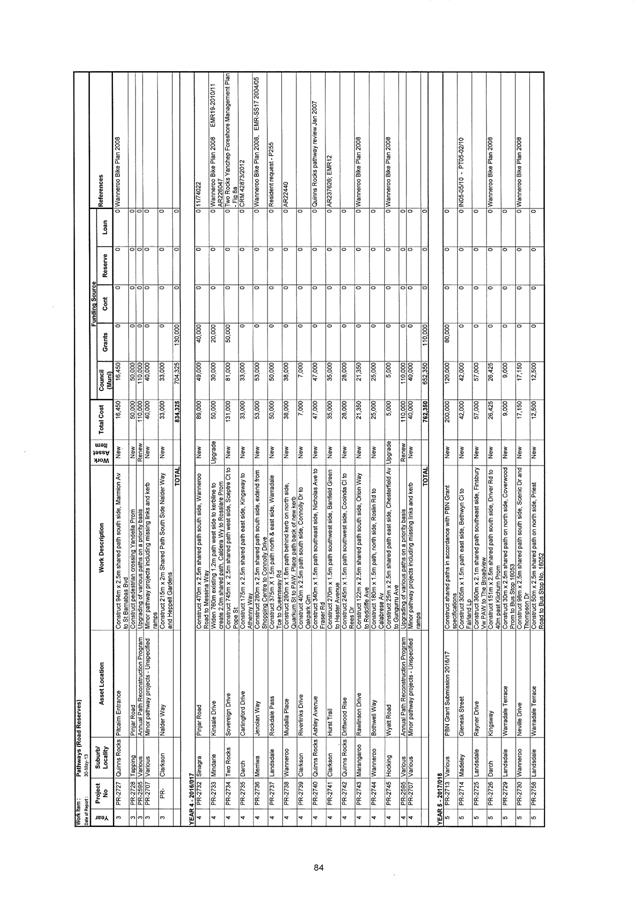

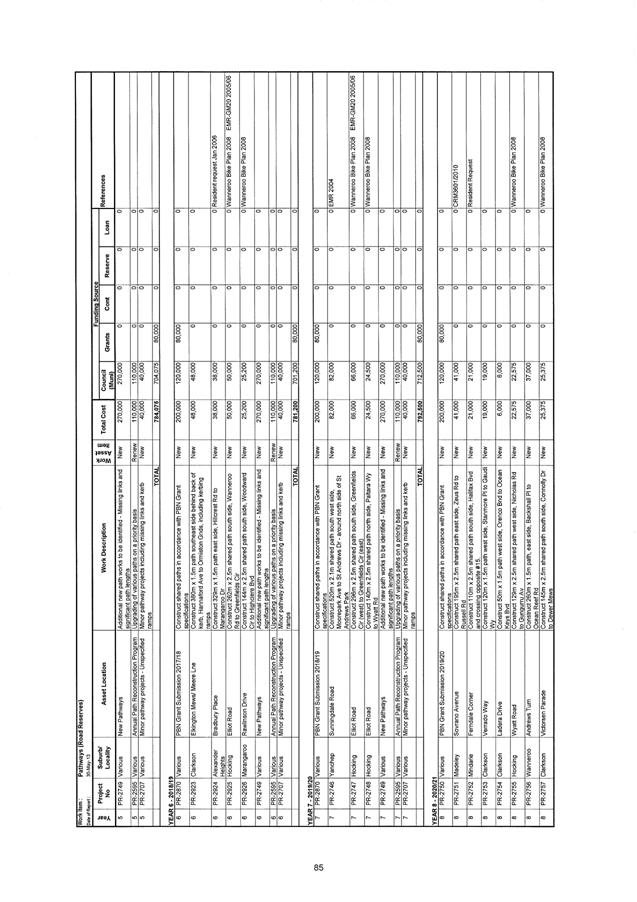

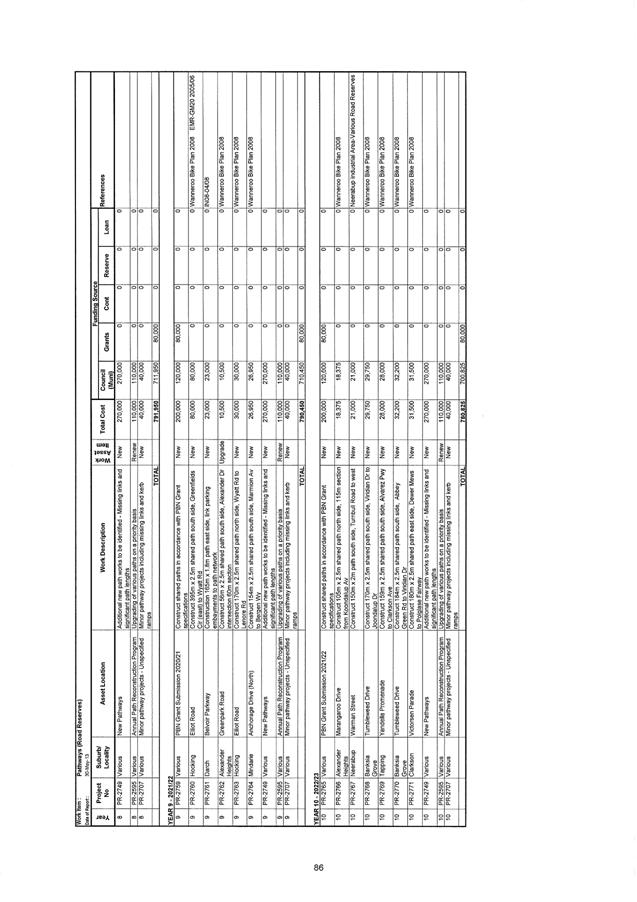

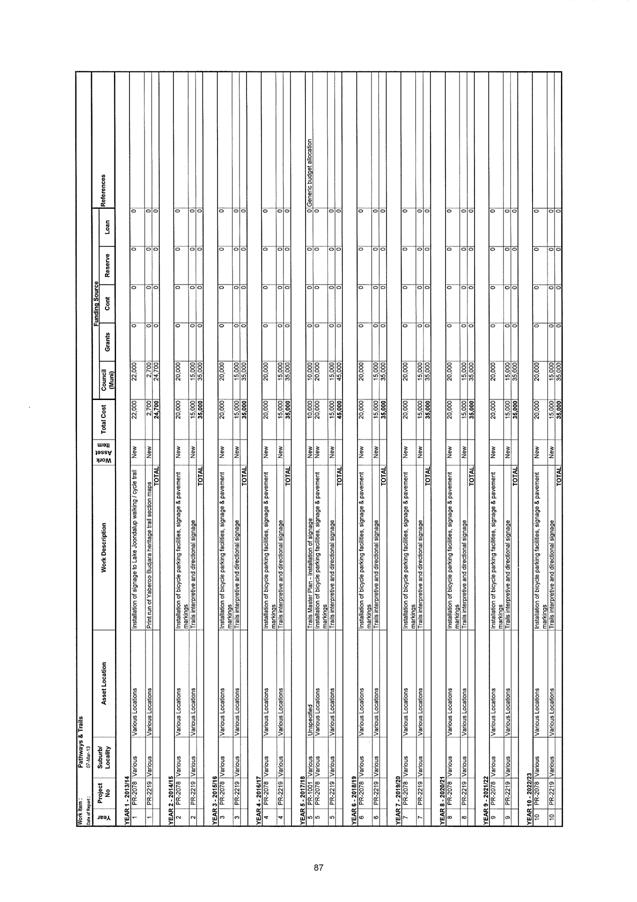

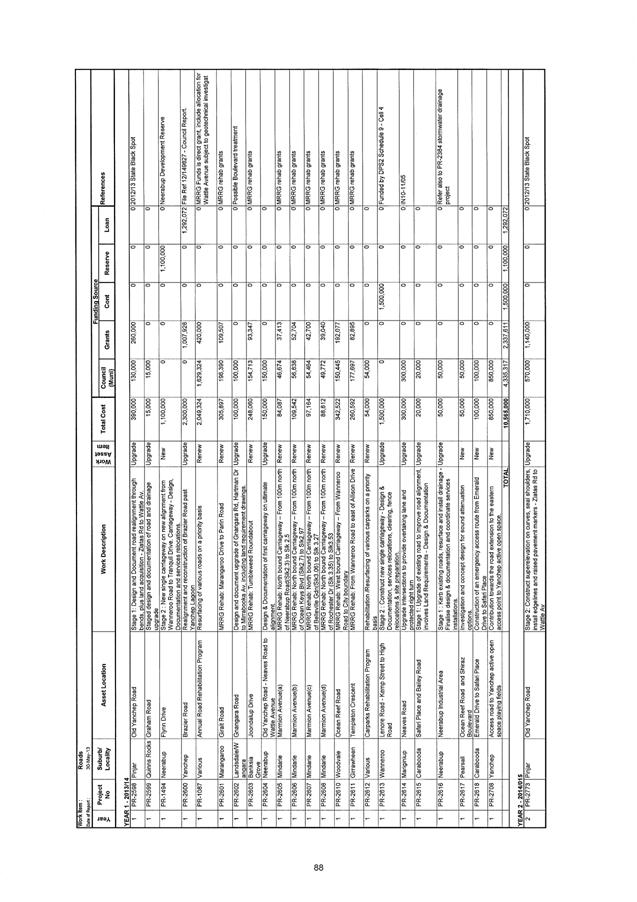

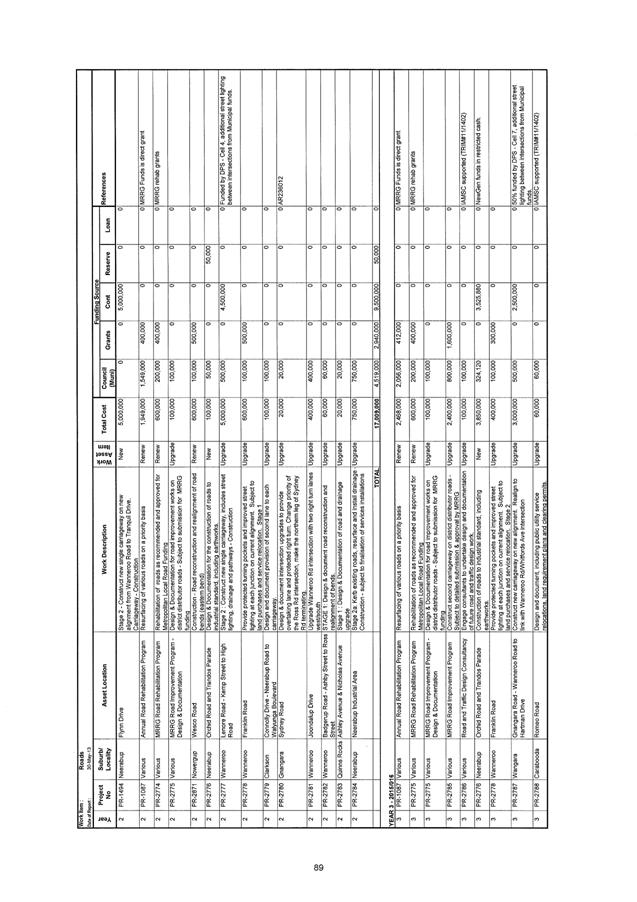

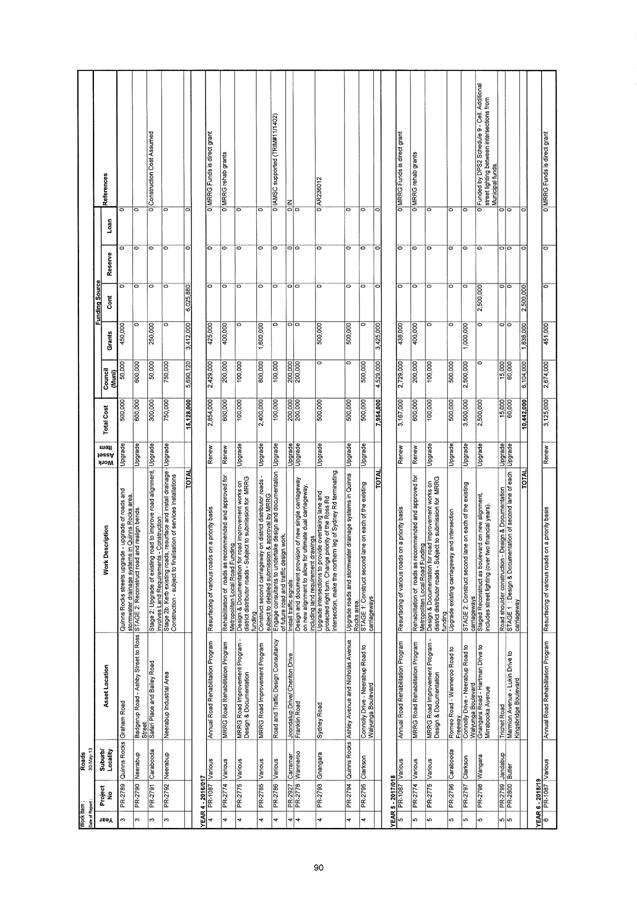

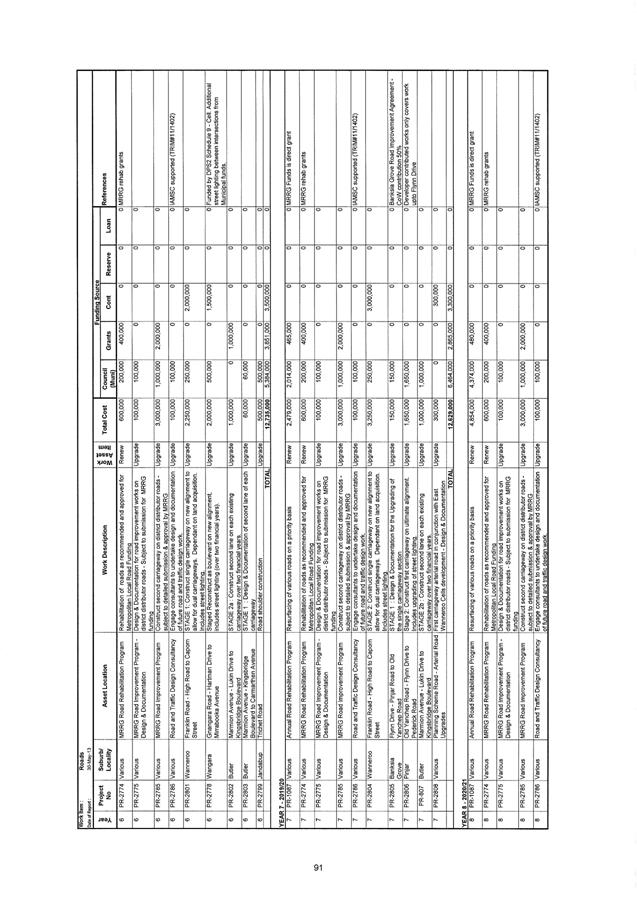

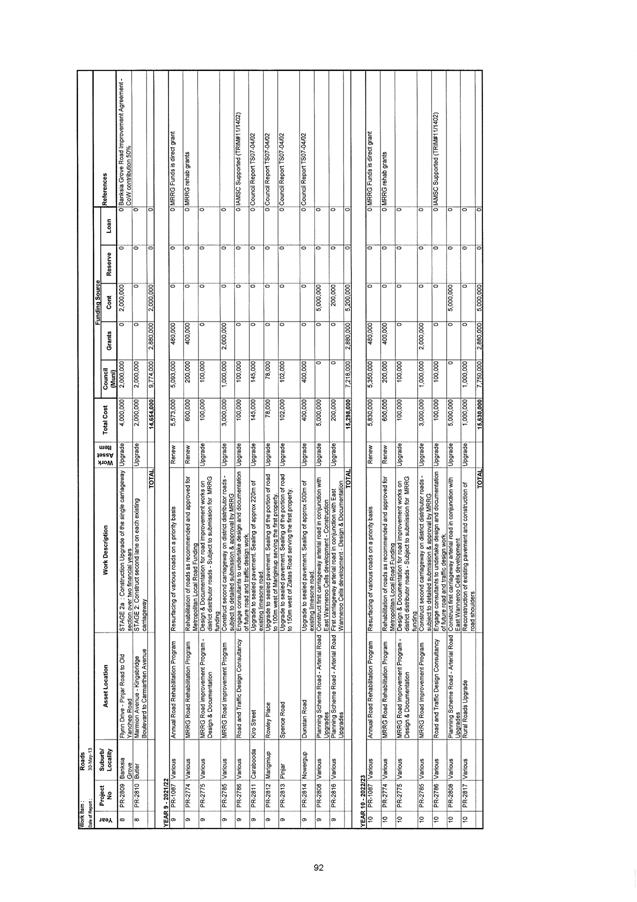

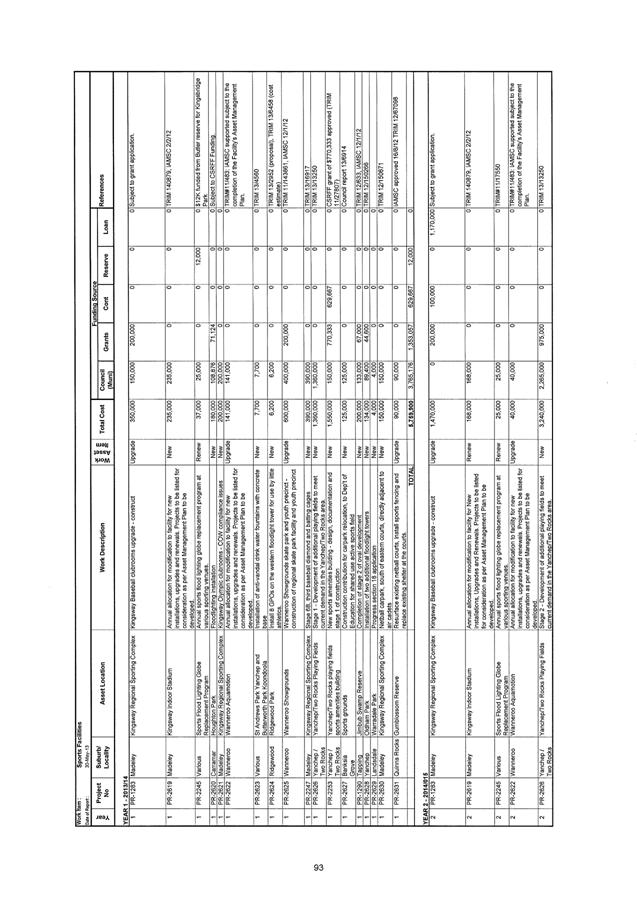

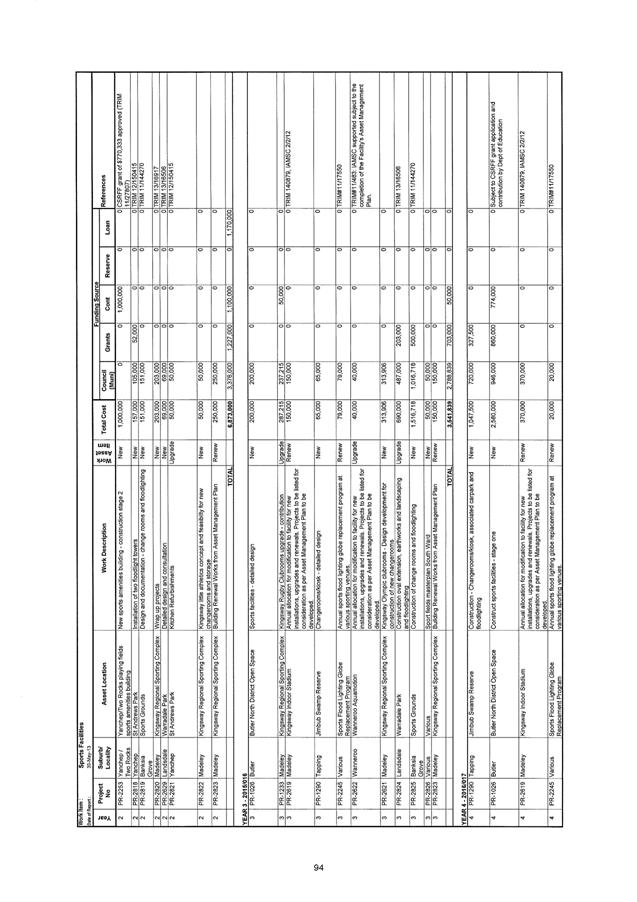

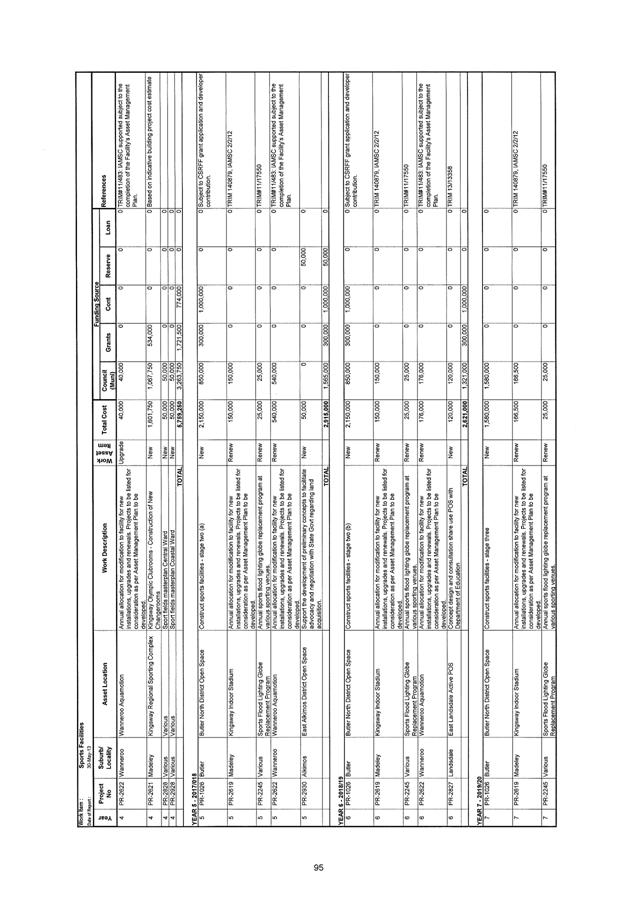

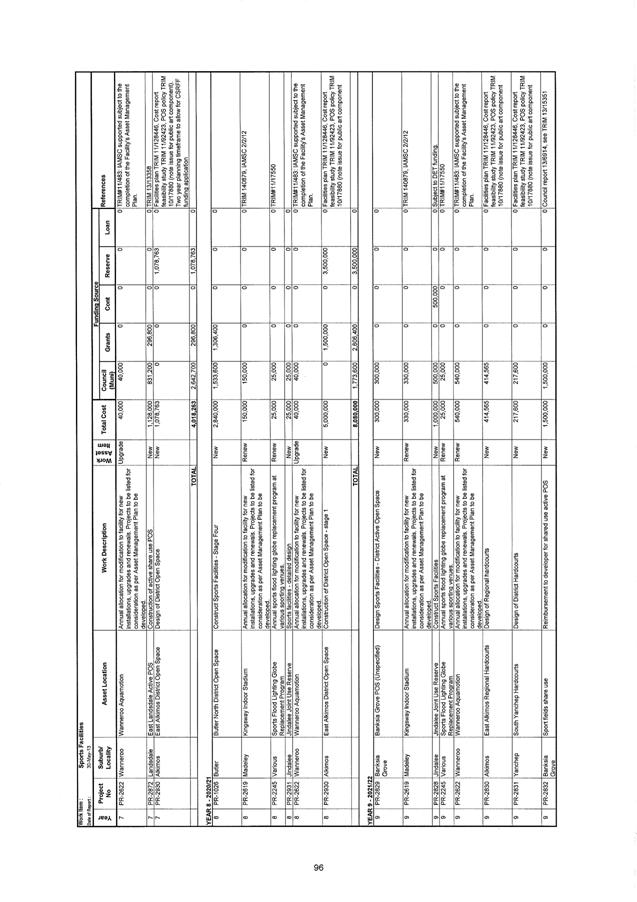

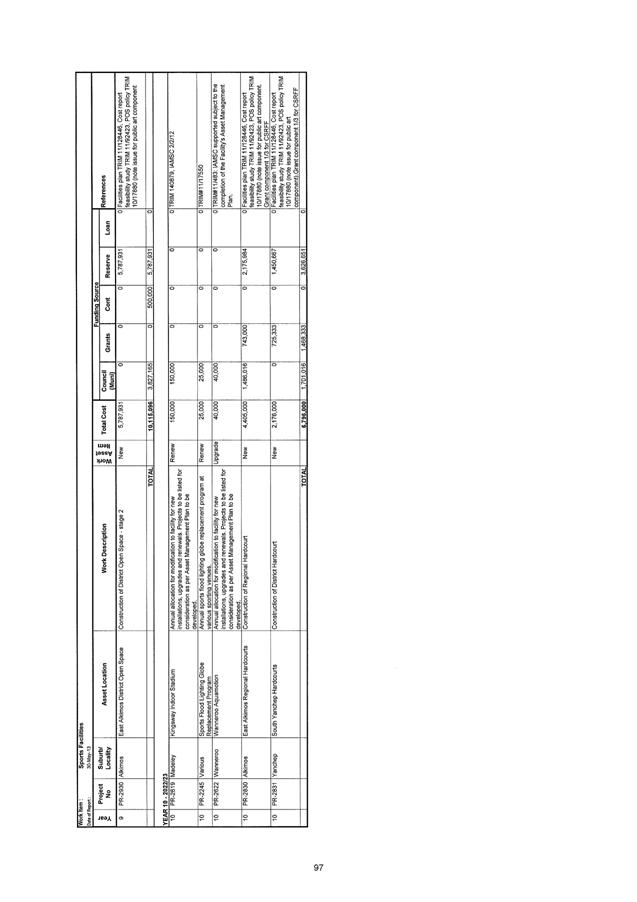

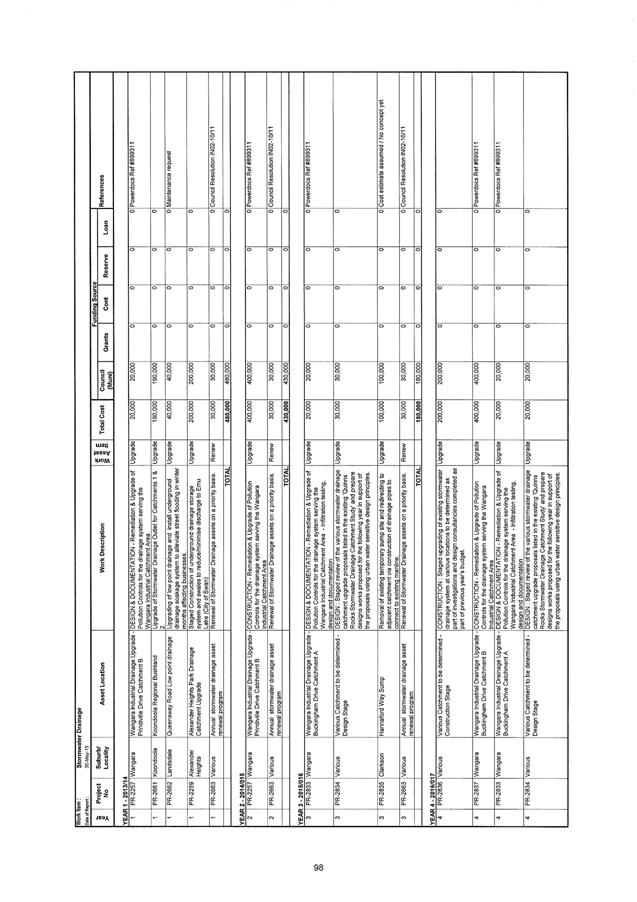

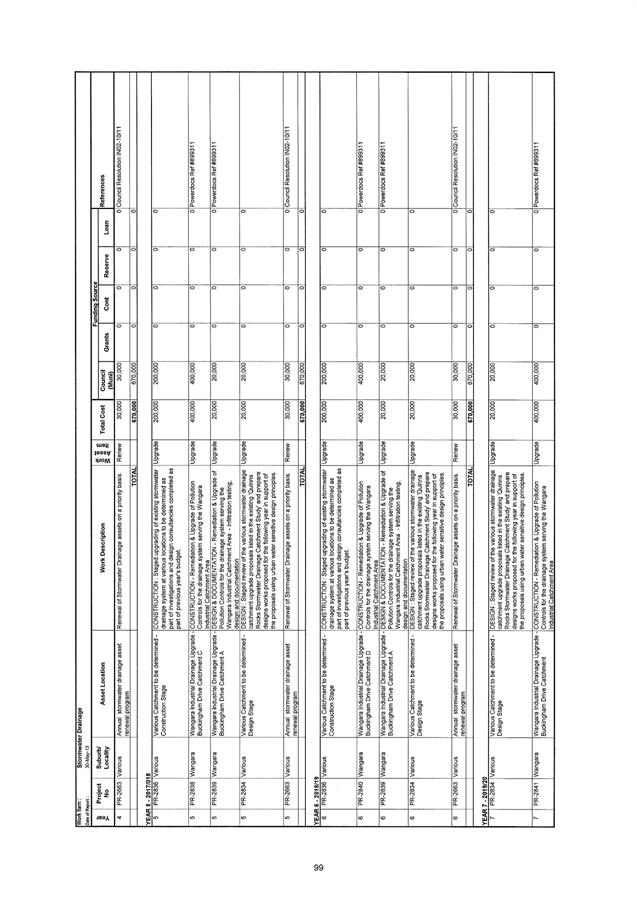

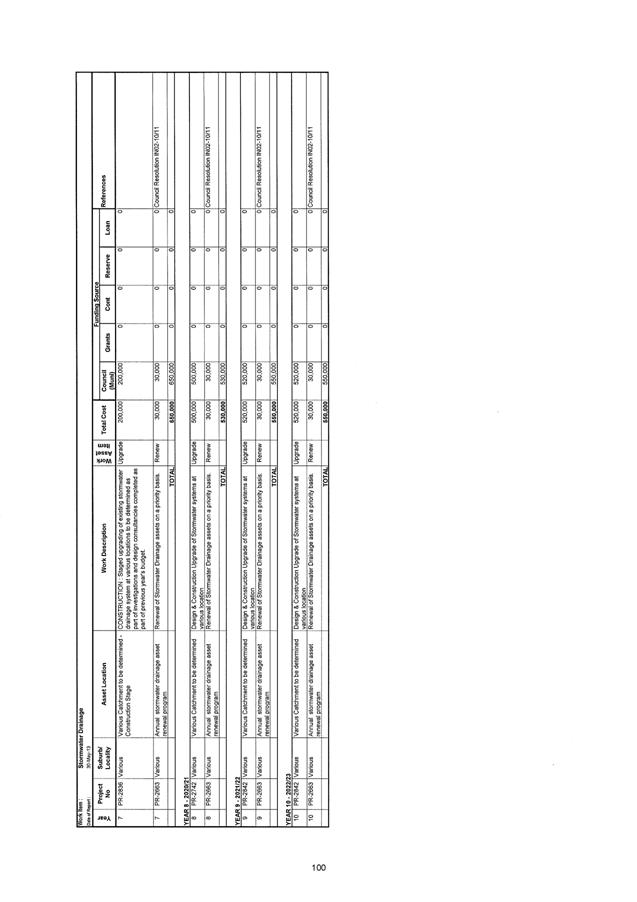

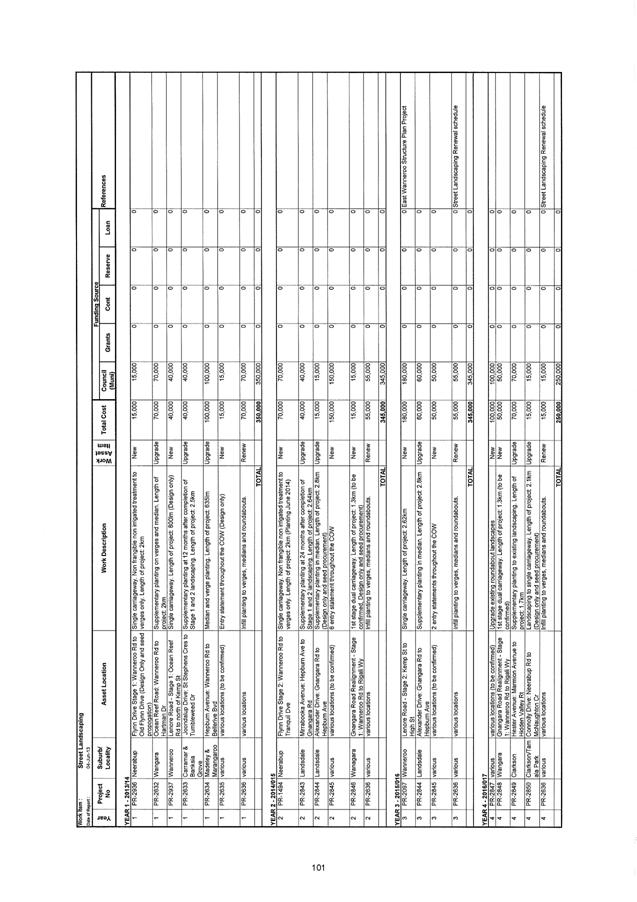

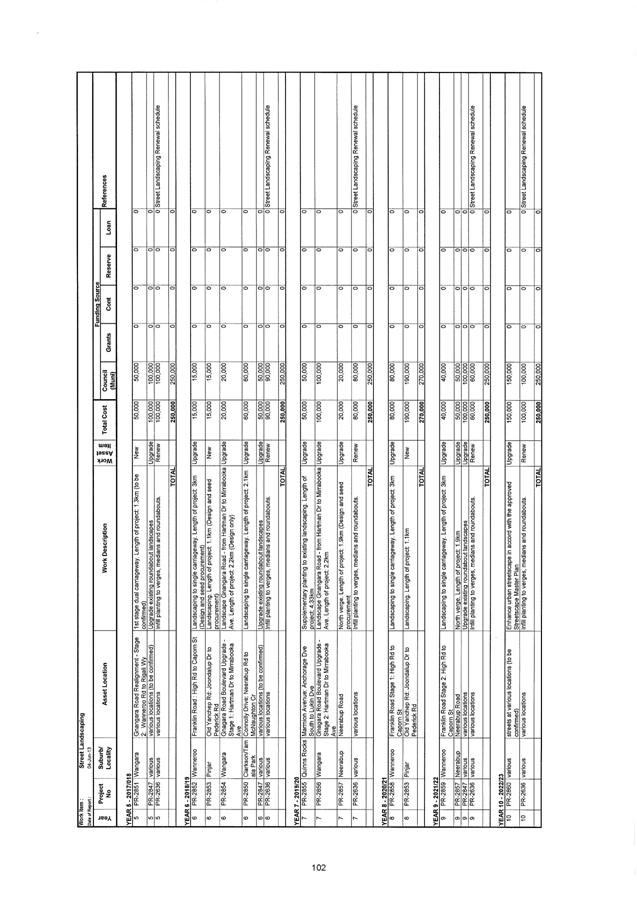

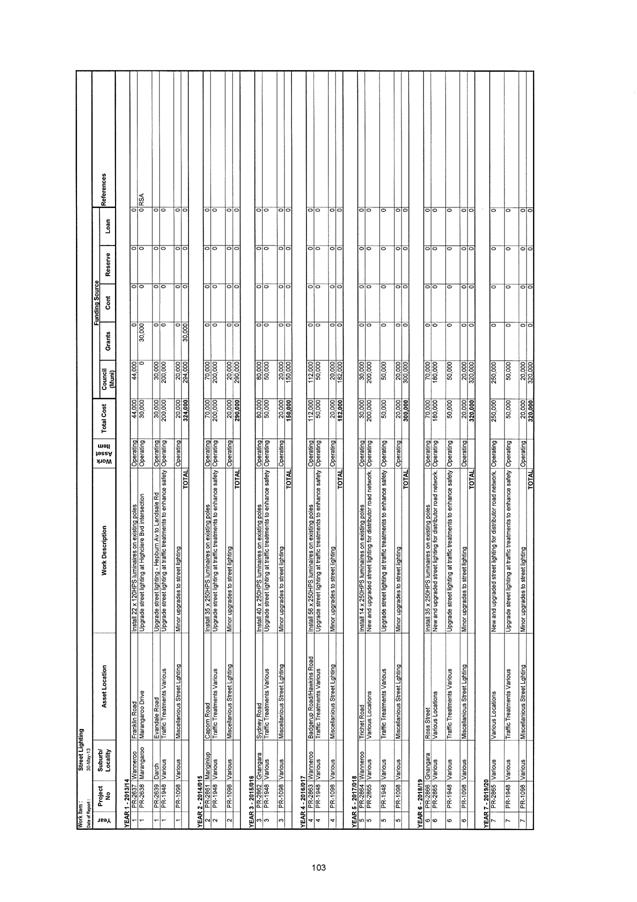

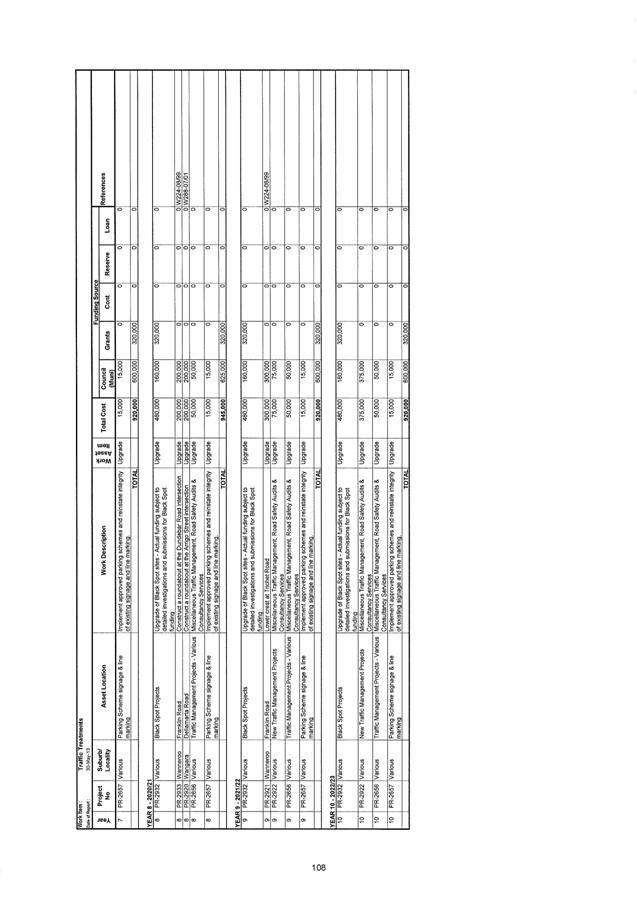

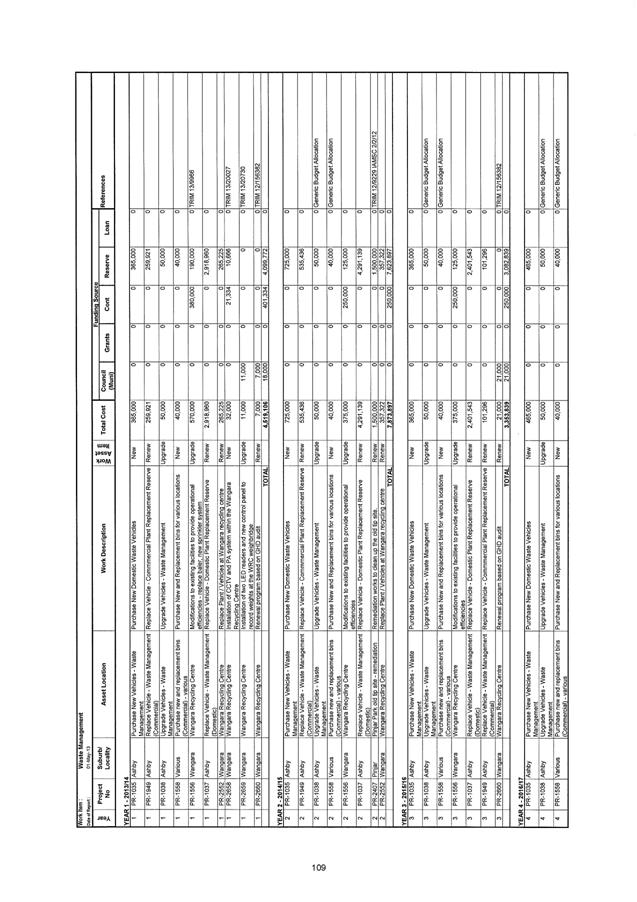

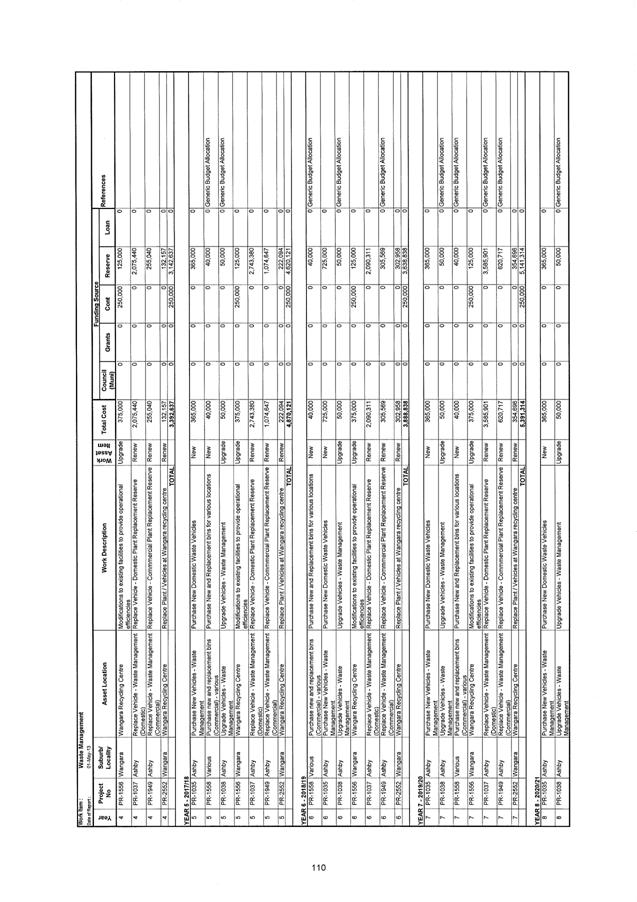

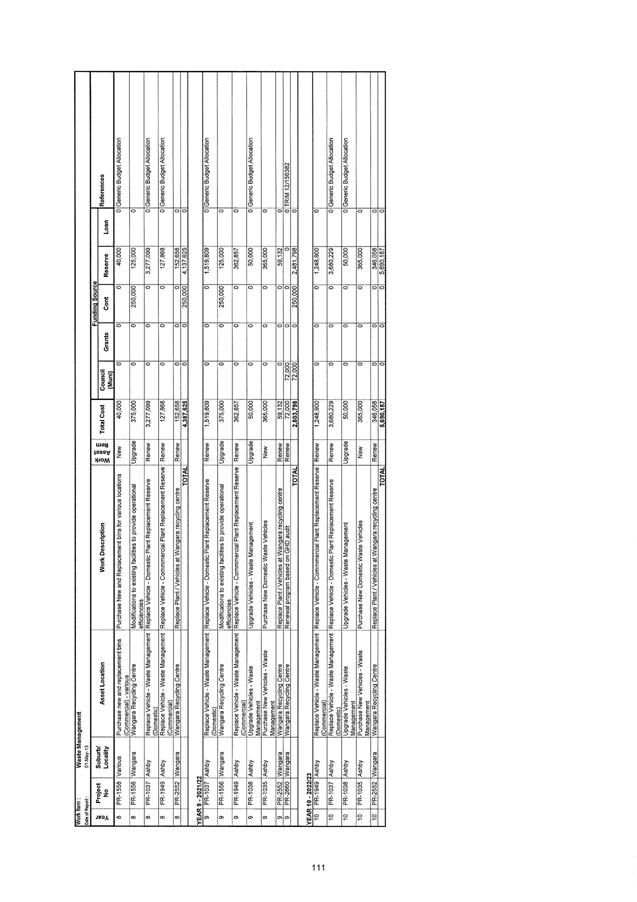

Capital Works

The 10 Year Capital Works Program (incorporated into the LTFP) has been closely reviewed, balancing the demands for new infrastructure with the need to maintain and upgrade existing assets. Asset management plans have been developed for the different asset classes as an integral part of the Integrated Planning Framework to assist with the programming of maintenance, upgrade and replacement for existing assets.

The 2013/2014 Budget provides a total of $42.158 million Capital Works Program, excluding $30.152 million carry forward capital projects from 2012/2013 (Attachment 3). Some major new construction projects addressing the growth in the City include:

· Commencement of a major expansion ($27m) of the Civic Centre building - $1.635 million,

· Remediation and subdivision works of $1.600 million on Wangara industrial area,

· In excess on $0.670 million expanding our network of footpaths in the City,

· $2.300 million on the realignment of Brazier Road in Yanchep,

· A further $1.500 million on the upgrade of Lenore Road in Wanneroo,

· $2.900 million towards the construction of new district sporting facilities in the Yanchep/Two Rocks area.

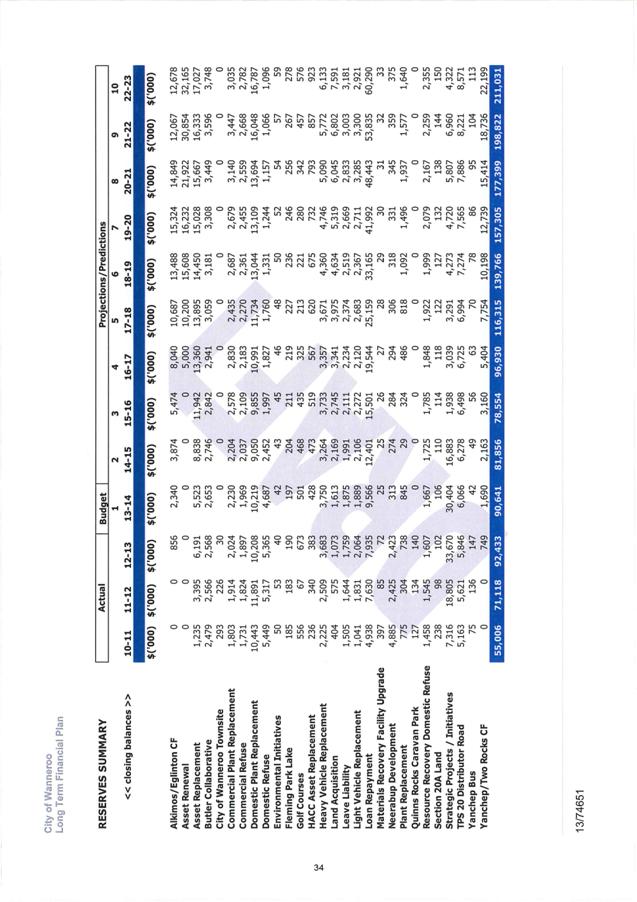

Reserves

In order to meet the funding requirements of the Budget, a range of Reserve transfers are proposed from particular Reserves established for the relevant purpose. This includes transfers from the following Reserves:

· Asset Replacement

· Butler Collaborative Infrastructure Agreement

· City of Wanneroo Townsite

· Commercial Refuse - Plant Replacement

· Domestic Refuse

· Domestic Refuse - Plant Replacement

· Environmental Initiatives

· Golf Course

· Heavy Vehicle Replacement

· Light Vehicle Replacement

· Materials Facility Upgrade

· Neerabup Development

· Plant Replacement

· Quinns Caravan Park

· Strategic Projects/Initiatives

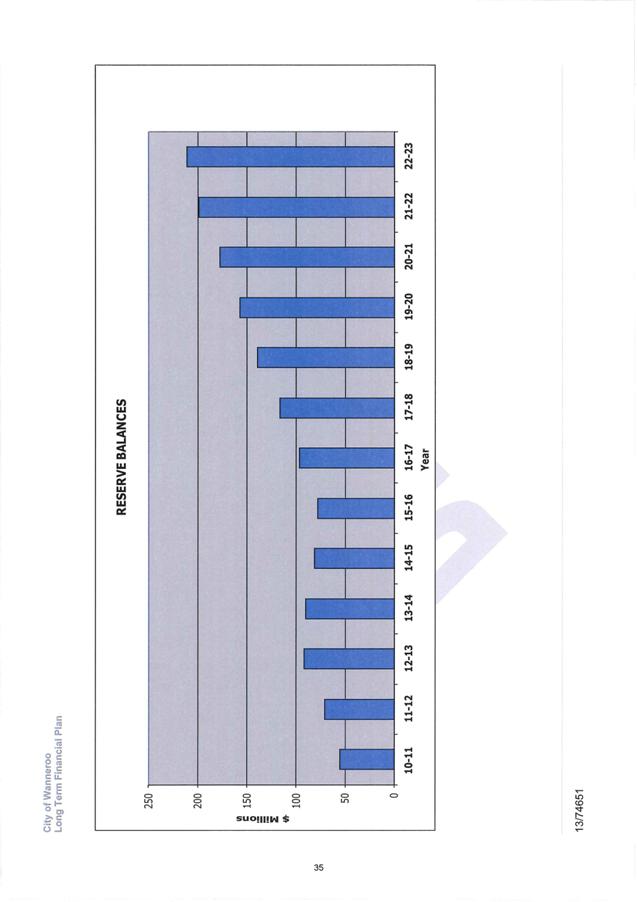

Through prudent budgeting in accordance with the previously adopted Budget Principles and the current Long Term Financial Plan, it has been possible to improve the City’s reserve funding capacity, which should enhance the City’s ability to meet future demands, without requirements on further loan funding.

Furthermore, to provide greater clarity and appropriate recognition of specific funding needs from reserves the establishment of an additional reserve and deletion of other reserves are proposed as follows:

Addition:

· Asset Renewal Reserve: To be used for the purpose of setting aside necessary funds for the future requirements of asset renewal and replenishments.

Deletion:

· Commercial Refuse Plant Reserve,

· Domestic Refuse Plant Replacement Reserve,

· Heavy Vehicle Replacement Reserve,

· Light Vehicle Replacement Reserve,

It is proposed that the above 4 reserves are to be abolished to rationalise the number of reserves, particularly that service similar requirements.

Funds equal to the carried forward replacement programs are to be transferred to the Plant Replacement Reserve with the balance being transferred to the Strategic Projects/Initiative Reserve.

· Asset Preservation Reserve,

· Fleming Park Lake Reserve.

It is proposed that the above 2 reserves are to be abolished due to the immaterial amount involved and the balance of the funds, if any, transferred to the Municipal Account to support the on-going expenses requirements.

Loan Funding

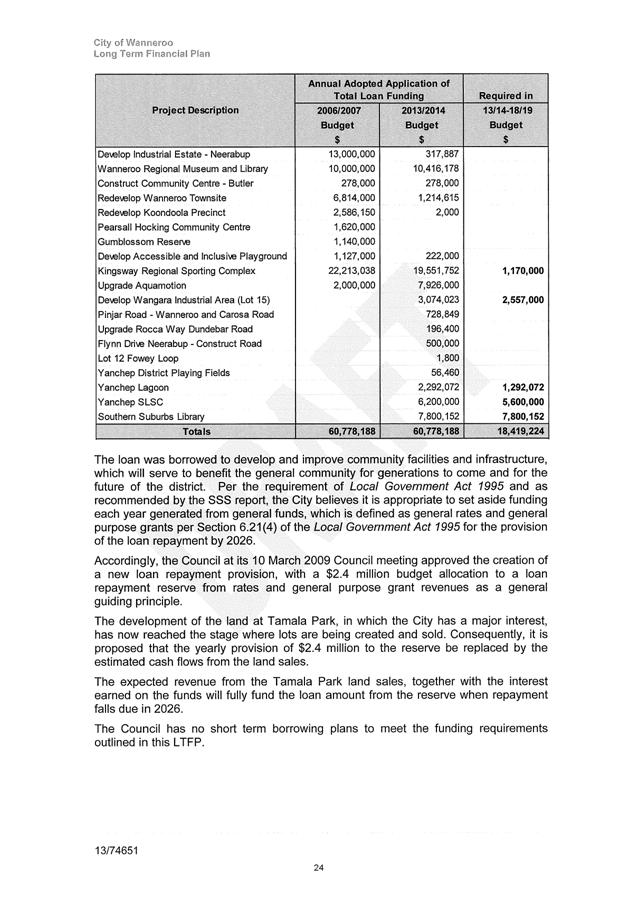

In 2006, the City secured a $60.778 million loan from Treasury Corp, to be drawn down over five years to assist in funding major and strategic projects with the final drawdown of $14.060 million having taken place in November 2010. Repayments are interest only, with the principal due for repayment in December 2026.

The application of the loans has been varied in successive Budgets to recognise changes in project costs, availability of alternative funding and changes in priorities and timing of projects. It is worth noting that the Loan Repayment Reserve is projected to have sufficient funds to fully repay the City’s $60.778 million loan back to State Treasury when it falls due (2026) through the previous annual transfers of $2.400 million to 2011/2012 together with forecast sale of land dividend income from Tamala Park Regional Council.

Key Changes to Budget since Workshop 3

The development of the Annual Budget is informed and updated continuously to reflect the latest factors likely to influence the City’s operations. As a result of a range of factors or clarification being obtained, the following adjustments have been made to the draft Budget since the previous Budget Workshop with Elected Members.

Operating Revenues -$2.692 million

Reduced to recognise that an early payment from the Grants Commission of 50% of the 2013/2014 Financial Assistance Grant will take place in 2012/2013.

Operating Expenses -$0.042 million

Reduced to recognise updated Depreciation calculations based on latest data to Budget 2013/2014.

Non Operating Revenue & Expenses +$1.977 million

Reduced to recognise recently signed contracts for the sale of the 2 EcoVision properties with 50% of the net proceeds to be recorded in 2012/2013 however also increased to reflect the funding of carry forward capital works.

New Capital +$0.900 million

To recognise an increase of $0.050 million to the furniture replacement program and a new inclusion of $0.850 million for an access road to Yanchep Playing Fields.

Carry Forward Capital +$30.152 million

To recognise the forecast value of Capital Projects which are likely to remain unspent as at the end of the current financial year, to be finished in 2013/2014. Major projects to be carried forward include:

PR-1671 Yanchep Lagoon Redevelopment $0.850m

Kingsway Regional Sporting Complex $3.602m

Flynn Drive, Neerabup – Construct Road $6.341m

Lenore Road, Wanneroo – Construct Carriageway $6.120m

Upgrade Roundabout Marmion/Hester Ave $0.900M

Upgrade road – McPharlin Ave $0.470M

Traffic treatments – Lagoon Dr/Brazier Ave $0.517M

Wanneroo Road Streetscape $0.927M

Wangara MRF Upgrade $0.498M

The carry forward projects are supported by the following funding sources:

- Grants and Contributions $5.382M

- TPS $9.310M

- Reserves $2.718M

- Loans $4.897M

- Municipal $7.845M

Consultation

In accordance with the requirements of Section 6.36 of the Local Government Act 1995, the City is required to give notice of its intention to levy Differential General Rates and Specified Minimum Payments. Notices to this effect were advertised on 21 May 2013, open for a submission period of 21 days. No submissions were received within the submission period.

Comment

In developing the 2013/2014 Budget, various non-controllable economic and legislative factors have been considered, including the uncertain and remaining weak international economic environment, Australia’s slowing national growth and low inflation, plus a full year better than anticipated impact of the new Building Act legislation and the flow on effects of the carbon tax. The compound effect of these factors together with the compliance requirements of the Integrated Planning Framework creates a significant degree of complexity to the preparation of the 2013/2014 Budget. Nonetheless, a prudent and responsible approach has been taken in forecasting revenues and activity levels for Wanneroo.

This approach results in an Operating budget that reflects an 8.3% increase in Operating Income and an increase in Operating Expenditure of 7.7% when comparing to the 2012/2013 Adopted Budget. Furthermore, the following factors and the associated risks and opportunities affecting the City’s Budget must be noted:

1. On the 7 June 2013, Commonwealth Government has paid the City in advance 50% of the 2013/2014 Financial Assistance Grants which equated to $3.006 million. This revenue will be receipted as income in 2012/2013. This factor alone can be directly attributed to the Operating deficit (-$1.578 million) being reflected for 2013/2014. Hence notionally reinstating the grants income to a full year scenario would provide a modest Operating Surplus.

2. The Reserve Bank recently cut the cash rate by another 0.25% at its May meeting with the current cash rate now reflecting as 2.75%. Economic commentaries suggest that further rate cuts may be possible by end of this year and if they eventuate, the situation will have some detrimental impact on the City's investment earnings.

3. Recent amendments to the Local Government (Financial Management) Regulations 1996, restrict investments effective from 1 July 2012 onwards to the following highly secured investments:

· Authorised deposit taking institutions and the Western Australian Treasury Corporation for a term not exceeding 12 months;

· Bonds that are guaranteed by the Commonwealth Government or a State or Territory for a term not exceeding three years; and

· Australian currency.

This regulation has materially restricted the flexibility of local government investment options to low yield high security financial instruments, however; that is consistent with the City's previous prudent approach.

4. A Review of Commercial Waste has been undertaken and the City will phase out a portion of the commercial business stream, in particular Bulk Bins, which operates in a highly competitive market.

5. The changes to the Building Act which came into effect 1 April 2012 have shown minimal adverse impacts to the City's building application approval activities and revenues in 2012/2013. However, the City will continue to closely monitor the development in this regard, especially the growth in private certification practices businesses. It is believed that the new legislation's impact will not be known until after another 12 months.

6. The Mindarie Regional Council (MRC) Gate Fee has been modelled on a scenario of $149 per tonne, increased from this year's fee of $137 per tonne (8.6% increase). The impact of the Gate Fee on Refuse Removal Expenses is significant given the City is the largest contributor to MRC by way of tonnages, which are estimated at approximately 78,000 tonnes, including the residue from the Wangara Recycling Centre.

The Budget provides a total of $42.158 million Capital Works Program (excluding $30.152 million Carry Forward Capital Projects from 2012/2013), which will deliver significant improvements to the local community. It balances the real need for services and infrastructure in the City’s North and Coastal growth corridors whilst recognising the need for new, renewal and upgrade of facilities and services in the City’s established areas.

In light of the recent economic uncertainty, this Budget is considered to be financially prudent and responsible, providing efficiencies, whilst maintaining a high level of service and delivering on long-term sustainability through initiatives such as the Debt Management Strategy and addressing Asset Renewal and Upgrade. Importantly, over the longer term, it establishes a process for building on the City’s Reserves.

The proposed level of rate increase of 5.5% is consistent with the principle established in the PWC report Western Australian Local Government Association Rate Setting Processes, Funding Amenity and Service Sustainability of WA Outer Metropolitan Growth Councils and actually 0.4% lower than that forecast in the previous LTFP. This is considered appropriate when taking into account the challenges imposed by the reduced growth in income and noting that the Rate includes the Rubbish Charge.

Statutory Compliance

The accompanying Budget for 2013/2014 has been prepared in accordance with the Local Government Act 1995 (the Act), Local Government (Financial Management) Regulations 1996 and Australian Accounting Standards.

Pursuant to Section 6.33(3) of the Act, Administration has written to the Minister seeking approval to the Differential General Rates as published. Confirmation of approval is required (and anticipated) prior to Budget Adoption, however at the time of writing this report is yet to be received.

Pursuant to Section 6.36(1) of the Act, the City has given the appropriate notice of its intention to impose Differential General Rates and Specified Minimum Payments in respect of each Differential Rate Category. No submissions were received by close of submission period.

In accordance with Section 6.36(5), the City may modify the proposed rates and minimum payments after considering any submissions, without the requirement for further local public notice. The only modification proposed is to reduce the Minimum Rate for Residential Vacant from $701 to $668 to comply with the legislative requirement for a maximum of 50% of properties in a category to be rated on a minimum rate basis.

Sub-regulation 56(4)(b) of the Local Government (Financial Management) Regulations 1996 requires that the Rate Notices provide details and reasons for any variation in the Minimum Rate and Differential Rate from that proposed in the notice published in accordance with Section 6.36 of the Act.

Strategic Implications

The proposal accords with the following Outcome Objective of the City’s Strategic Plan 2006 – 2021:

“4 Governance

4.6 Provide and maintain a high standard of governance and accountability”

Policy Implications

Nil

Financial Implications

The timely adoption of the 2013/2014 Annual Budget will facilitate opportunities in terms of investment revenue and allow the implementation of the Capital Program.

Voting Requirements

Absolute Majority

That Council by an ABSOLUTE MAJORITY: -

1. ADOPTS the Budget for the City of Wanneroo for the Financial Year Ending 30 June 2014, incorporating:

1.1 Statement of Comprehensive Income, showing Total Comprehensive Income of $43,106,715 Surplus.

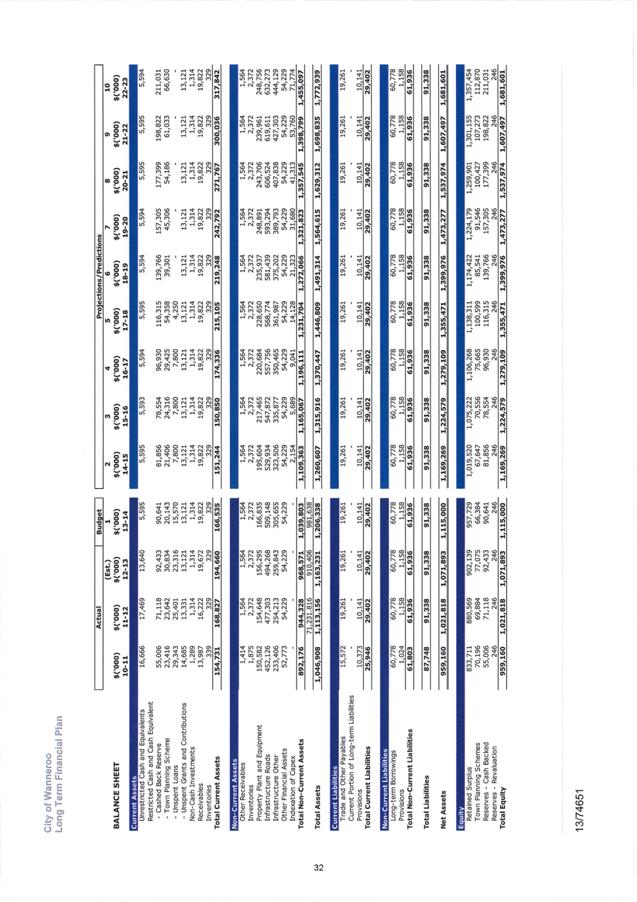

1.2 Statement of Cash Flows, showing cash at end of year position of $145,069,608.

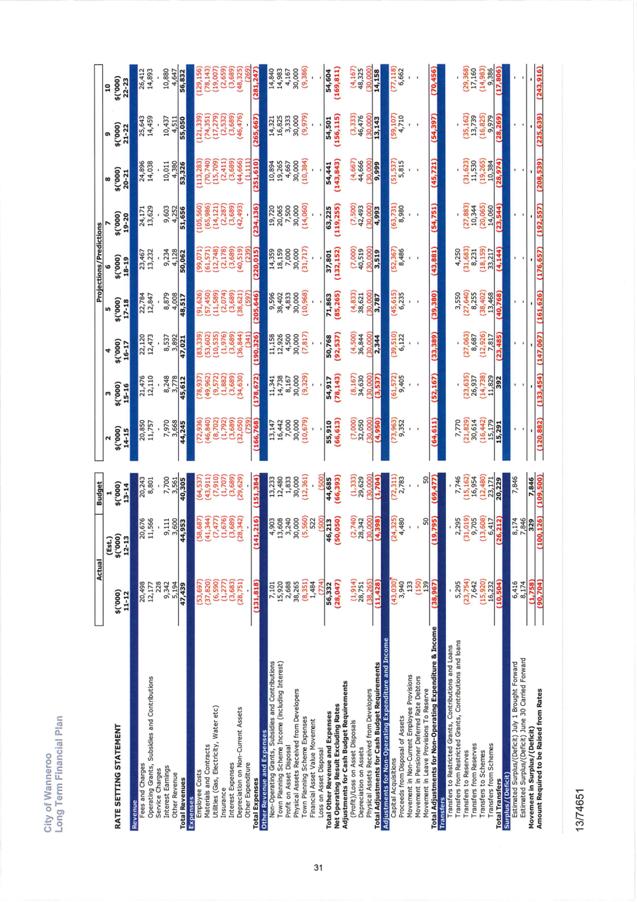

1.3 Rate Setting Statement, showing the need to generate $109,500,000 in Rates.

1.4 Notes To and Forming Part of the Budget.

1.5 Attachments (3) & (4) being –

(3) 2013/2014 Capital Works Program (including Carry Forwards from 2012/2013).

(4) 2013/2014 Schedule of Fees and Charges.

2. In accordance with Section 6.47 of the Local Government Act 1995, AGREES to waive the 2013/2014 Council rates (excludes Emergency Services Levy) for land leased by the City to the following community groups:

· AJS Motorcycle Club of WA Inc

· Kingsway Football & Sporting Club Inc

· Kingsway Olympic Sports Club

· Quinns Mindarie Surf Lifesaving Club Inc

· Quinns Rocks Sports Club

· Tiger Kart Club Inc

· Wanneroo Agricultural Society

· Wanneroo Amateur Football Club, Wanneroo Cricket Club, Wanneroo Junior Cricket Club and Wanneroo Junior Football Club (Wanneroo Showgrounds Clubrooms)

· Wanneroo BMX Club

· Wanneroo City Soccer Club Inc

· Wanneroo Districts Cricket Club Inc (indoor facility)

· Wanneroo Districts Cricket Club Inc & Wanneroo Districts Hockey Association Inc

· Wanneroo Districts Netball Association

· Wanneroo Districts Rugby Union Football Club Inc

· Wanneroo Horse & Pony Club

· Wanneroo Junior Motocross Club Inc

· Wanneroo Racing Pigeon Club

· Wanneroo Shooting Complex Inc

· Wanneroo Sports & Social Club

· Wanneroo Tennis

· Wanneroo Trotting & Training Club Inc

· Yanchep Golf Club

· Yanchep Sports Club Inc

· Yanchep Surf Lifesaving Club Inc

3. Differential Rating

In accordance with the provisions of Sections 6.32, 6.33 and 6.35 of the Local Government Act 1995:

3.1 IMPOSES Differential Rates and Minimum Rates for the 2013/2014 Financial Year; and

3.2 NOTES that the Differential Rates and Minimum Rates for the 2013/2014 Financial Year are inclusive of Domestic Rubbish Collection Charges where applicable, and

3.3 SETS the Differential General Rates in accordance with the following tables:

3.3.1 General Rate – Gross Rental Value & Minimum Rates

In accordance with the Minister’s approval received on xx June 2013 and subject to the provisions of Sections 6.32, 6.33 and 6.35 of the Local Government Act 1995, impose the 2013/2014 Gross Rental Value Differential Rates and Minimum Rates as follows: -

|

GRV Category |

Rate in Dollar (cents) |

General Minimum Rate $ |

|

Caravan Parks & Park Homes Improved |

7.7564 |

362 |

|

Commercial Improved |

7.5144 |

1135 |

|

Community Groups – Major Improved** |

8.3111 |

240 |

|

Community Groups – Surf Clubs Improved |

2.0505 |

240 |

|

Community Groups – General Improved |

3.9269 |

240 |

|

Industrial Improved |

6.3257 |

1135 |

|

Industrial Improved – Lesser Minimum |

N/A |

567 |

|

Residential Improved |

7.7574 |

1155 |

|

Rural and Mining Improved |

8.4819 |

1145 |

|

Commercial Vacant |

6.4213 |

1135 |

|

Industrial Vacant |

4.1348 |

1135 |

|

Residential Vacant |

10.8424 |

668 |

|

Rural and Mining Vacant |

7.9262 |

770 |

** = Sporting Clubs & Major Event Providers

3.3.2 General Rate – Unimproved Value & Minimum Rates

In accordance with the Minister’s approval received on xx June 2013 and subject to the provisions of Sections 6.32, 6.33 and 6.35 of the Local Government Act 1995, impose the 2013/2014 Unimproved Value Differential Rates and Minimum Rates as follows: -

|

UV Category |

Rate in Dollar (cents) |

General Minimum Rate $ |

|

Commercial Improved |

0.2597 |

1135 |

|

Community Groups – Major Improved** |

0.2550 |

240 |

|

Community Groups – General Improved |

0.1237 |

240 |

|

Industrial Improved |

0.2420 |

1135 |

|

Residential Improved |

0.3304 |

1155 |

|

Rural and Mining Improved |

0.3211 |

1145 |

|

Commercial Vacant |

0.2757 |

1135 |

|

Industrial Vacant |

0.2719 |

1135 |

|

Residential Vacant |

0.4296 |

701 |

|

Rural and Mining Vacant |

0.3410 |

770 |

** = Sporting Clubs & Major Event Providers

4. Domestic Refuse Charges

Pursuant to the provisions of Division 5 of Part IV of the Health Act (as amended) and Section 67 under Division 3, Part 6 of the Waste Avoidance and Resource Recovery Act 2007, impose the following Domestic Refuse Charges for the 2013/2014 Financial Year: -

4.1 Standard Service Charge p.a. (one 240L recycling bin & one 240L rubbish bin) included within General Rates.

4.2 Additional Service Charge p.a. (one 240L recycling bin & one 240L rubbish bin) $360.50.

4.2 Additional Recycling Service Charge Only p.a. (one 240L recycling bin) $160.00.

4.3 Additional Rubbish Service Charge Only p.a. (one 240L rubbish bin) $334.75.

4.4 Establishment Charge (per each new or additional service, one 240L recycling bin & one 240L rubbish bin) $98.90.

4.5 Establishment Charge (per each new or additional 240L recycling bin or additional 240L rubbish bin) $54.40.

5. Private Swimming Pool Inspection Fees

In accordance with the provisions of the Local Government (Miscellaneous Provisions) Act 1960, Section 245A, IMPOSES for the 2013/2014 financial year, a Private Swimming Pool Inspection Fee on construction of $39.60 (inclusive of GST) and in each subsequent year thereafter a Private Swimming Pool Inspection Fee of $18.20 (inclusive GST) for each property where there is located a private swimming pool.

6. Payment Incentives

In accordance with the provisions of Section 6.46 of the Local Government Act 1995, offer the following incentives for the payment of Rates and Charges: -

• Full payment

Full payment of all current and arrears of Rates and Charges and Private Swimming Pool Inspection Fees (inclusive of GST) within 35 days of the issue date on the Annual Rate Notice: -

- eligibility to enter the early incentive draw.

• Two Instalments

The first instalment of 50% of the total current Rates and Charges, Private Swimming Pool Inspection Fees (inclusive of GST) and Instalment Charge, plus the total outstanding arrears payable within thirty-five (35) days of date of issue of the Annual Rate Notice: -

- eligibility to enter the early incentive draw.

• Four Instalments

The first instalment of 25% of the total current Rates and Charges, Private Swimming Pool Inspection Fees (inclusive of GST) and Instalment Charge, plus the total outstanding arrears payable within thirty-five (35) days of date of issue of the Annual Rate Notice: -

- eligibility to enter the early incentive draw.

7. Payment Options

In accordance with the provisions of Section 6.45 of the Local Government Act 1995, offer the following payment options for the payment of Rates and Charges and Private Swimming Pool Inspection Fees (inclusive of GST): -

• One Instalment

Payment in full within 35 days of the issue date of the Annual Rate Notice.

· Two Instalments

The first instalment of 50% of the total current Rates and Charges, Private Swimming Pool Inspection Fees (inclusive of GST) and Instalment Charge, plus the total outstanding arrears payable within 35 days of date of issue of the Annual Rate Notice.

The second instalment of 50% of the total current Rates and Charges, Private Swimming Pool Inspection Fees (inclusive of GST) and Instalment Charge, payable 63 days after due date of first instalment.

· Four Instalments

The first instalment of 25% of the total current Rates and Charges, Private Swimming Pool Inspection Fees (inclusive of GST) and Instalment Charge, plus the total outstanding arrears payable within 35 days of date of issue of the Annual Rate Notice.

The second, third and fourth instalments each of 25% of the total current Rates and Charges, Private Swimming Pool Inspection Fees (inclusive of GST) and Instalment Charge, payable as follows: -

- Second Instalment 63 days after due date of first instalment.

- Third Instalment 63 days after due date of second instalment.

- Fourth Instalment 63 days after due date of third instalment.

8. Late Payment Interest

In accordance with the provisions of Sections 6.13 and 6.51 of the Local Government Act 1995, impose interest on all arrears and current charges in respect of Rates and Charges and Private Swimming Pool Inspection Fees (including GST where applicable) at a rate of 8.45% per annum, calculated on a simple interest basis on arrears amounts that remain unpaid and current amounts that remain unpaid after thirty-five (35) days from the issue date of the Original Rate Notice, or the due date of the instalment and continues until instalment is paid.

Excluded are Deferred Rates, Instalment current amounts not yet due under the Four (4) payment options, Registered Pensioner Portions and current Government Pensioner Rebate amounts.

Such interest is to be charged once per month on the outstanding balance on the day of calculation for the number of days, as previously detailed.

9. Instalment and Arrangements Administration Fees and Interest Charges

In accordance with the provisions of Section 6.45 of the Local Government Act 1995, for the 2013/2014 Financial Year, the following Administration Fees and Charges are imposed for payment of Rates and Charges and Private Swimming Pool Inspection Fees (inclusive of GST): -

Two Instalment Option

An Administration Fee of $5.00 for Instalment Two, together with an Interest Charge of 5.5% per annum, calculated on a simple interest basis on:

• 50% of the total current General Rate and Charges and Private Swimming Pool Inspection Fees (inclusive of GST) calculated 35 days from the date of issue of the Annual Rate Notice to 63 days after the due date of the first instalment.

Four Instalment Option

An Administration Fee of $5.00 for each of Instalment Two, Three and Four, together with an Interest Charge of 5.5% per annum, calculated on a simple interest basis on:-

• 75% of the total current General Rate and Charges and Private Swimming Pool Inspection Fees (inclusive of GST) calculated thirty-five (35) days from the date of issue of the Annual Rate Notice to 63 days after the due date of the first instalment;

• 50% of the total current General Rate and Charges and Private Swimming Pool Inspection Fees (inclusive of GST) calculated from the due date of the Second (2nd) Instalment to the due date of the Third (3rd) Instalment; and

• 25% of the total current General Rate and Charges and Private Swimming Pool Inspection Fees (inclusive of GST) calculated from the due date of the Third (3rd) Instalment to the due date of the Fourth (4th) Instalment.

10. ADOPTS the Significant Accounting Policies as detailed in Note 1 of Attachment 2 (2013/2014 Statutory Budget).

11. ADOPTS a percentage of 10% for the purposes of the reporting of material variances by Nature and Type monthly for the 2013/2014 Financial Year, in accordance with Regulation 34(5) of the Local Government (Financial Management) Regulations 1996.

12. As part of the Budget AUTHORISES the establishment of the following new Reserve:

· Asset Renewal.

13. As part of the Budget AUTHORISES the deletion of the following Reserves:

· Commercial Refuse Plant Replacement;

· Domestic Refuse Plant Replacement;

· Heavy Vehicle Replacement;

· Light Vehicle Replacement;

· Asset Preservation; and

· Fleming Park Lake.

Attachments:

|

1View. |

Annual Budget Overview 2013 2014 |

13/87087 |

|

|

2View. |

2013_2014 Model Budget with carry forwards |

13/87133 |

|

|

3View. |

2013/2014 Capital Works Budget |

13/82073 |

|

|

4View. |

Fees and Charges 2013 2014 |

13/80687 |

|

L.2 Integrated Planning & Reporting Framework

File Ref: 6671 – 13/78962

Responsible Officer: Director, Corporate Strategy and Performance

Disclosure of Interest: Nil

Attachments: 7

Issue

To approve the Strategic Community Plan, Corporate Business Plan and other components of the Integrated Planning and Reporting Framework (IPRF).

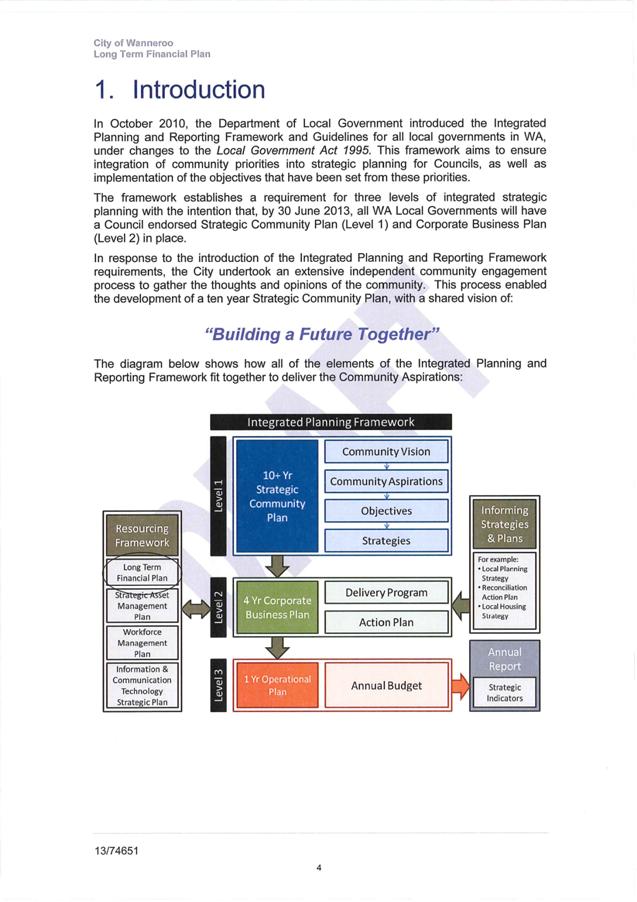

Background

The Integrated Planning and Reporting Framework (IPRF) has been introduced by State Government and places a requirement on all local governments to adopt relevant Plans by 30 June 2013. The IPRF has been developed as part of the State Government's Local Government Reform Program; to provide local governments a framework for establishing local priorities and to link this information to operational functions. All local governments are currently required to produce a plan for the future under section 5.56(1) of the Local Government Act 1995. Regulations under section 5.56(2) set out the minimum requirements to achieve this, which prescribes the development of a Strategic Community Plan (SCP) and Corporate Business Plan (CBP).

In developing the SCP, a workshop was held with Elected Members on 31 July 2012, followed by a further report presented to Council Forum on 4 September 2012. A Draft SCP was then presented to Council on 13 November 2012, resulting in the following resolution being adopted:

"That Council:-

1. NOTES the draft Strategic Community Plan, "Building a Future Together" and the summary version;

2. ENDORSES the draft "Building a Future Together" and summary document for community consultation;

3. APPROVES the consultation process as outlined in this report."

The Draft SCP was then advertised for public comment, with the submission period closing 31 December 2012. As a result of the consultation process and further review of the document, various formatting changes were implemented, along with minor grammatical corrections. In addition, the following amendments were introduced to the strategies and objectives within the respective Pillars:

Pillar 1: Environment

· Aspiration changed from 'A sustainable natural, built and healthy environment' to 'A healthy and sustainable natural and built environment'.

· Strategy 1.1.1 amended by replacing the word 'lakes' with 'waterways'.

Pillar 2: Society

· Aspiration amended to replace the word 'connected' with 'active'.

· Strategy 2.1.2 amended by replacing the word 'culture' with 'cultural diversity'.

· Strategy 2.2.3 amended by replacing the word 'living' with 'activity'.

· Strategy 2.3.1 amended by replacing the word 'region' with 'community'.

Pillar 3: Economy

· Strategy 3.3.4 added 'Increase walking and cycling opportunities'.

Detail

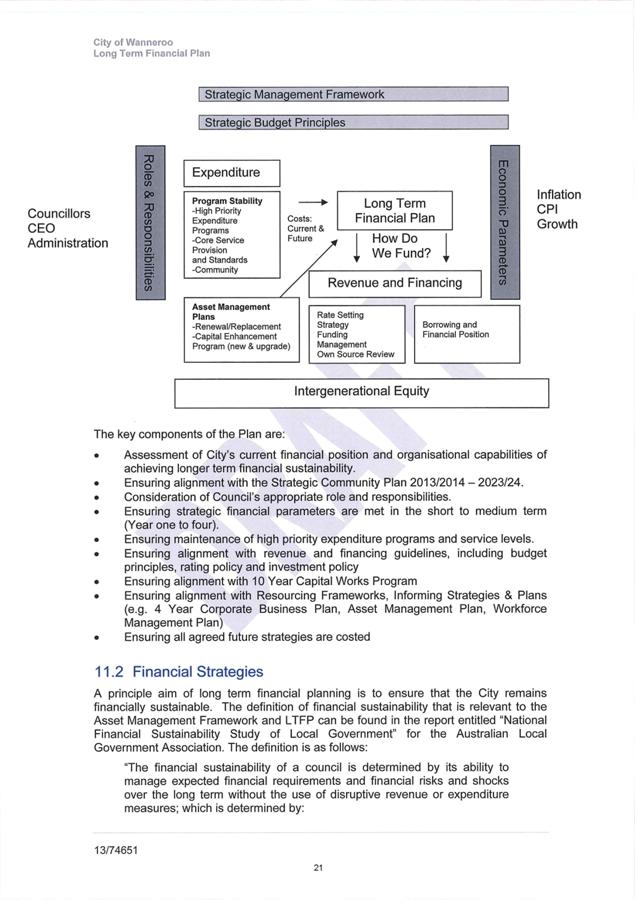

Following the development of the Draft SCP, the organisation has utilised the guidance published by the Department of Local Government to develop the other Plans and Resourcing Strategies required under IPRF:

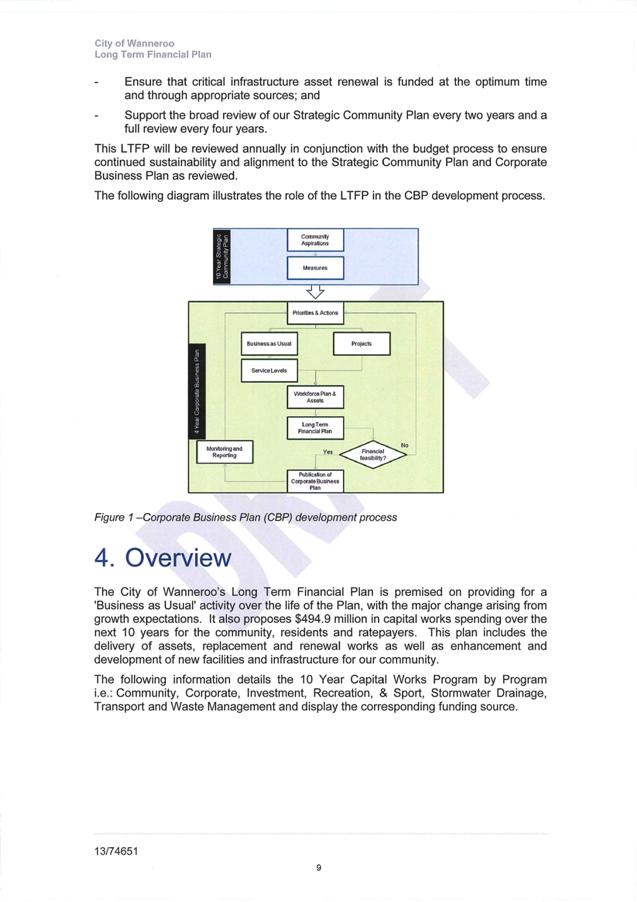

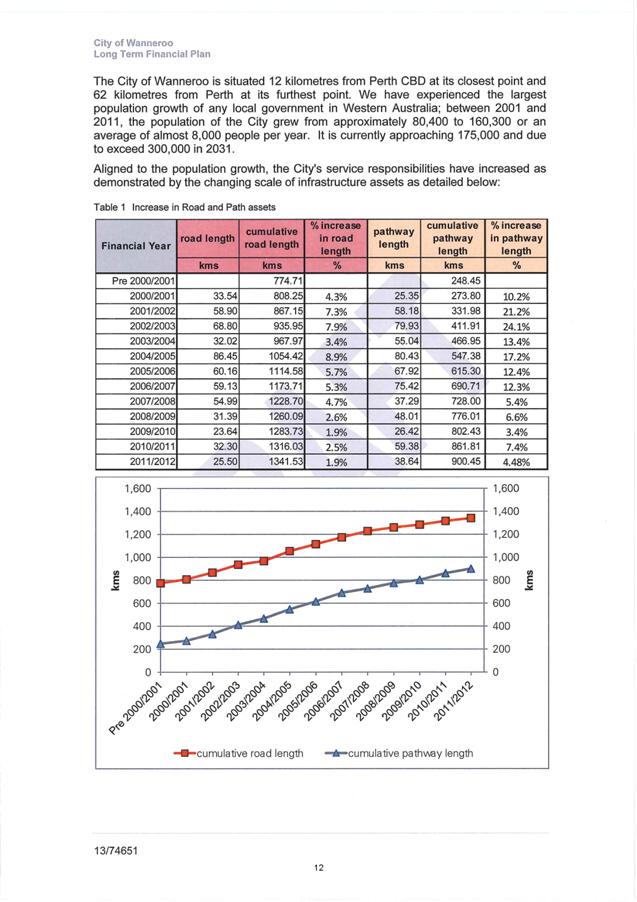

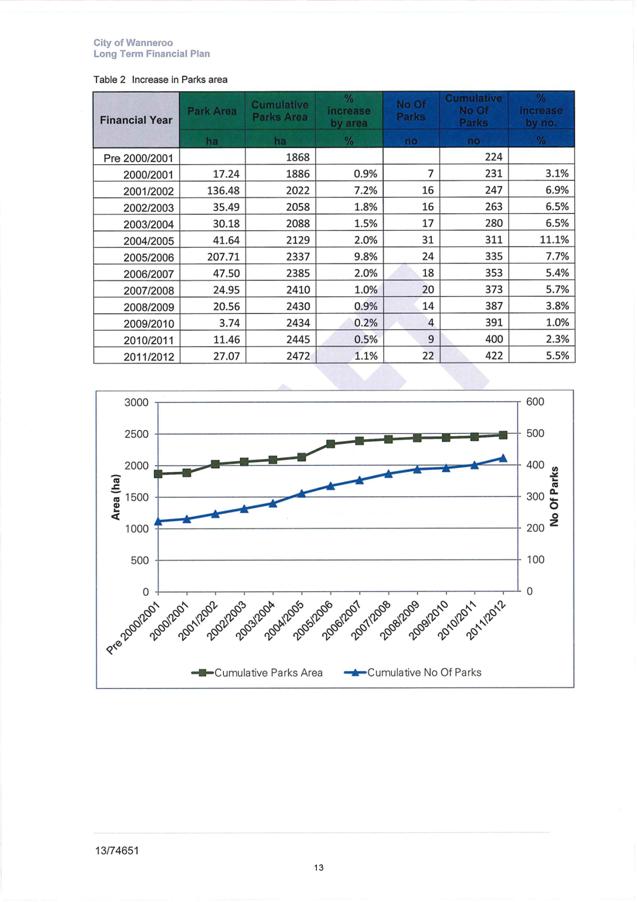

This new integrated framework builds on the City's existing work and ensures that this is geared towards meeting the wider community's expectations and aspirations within the organisation's financial and resource capacity. Importantly, the context for the City must take into consideration the forecast growth, which will see the population of the City of Wanneroo increase from an estimated 175,000 to 249,000 during the 10 Year life of the SCP.

Accordingly, the following draft documents have now been completed, the drafts of which were presented to the Council Forum meeting of 4 June 2013:

· Strategic Community Plan

· Corporate Business Plan

· Asset Management Framework (incorporating Asset Management Policy, Asset Management Strategy and Summary Asset Management Plan)

· Workforce Management Plan

· Long Term Financial Plan

External Assessment of Compliance Requirements

In developing the IPRF, the City engaged Consultants KPMG to evaluate the draft Plans and provide an assessment of the progress towards completion of each IPRF component. The resulting gap analysis provided a basis for identifying the work required to:

- Meet the minimum compliance requirements by 30 June 2013

- Improve the IPRF processes and component Plans in the short term to ensure better alignment and integration (during 2013/14)

As this is the first year of implementation of the new legislative requirement, the City has focused efforts in addressing the gaps identified by KPMG to ensure in the first instance that the minimum statutory requirements of the IPRF are met. The redrafted Plans were then further reviewed by KPMG and confirmation provided to the City that the content of these are in accordance with the requirements. The various Plans are required to be adopted by Council by 30 June 2013.

The status of each key IPRF component and the identified improvements that will be addressed as next steps during 2013/14 and beyond are detailed below:

Strategic Community Plan (Attachment 1)

- Current status

The City's Strategic Community Plan (SCP) Building a Future Together 2013/14 – 2022/23 articulates the community aspirations, with specific strategies which will be implemented to achieve the stated objectives. The development of the SCP provided an opportunity to revisit the overarching vision, objectives and strategies of the previous Strategic Plan 2006-2021 (Revised 2010) in light of feedback from the community, Elected Members, and other stakeholders.

The priorities of the community under the City's vision of Building a Future Together have been grouped into four pillars, being Environment, Society, Economy, and Civic Leadership, as workshopped with Elected Members. Within each pillar is a set of objectives that will be addressed to deliver on the priorities identified by the community.

The SCP informs the Corporate Business Plan. All operational business and projects to be delivered are required to align with the SCP. This approach ensures that the efforts and resources are appropriately directed to achieving the strategic objectives, and in turn the aspirations of the community.

Since the SCP was presented to Council Forum on 4 June 2013, the key change to the SCP has been to review the methodology for measuring and reporting back to the community the achievement over time of the strategic objectives and aspirations.

This has resulted in the addition of two performance measures against each of the objectives within the four pillars of Environment, Society, Economy, and Civic Leadership. These improved measures will enable more comprehensive annual reporting on the City's progress.

- Next steps

Periodic reviews of the SCP will be undertaken in order to adapt our actions to account for any shifts in community expectations and priorities. The SCP will be reviewed within two years and endorsed by Council prior to 30 June 2015. This review will focus on the strategies to ensure that they are still appropriate for achieving the community objectives.

A full review of the SCP will be undertaken within four years in accordance with the requirements of Regulation 19C (4) of the Local Government (Administration) Regulations 1996 and presented to Council by 30 June 2017. This will include going back to the community to test whether the vision, aspirations and objectives need to be changed in light of any changes to community priorities or capacity changes on the part of the City.

Corporate Business Plan (Attachment 2)

- Current Status

The Corporate Business Plan (CBP) details the City's priorities and actions for achieving the objectives and aspirations of the community as set out in the SCP. Essentially it operationalises the SCP and becomes a delivery plan. It is at the heart of the IPRF as it informs, and must take into account, all other components of the framework including the:

o Workforce Plan (WFP)

o Assets Management Plans

o ICT Strategic Plan

o Long Term Financial Plan (LTFP)

The CBP is essentially a contract between the CEO and the Elected Members that states how the City will activate the SCP. It aims to provide transparency and greater accountability by informing the community of the City's commitments.

The CBP comprises two key aspects; these being one-off projects and the business as usual operational activities that will be delivered over a four-year period. The Corporate Business Plan directly informs the development of the Workforce Plan by quantifying the level of human resource that will be required to deliver on projects and operational activities and the development of the Long Term Financial Plan. This move from an annual to a four-year delivery plan through the Corporate Business Plan enables more effective budgeting and project implementation over a longer timeframe.

The development of the CBP provides in a single source document the extent of activity being undertaken in terms of day to day service delivery, along with an ambitious list of new projects to be delivered each year. The review by KPMG highlighted pressure points within the organisation where there appears to be a heavy reliance on the goodwill of employees to deliver the projects along with business as usual activities. A lack of consistently mapped corporate processes means that the City lacks a true understanding of the baseline resourcing levels which in turn impairs the City's ability to accurately identify opportunities for process efficiency or to purposefully plan workforce requirements.

Since the CBP was presented to the Council Forum of 4 June

2013, the key change to the document has been to amend the format that the

priority projects and actions are presented. These are now listed without the

dollar figures and instead, an indication of when the projects will be

delivered, together with their funding source is detailed.

- Next steps

Critical improvements to the ongoing development of the CBP are:

- Prioritise the understanding of core business outcomes and the mapping of corporate processes. This will:

o provide a sound baseline for understanding the human resources required to support business delivery, and where processes can be made more efficient.

o build capacity within the City.

- Introduce one single point of coordination and oversight of projects:

o the implementation of a Project Management Framework will enable improved end to end project governance, controls, accountability, planning and budgeting in relation to projects.

o this is essential if the City is to have clarity on how we activate the SCP and in turn understand the true levels of human resourcing and financing required.

The CBP will be reviewed, reprioritised and reported on annually to provide information to the community and statutory bodies on the City's progress in delivering services, projects and other operations to meet the community's short term, medium term and long term aspirations. The CBP will evolve as a rolling four-year Plan which generates the annual budget and informs the Resourcing Plans described below.

RESOURCING FRAMEWORK

Workforce Plan (Attachment 3)

The Workforce Plan (WFP) is a resourcing strategy which coordinates the human resource requirements for delivering the City's operations. The WFP aligns with the operational and project priorities of the CBP to ensure the workforce needs and limitations are addressed. The WFP also details strategies for addressing both the present and anticipated workforce issues.

The WFP has been developed through:

- Analysis of internal and external environment and workforce

- Workforce implications of the SCP and CBP

- Growth projections and strategies to meet future workforce needs

Since the WFP was presented to the Council Forum of 4 June 2013 a number of changes have been made. These have been to finesse the format and grammar within the document, and to include a section that identifies the key human resourcing risks for the City and how these have been addressed through the WFP strategies.

Next steps

As the WFP derives information of the human resource requirements from the services and projects detailed within the CBP, ongoing work will be required to maintain and improve these linkages as the CBP is amended in the future. As a resourcing baseline for the delivery of business-as-usual services has not been established, this will aid the costing of changes to services subject to the City's population growth.

The work to establish the baseline will be informed thorough understanding core business processes, and the required human resources to deliver these at particular levels of service.

It will also be important to review and strengthen the alignment and integration of the WFP with the Asset Management Plans and ICT Strategic Plan. In particular, the linkages of human resource strategies with those strategies which incorporate the City's future growth, changes in the external environment, internal business processes, assets such as office accommodation, vehicles, office equipment and the opportunities from technological resources such as devices, hardware/software and systems. This will ensure that the human resource strategies maximise opportunities and address the challenges in each of these areas.

Strategic Asset Management Plan

- Current Status

The City has an ongoing commitment to sustainable asset management and has previously adopted an Infrastructure Asset Management Policy and Asset Management Plans for most of the City's Infrastructure assets. The IPRF, however requires a more comprehensive and integrated approach. Given the scale of the City's operation, it has been determined that addressing the requirements of the IPRF can best be achieved through the adoption of an Asset Management Framework.

The components of the Framework that are presented for adoption include:

· Asset Management Policy (Attachment 4)

This policy will supersede the existing Infrastructure Asset Management Policy and provide overarching key principles against which assets are to be managed. This will ensure there is an organisation-wide commitment to asset management, and the framework and objectives for the development of the AM Strategy and AM Plans.

· Asset Management Strategy (Attachment 5)

The Strategy sets asset management objectives, practices and strategies for the improvement of the asset base and the asset management system, and drives the entire asset management process. It ensures the objectives of the AM Policy one implemented, and provides the management framework to enable the implementation of detailed Asset Management Plans.

· Summary Asset Management Plan (Attachment 6)

This document summarises the outputs from the detailed AMPs on the long term asset renewal demand predictions and provides the link to the long-term financial planning and strategic planning. This Plan also brings together the corporate requirements such as Levels of Service and AM Data and Systems from the various detailed asset management plans and improvement planning summaries.

Since the Council Forum of 4 June when these documents were presented, they have been further reviewed, and a number of minor changes made. These changes have been primarily to the grammar and formatting, in order to improve the clarity and readability of the documents.

- Next Steps

The City is currently developing its asset management capacity and capability; Asset Management Plans currently focus primarily on infrastructure assets however, and exclude other asset classes such as ICT, Plant, Fleet, and Land.

The City will therefore review and consider a consistent approach and common corporate framework for the management of all assets, including consistency in the asset registers across all asset classes. Asset renewal demand should be integrated as a critical and mandatory consideration in all financial and capital decision making as this is key financial information for asset management strategies and the Long Term Financial Plan. In addition, processes to ensure that asset projects incorporate "whole of life" project costing for upgrades or new assets will ensure that the CBP and budget / Long Term Financial Plan are developed with accurate information.

The Asset Management Strategy outlines a range of tasks and strategies dealing with areas of accountability, integration, lifecycle management, standards and levels of service. These will need to be assigned, prioritised and progressively implemented. In addition, further analysis is required in terms of the long term financial impact of the predicted renewal program and funding strategies considered for integration into the City's long term financial planning.

ICT Strategic Plan

- Current Status

The City is currently developing an Information and Communication Technology (ICT) Strategic Plan which presents the City's approach to planning for, and managing, technology to improve business operations and ultimately service delivery to the community. The ICT Strategic Plan is not a legislative requirement of the IPRF (and is not included for adoption) however as a key contributor to productivity and a critical enabler of business, it is seen as a significant component of the City's overall framework for planning and reporting.

- Next Steps

Through the ICT Strategic Plan, a comprehensive evaluation of the technological opportunities to support the medium to longer term strategies of the WFP – such as the enabling of smart workplaces - and improvements to internal operations and service delivery will be undertaken. This will be achieved through understanding business processes and operational requirements. This is also coupled with an appreciation of the strategic requirements of the organisation and an exploration of appropriate ICT solutions to enable business process improvement and to support our business into the future. By maximising the appropriate use of ICT solutions the City may also reduce the demands on additional human resourcing that is required, with potential for increased efficiency.

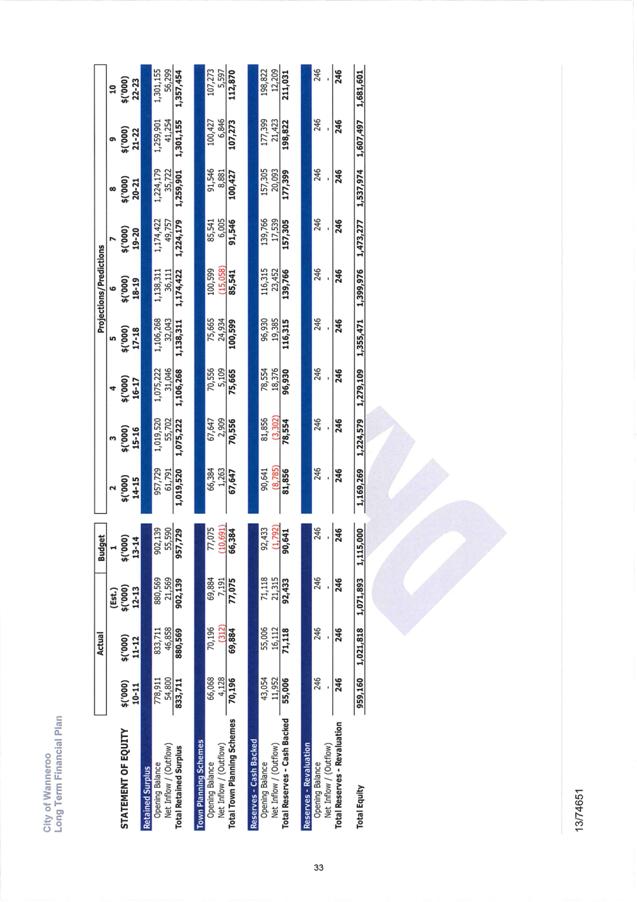

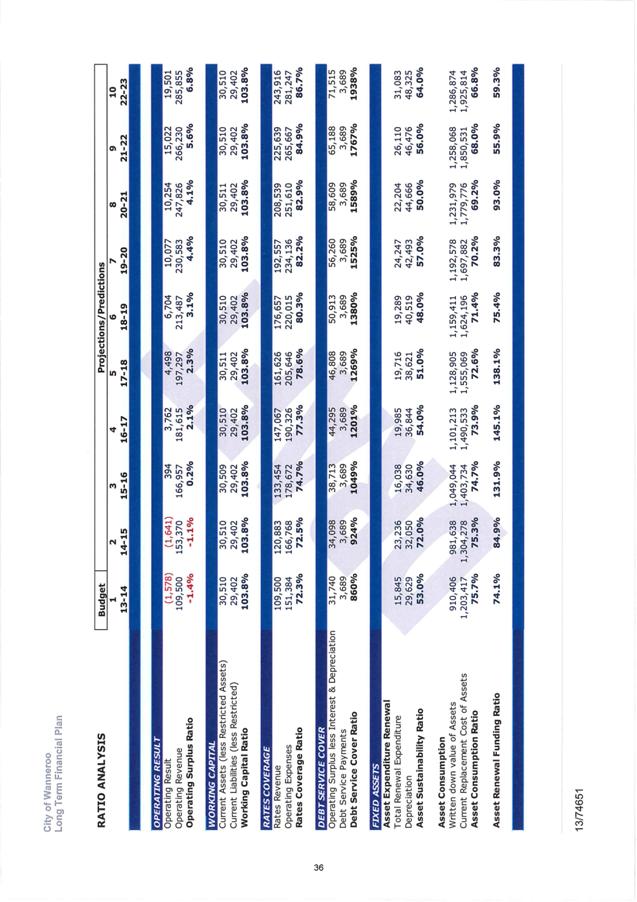

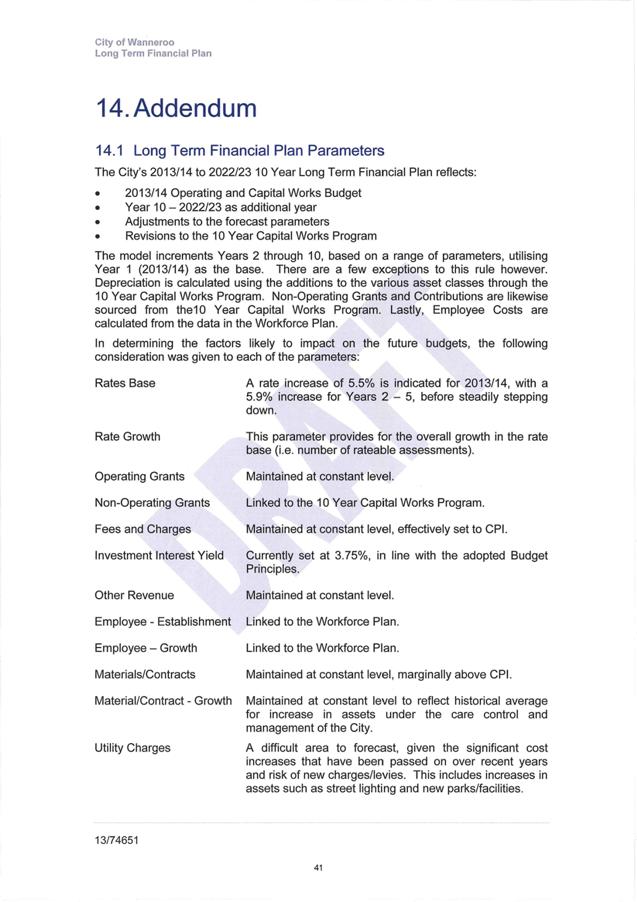

Long Term Financial Plan (Attachment 7)

- Current Status

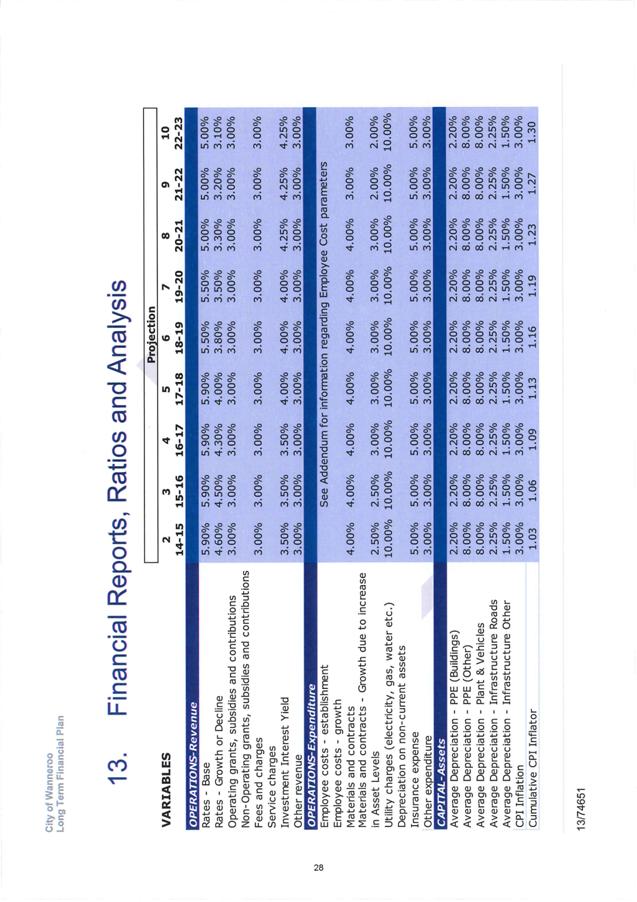

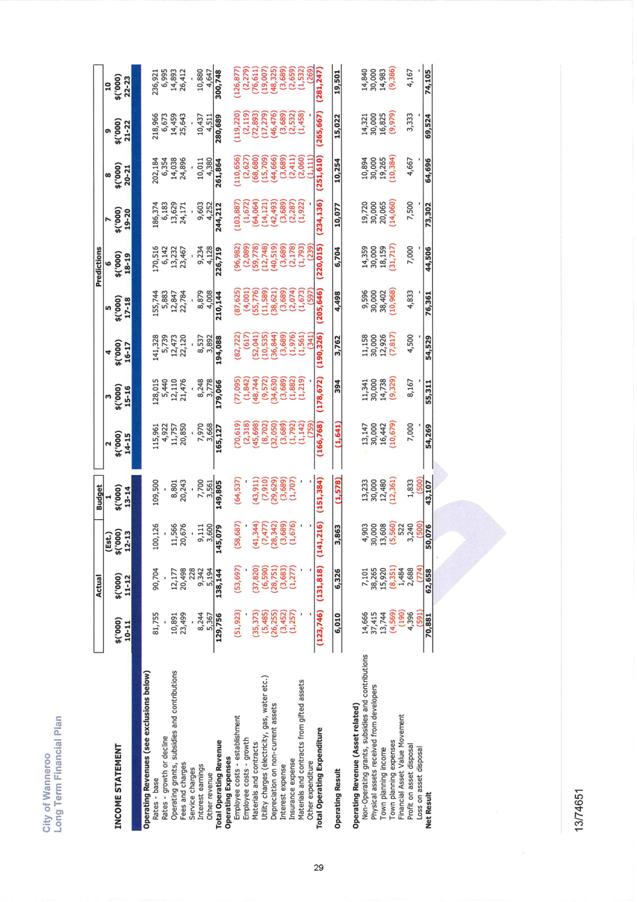

The City has developed a Long Term Financial Plan (LTFP) which is a 10-year rolling plan that draws from the Workforce Plan and Asset Management Framework, and informs the Corporate Business Plan to activate Strategic Community Plan priorities. The LTFP provides an indication of the City's long term financial sustainability to enable early identification of financial issues and their longer term impacts. The estimates and projections of the LTFP have been developed based on the City's business activities, financial commitments, community priorities and a set of assumptions (which include factors such as population growth, inflation forecasts, and revenue streams).

The City's financial resilience has been improving through successive budgets and the draft LTFP presents a reasonably strong position. Initiatives such as the Community Facility Plan and proposed Development Contribution Plan provide significant opportunities to improve the City's financial sustainability by reducing the demand on Municipal capital funding.

This is offset, however in the longer term by operational requirements, including significant asset management responsibilities. It is important therefore that strategies are developed with a much longer-term perspective than the 10 years covered by the LTFP.

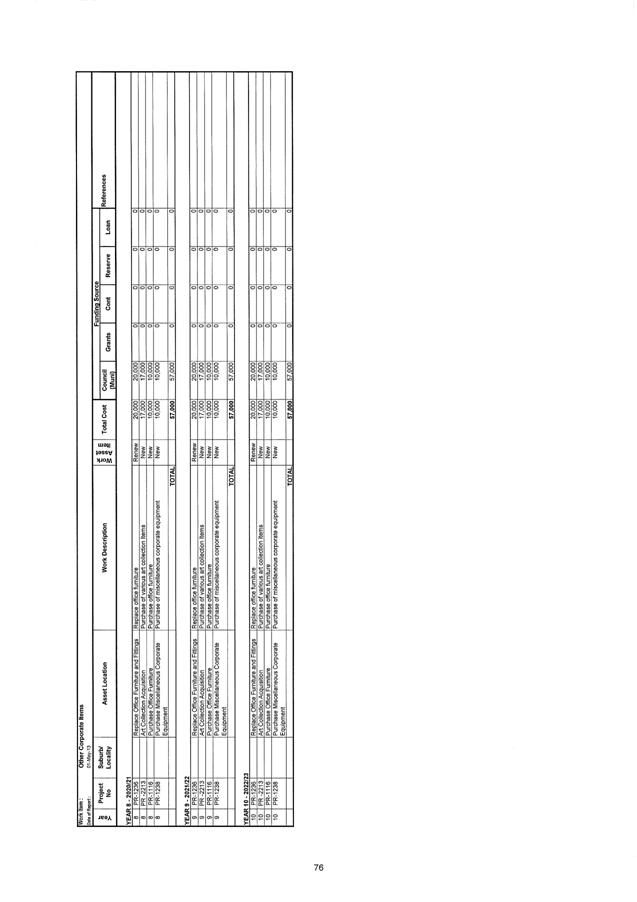

The 10 Year Capital Works Program is linked to the LTFP and included in the current documents. For Elected Member information, there have been no changes to the 10 Year Capital Works Program 2013/14 – 2022/23 as presented to Budget Workshop 3 other than those reported at the Council Forum on 4 June 2013, being:

Community Buildings: increase Furniture Replacement Program in Year 1 (PR-2203) from $30,000 to $80,000.

Pathways: delete Marmion Avenue pedestrian underpass project in Year 4 ($50,000).

Roads: add Access Road to Yanchep Active Open Space (YAOS) in Year 1 ($850,000) to reflect Council's committed contribution to road construction.

Sports Facilities: Increase budget for Yanchep/Two Rocks Playing Fields in Year 2 from $2,280,000 to $3,240,000 to correctly reflect potential cost of the YAOS project.

Since the LTFP was presented to the Council Forum of 4 June 2013 minor grammatical and formatting changes have been made to the document. Additional information has also been included, these being changes to the following areas:

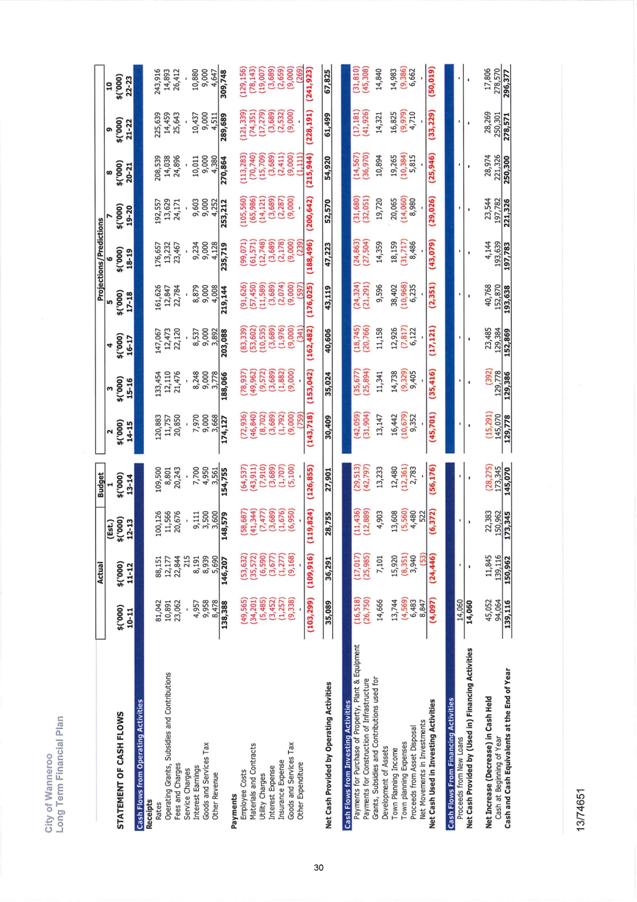

o Statement of Cash Flow (as part of the IPRF compliance requirement);

o Information about a review of the City's Rating Strategy by external consultants, the findings and recommendations of which will be workshopped with Elected Members during 2013/14;

o A section on risk assessment which identifies the prevailing global and local economic, legislative, social and environmental considerations;

o A Disclaimer to protect the City's interests in relation to the reliance and use of the information provided in the document by third parties.

- Next Steps

The City will focus efforts on strengthening the processes, systems and knowledge of planning for whole of life costing for operating and capital projects. Improvements to the financial planning model will be made to enable scenario modelling, such as the impact of introducing individual projects, with whole of life costs and the impact on rates over the longer term, or modelling for different scenarios of growth, and to enable sensitivity analysis testing.

The Long Term Financial Plan will be reviewed in conjunction with reviews of the Strategic Community Plan. This will involve a desktop review every two years (or annually prior to development of the Annual Budget) and a full review undertaken every four years. Importantly, reviews will need to progressively consider strategies to address the long term implications of predicted asset renewal demand.

Improvements to IPRF processes

It is recognised that there is room for further improvement to IPRF content and processes employed by the City. This will maximise the opportunity to apply the framework as a tool that drives improved planning, prioritised budgeting, and ultimately the longer term sustainability of the organisation whilst ensuring alignment to aspirations of the community. The opportunity for this lies in exploring improvements and the work required to:

- Embed IPRF processes as part of 'the way we work' so that it is not a bolt-on to business as usual, but an integral part of it;

- Undertake a comprehensive corporate change program to address business process inefficiencies and improve capacity and productivity;

- Implement improved governance and assurance frameworks particularly around projects;

- Undertake a comprehensive review and evaluation of the technology that is required to support improved business processes, and the opportunities of technological advancement to enable business improvement, achievement of strategies (such as workforce strategies) and to support the anticipated growth of the organisation.

Consultation

Extensive consultation has been undertaken throughout Wanneroo's diverse community in the development of inputs to the Strategic Community Plan which included the following key elements:

· Thinking Ahead Marketing Campaign – posters, bus signage, media advertising and giveaways to raise awareness of the integrated planning process.

· Post Card Campaign - distribution of reply paid postcards through shopping centres, sports venues, Clarkson Rail Station, playground, libraries and community programs – which elicited 1,781 responses.

· Resident phone survey – undertaken by Catalyse Market Research – which elicited 403 responses.

· Business phone survey – undertaken by Catalyse Market Research – which elicited 126 responses.

· Focus Groups – two with youth aged 12 – 24; one each with young families, older families, adult singles/couples with no children at home, seniors 55 plus.

· In depth interviews – with people with a disability or impairment or their carers; and with people with a non-English speaking background.

Further consultation occurred when the Draft Strategic Community Plan was published in November 2012, the results of which have been incorporated into the latest Draft of the Plan.

The adoption of the Strategic Community Plan will necessitate publication of a Local Public Notice informing of the availability of the SCP. It is proposed that all of the components of the IPRF would be publicly available on the City's website.

Any significant changes arising from reviews of these documents in subsequent years are required to be reported back to the community and to be tested against community aspirations.

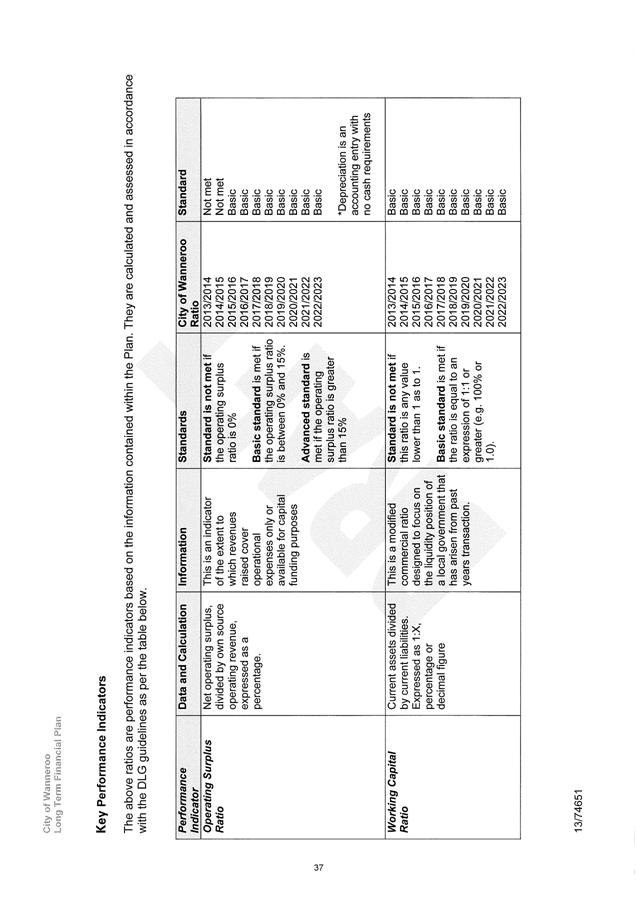

Comment

Whilst the City has developed the IPRF to ensure statutory compliance, it is recognised that the scale of activity will require improvements through successive versions. It is however considered to be an excellent launch into the process. Importantly, the components meet the requirements of legislation. It should be noted however the City's scorecard in terms of the various ratios prescribed reflect a mixed result, generally due to the unique growth rate experienced and impact on the City's asset base.

The task of developing and integrating the components of the IPRF has been particularly informative and enlightening and has identified the need to consider fundamental changes and improvements to facilitate operational efficiency and effectiveness.

Through the growth of the organisation, the City has placed heavy reliance on the goodwill of employees to deliver on services and projects to an expanding community. This coupled with processes that are not always optimised and ICT systems which may not adequately support business requirements into the future (given the City's growth projections), means the organisation could struggle to continue to grow efficiently and sustain the required level of outputs.

In order to establish an organisation that is geared to the requirements of servicing a much larger community, it is proposed to implement a transformational change program initially to the corporate areas and systems of the organisation. This process will need to be balanced with continuing to maintain the delivery of business as usual activities.

Further consideration will need to be given to the implications and requirement to defer some discretionary projects during the period of this program to create the necessary capacity within the organisation.

Statutory Compliance

The development of the Integrated Planning and Reporting Framework is a legislative requirement of local governments. Specifically, it is prescribed by section 5.56 of the Local Government Act 1995 (Planning for the Future) and Division 3 of the Local Government (Administration) Regulations 1996.

Strategic Implications

The proposal accords with the following Outcome Objective of the City’s Strategic Plan 2006 – 2021:

“4 Governance

4.6 Provide and maintain a high standard of governance and accountability”

Policy Implications

The continuous improvement in the City's Integrated Planning and Reporting Framework will have implications across a range of policies, with the first being the replacement of the existing Infrastructure Asset Management Policy with a more comprehensive Asset Management Policy.

Financial Implications

The introduction of the LTFP does not of itself impose financial implications, in fact its purpose is to provide greater clarity and transparency of decision making on long term capacity and financial sustainability.

Implementation of a Transformational Change Program to introduce improvements to efficiency and effectiveness of corporate processes and ICT systems will have a budgetary implication; however this will depend on the scale and staging of the activity. Further planning is required in this respect to work within current budgetary provisions.

Voting Requirements

Absolute Majority

Recommendation

That Council:-

1. By absolute majority Adopts the 10-year Strategic Community Plan 2013/14 – 2022/13 'Building A Future Together', as detailed in Attachment 1;

2. By absolute majority Adopts the 4-year Corporate Business Plan 2013/14 – 2016/17 as detailed in Attachment 2;

3. ADOPTS the Workforce Management Plan 2013-2017 as detailed in Attachment 3;

4. Rescinds the Infrastructure Asset Management Policy as adopted on 5 February 2013 – CS06-02/13;

5. Adopts the Asset Management Policy as detailed in Attachment 4;

6. Adopts the Asset Management Strategy as detailed in Attachment 5;

7. Adopts the Summary Asset Management Plan as detailed in Attachment 6; and

8. Adopts the 10-year Long Term Financial Plan 2013/14 – 2022/23 (inclusive of 10-year Capital Works Program) as detailed in Attachment 7.

Attachments:

|

1View. |

Strategic Community Plan |

13/86101 |

Minuted |

|

2View. |

Corporate Business Plan |

13/87275 |

Minuted |

|

3View. |

Workforce Management Plan 2013-2017 |

13/87360 |

Minuted |

|

4View. |

Asset Management Policy |

13/73383 |

Minuted |

|

5View. |

Asset Management Strategy |

13/73378 |

Minuted |

|

6View. |

Summary Asset Management Plan |

13/76426 |

Minuted |

|

7View. |

10 Year Long Term Financial Plan |

13/87808 |

Minuted |

Asset Management Policy

Policy Owner: Infrastructure

Contact Person: Manager Asset Management

Date of Approval:

1. Policy Statement

The purpose of this policy is to guide the strategic management of all City assets in accordance with the Integrated Planning & Reporting Framework (IPRF) strategies, relevant Legislation & Regulations, Australian Standards, Australian Accounting Standards, recognised best practice principles (International Infrastructure Management Manual IIMM) and other City policies.

It will be achieved by

· having an Asset Management Strategy (AMS);

· having a Summary Asset Management plan providing guidance for individual Asset Management Plans for each specific asset class; and,

· ensuring that the AMS and associated systems are kept up to date.

This policy provides an integrated and multidisciplinary environment for undertaking asset management in such a way as to:

1.1 Ensure that assets service the community for current and future generations;

1.2 Ensure that assets provide a level of service and risk the community is willing to support;

1.3 Ensure the sustainable management of assets;

1.4 Encourage and support the economic and social well being of our community; and,

1.5 Allow informed decision making, incorporating whole of lifecycle costing principles.

2. Key Definitions

2.1 Assets

In accordance with the International Infrastructure Management Manual 2011, Infrastructure Assets are ……stationary systems forming a network and serving whole communities where the system as a whole is intended to be maintained indefinitely at a particular level of service potential by the continuing replacement and refurbishment of its components. The network may include normally recognised ordinary assets as its components.

The assets to be considered in this policy include,

· Infrastructure assets such as roads, kerbing, stormwater drainage, pathways, bridges, buildings, playground equipment, public open spaces, sporting facilities, reserves;

· Fleet, plant and equipment;

· Information Technology such as computer hand ware and software; and

· Museum artefacts and art collections.

2.2 Asset Management

The combination of management, financial, economic, engineering and other practices applied to assets from their planning, acquisition, operation, maintenance, replacement and disposal, to ensure that the assets meet the priorities of the Strategic Community Plan with the objective of providing the required level of service in the most cost-effective manner.

3. Objective

The key objective of this policy is to ensure that there is organisation-wide commitment to asset management and that the objectives of the City's AMS are achieved. This will ensure financial data on asset renewals, maintenance of existing assets and new assets are identified and form part of City’s Long Term Financial Plan.

The principal objective of asset management is to enable the City to meet its service delivery objectives efficiently and effectively and through this policy aim to achieve the following:

3.1 Support the City’s vision and strategic objectives through a dynamic framework that will enable asset management to be undertaken in a structured and integrated manner with consideration to full lifecycle costing and assessment of the feasibility and cost of future replacement.

3.2 Provide an essential framework and rationale for recognised best practice asset management decision-making and compliance with relevant Australian Accounting Standards, relevant Legislation & Regulations, Australian Standards, recognised best practice principles (International Infrastructure Management Manual) and other City policies and informing the organisation on how it will maintain its assets to meet service delivery requirements.

3.3 Complement and build on the City’s Strategic Community Plan, and provides a more formalised approach to asset management principles and methodology and integration with the IPRF Framework.

3.4 Provide the framework for the preparation of an Asset Management Strategy and Plans for all assets classes.

3.5 This policy also outlines the importance of asset management and what needs to be considered to ensure:

3.5.1 Financial, social and environmental sustainability issues are clearly understood and recognised by Council (ie: the Elected Members) and the community while providing for present needs and sustaining resources for future generations.

3.5.2 A whole of life approach is incorporated into asset management processes, enabling informed decision-making to meet service needs over the life of an asset from planning, acquisition, operation, maintenance, renewal, investment through to disposal and incorporation into the long term financial plan.

3.5.3 Level of service needs form the basis of asset management with asset performance being measured against levels of service defined in the Asset Management Plans.

3.5.4 Management of assets is undertaken in a structured and integrated way. When assessing the renewal of an asset, upgrades are to be considered to actively reduce the environmental footprint of the asset and increase the opportunities for the use that the asset provides.

3.5.5 Corporate responsibility and resources are identified and established for assets inventory, condition, use and performance.

3.5.6 Risk management is considered as part of asset management planning.

3.5.7 Legislative and regulatory requirements are achieved including maintenance of an accurate asset register in accordance with the requirements of the appropriate accounting standards to enable accurate reporting and effective decision making.

3.5.8 New innovative ways of meeting level of service requirements are sought through continuous improvement.

4. Details