Due to the current pandemic situation, this meeting will be conducted electronically.

BRIEFING PAPERS

FOR COUNCIL MEMBERS’

BRIEFING SESSION

Draft Only

to be held via Video Conferencing

on 9 February, 2021 commencing at 6:00pm

Due to the current pandemic situation, this meeting will be conducted electronically.

BRIEFING PAPERS

FOR COUNCIL MEMBERS’

BRIEFING SESSION

Draft Only

to be held via Video Conferencing

on 9 February, 2021 commencing at 6:00pm

PROCEDURE FOR FULL COUNCIL BRIEFING SESSION

COVID-19 PANDEMIC SITUATION

The City of Wanneroo is committed to ensuring the safety of all attendees at public meetings. Due to the COVID-19 restrictions currently in place, the Wanneroo Council Briefing Session on Tuesday 9 February will be conducted via electronic means.

To ensure the safety of the members of the public, in line with State Government advice, this meeting may not be attended by members of the public, however an audio recording will be made available on the City’s Council Meeting website as soon as practicable after the meeting.

Members of the public who may wish to submit a question to Council are encouraged to do so via the City of Wanneroo's website.

Advice on public attendance at future briefing sessions and meetings will be provided pending updated State Government and Department of Health advice.

Thank you for your understanding of these circumstances.

PRINCIPLES

A Council Briefing occurs a week prior to the Ordinary Council Meeting and provides an opportunity for Council Members to ask questions and clarify issues relevant to the specific agenda items before council. The Briefing is not a decision-making forum and the Council has no power to make decisions. The Briefing Session will not be used, except in an emergency, as a venue or forum through which to invoke the requirements of the Local Government Act 1995 and call a Special Meeting of Council.

In order to ensure full transparency the meetings will be open to the public to observe the process. Where matters are of a confidential nature, they will be deferred to the conclusion of the Briefing and at that point, the Briefing Session closed to the public. The reports provided are the Officers’ professional opinions. Whilst it is acknowledged that Council Members may raise issues that have not been considered in the formulation of the report and recommendation, it is a basic principle that as part of the Briefing Sessions Council Members cannot direct Officers to change their reports or recommendations.

PROCESS

The Briefing Session will commence at 6.00pm and will be chaired by the Mayor or in his/her absence the Deputy Mayor. In the absence of both, Councillors will elect a Chairperson from amongst those present. In general, the Standing Orders Local Law 2008 will apply, EXCEPT THAT Council Members may speak more than once on any item, there is no moving or seconding items, Officer’s will address the Council Members and the order of business will be as follows:

Members of the public present may observe the process and there is an opportunity at the conclusion of the Briefing for a Public Question Time where members of the public may ask questions (no statements) relating only to the business on the Agenda. The Agenda will take the form of:

· Attendance and Apologies

· Declarations of Interest

· Reports for discussion

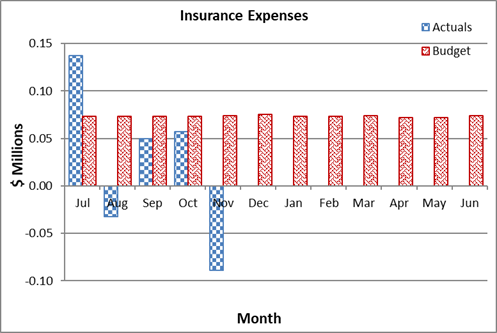

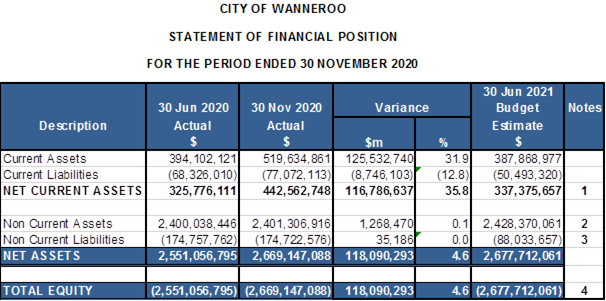

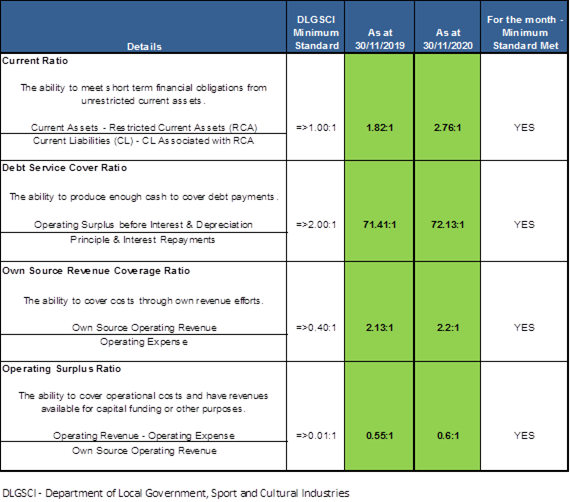

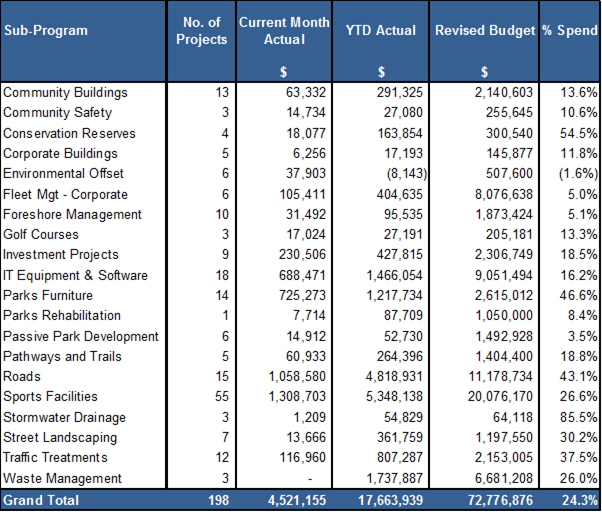

· Tabled Items

· Public Question Time

· Closure

Where an interest is involved in relation to an item, the same procedure which applies to Ordinary Council Meetings will apply. It is a breach of the City’s Code of Conduct for an interest to not be declared. The Briefing Session will consider items on the Agenda only and proceed to deal with each item as they appear. The process will be for the Mayor to call each item number in sequence and ask for questions. Where there are no questions regarding the item, the Briefing will proceed to the next item.

AGENDA CONTENTS

While every endeavour is made to ensure that all items to be presented to Council at the Ordinary Council Meeting are included in the Briefing Session papers, it should be noted that there will be occasions when, due to necessity, items will not be ready in time for the Briefing Session and will go straight to the full Council Agenda as a matter for decision. Further, there will be occasions when items are TABLED at the Briefing Session rather than the full report being provided in advance. In these instances, staff will endeavour to include the item on the Agenda as a late item, noting that a report will be tabled at the agenda Briefing Session.

AGENDA DISTRIBUTION

The Council Briefing Session Agenda will be distributed to Council Members on the FRIDAY prior to the Council Briefing Session. Copies will be made on the City’s website for interested members of the public. Spare Briefing Session papers will be available at the Briefing Session for interested members of the public.

RECORD OF BRIEFING

The formal record of the Council Briefing Session will be limited to notes regarding any agreed action to be taken by staff or Council Members. No recommendations will be included and the notes will be retained for reference and are not distributed to Council Members or the public.

LOCATION

The Council Briefing Session will take place via video conference.

Briefing Papers for Tuesday 9 February, 2021

Due to the current pandemic situation, this

meeting will be conducted electronically

CONTENTS

Item 2_____ Apologies and Leave of Absence

Strategic Land Use Planning & Environment

3.1 Consideration of Actions Relating to Developer Contribution Arrangements

3.3 Consideration

of Amendment No.182 to District Planning Scheme

No.2 - 198 Mary Street, Wanneroo

3.7 Draft Waste Plan 2020-2025 - Community and DWER Feedback

3.8 Community

Engagement outcomes for the upgrade of Frederick

Duffy Park

3.9 Heath Park Pavilion - Concept Design and Community Engagement Outcomes

3.10 Community

Sporting and Recreation Facilities Fund (CSRFF) -

2020 Funding Round Outcomes

3.11 Halesworth Park Pavilions - Concept Design and Community Engagement Outcomes

Corporate Strategy & Performance

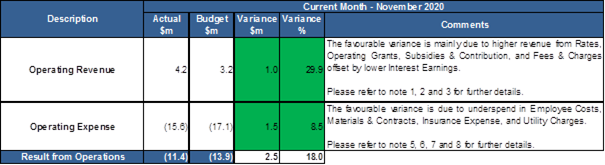

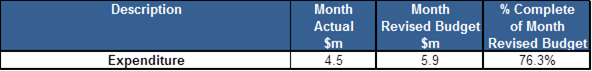

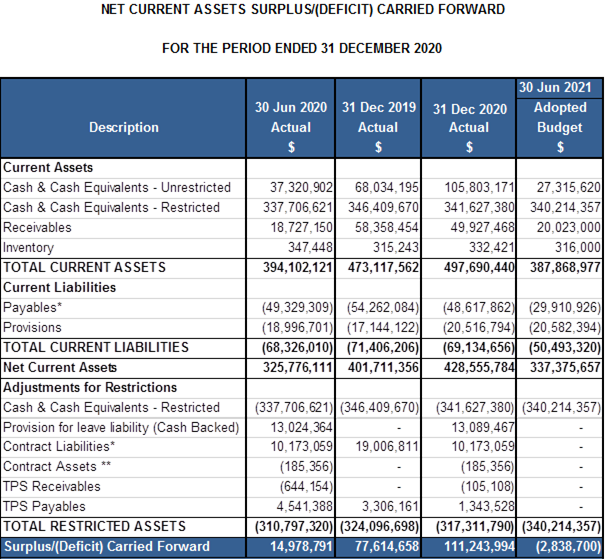

3.12 Financial

Activity Statement for the period ended

30 November 2020

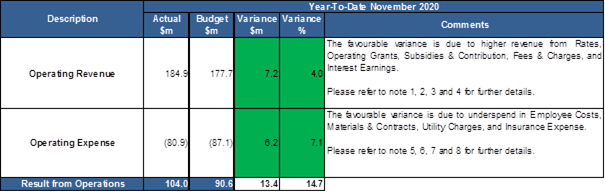

3.13 Financial

Activity Statement for the period ended

31 December 2020

3.14 Mid

Year Statutory Budget Review Report July to

December 2020

3.15 Warrant of Payments for the Period to 31 December 2020

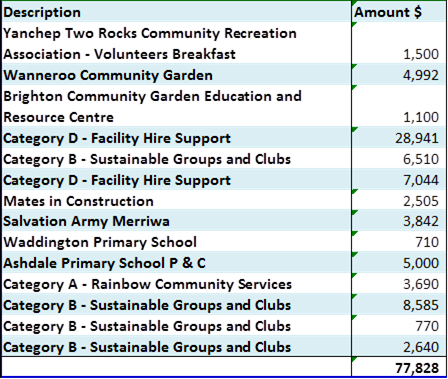

3.17 Donations to be Considered by Council February 2021

3.18 Local Government Postal Elections October 2021

3.19 Appointment

of Delegate to WALGA North Metropolitan Zone

and Various Working Groups

Advocacy & Economic Development

3.20 uDrew Pilot Program Proposal

3.21 Request for Extension to Review Dates and Review of Council Policies

Item 5_____ Late Reports (to be circulated under separate cover)

Item 6_____ Public Question Time

Item 8_____ Date of Next Meeting

Agenda

Good evening Councillors, staff, ladies and gentlemen, we wish to acknowledge the traditional custodians of the land we are meeting on, the Whadjuk people. We would like to pay respect to the Elders of the Nyoongar nation, past and present, who have walked and cared for the land and we acknowledge and respect their continuing culture and the contributions made to the life of this city and this region.

Item 2 Apologies and Leave of Absence

Strategic Land Use Planning & Environment

File Ref: 5734V05 – 21/3146

Responsible Officer: Director Planning and Sustainability

Disclosure of Interest: Nil

Attachments: 1

Issue

For Council to consider authorising various actions associated with the management of Developer Contribution Arrangements (DCA’s) under the City’s District Planning Scheme No. 2 (DPS2).

Background

At the Ordinary Council Meeting on 30 June 2020 (PS01-06/20), Council initiated Amendment 185 to DPS2 to advertise an amendment to the Scheme to facilitate a number of improvements to the provisions relating to the management of DCA’s by the City.

Administration has identified that there are numerous decisions required by Parts 9, 10 and Schedules 6, 7, 14 and 15 of DPS2 that are not currently able to be delegated to Administration, pending the finalisation of the Amendment to scheme. This is due to the reference to a decision by Council in relation to actions in certain sections of DPS2 (which cannot be delegated) rather than the local government (that can be delegated). Previously, the interpretation was broadly interpreted as ‘Council’ being the same as the ‘local government’; therefore, the daily decisions such as quotations, tax invoices and the deferral of contributions were carried out by Administration. As previously reported to Council, the inability to delegate certain aspects of Developer Contribution Plan (DCP) management was an unintended consequence embedded in the drafting of DPS2, but it cannot be interpreted differently until such time that DPS2 is amended to replace the term ‘Council’ with ‘local government’. This will enable delegation to be considered for those aspects of DCP management.

The consequence of this is that until the Scheme Amendment is gazetted, Council is required to make these decisions. Until this occurs, all discretionary decisions relating to DCP’s in DPS 2 that refer to ‘Council’, will need to be reported to Council for approval.

Subsequent to the finalisation of Amendment 185, Council will have the ability to determine which aspects of DCP management should be delegated to the Chief Executive Officer.

Detail

Administration is required to refer a range of DCP of decisions to Council in the form of a summary report to authorise various actions, including:

· Tax Invoice/ Quotations for Contributions required by conditions of subdivision or development approval;

· Deferral of contributions requests and lodgement of a Caveat;

· Offsetting of Cell Works credits against Infrastructure Contributions Payable (land or works); and

· Prefunding of Cell Works.

In relation to the above, the actions normally occur through the subdivision process and therefore require a timely determination. Subdividers frequently require quotations on DCP, offsetting of Cell Works Credits and payment of compensation in accordance with the requirements of DPS2 to satisfy conditions of subdivision. If these requests are not processed in a timely manner, then this could lead to delays in the creation of new lots.

In addition, certain actions required as part of the annual review of DCP’s may require an earlier determination by Council to inform the annual review process. These decisions may be included into the DCP report to enable the timely consideration of factors affecting the annual review.

Consultation

Nil

Comment

Attachment 1 includes the details of the various aspects of DCP management that require a Council determination as follows:

Tax Invoices/ Quotations

In accordance with the relevant sections of DPS2, Council may, upon receiving a written request from an owner of land in a Cell, provide the landowners with a Tax Invoice or Quotation to enable the subdivider to pay their infrastructure Costs. The estimates are valid for a period of six months and calculated using the Infrastructure Cost per Lot (ICPL) or contribution rate approved by Council at the last annual review of costs.

The preparation of a Tax Invoice is the preferred manner to provide landowners with an estimate of their Infrastructure Costs, which provides a mechanism to inform and capture the contribution liability for both the landowner and the City.

In most cases, a landowner will request a Tax Invoice or Quotation to facilitate the contribution payment necessary to comply with the conditions of planning approval. These conditions are most commonly associated with subdivision conditions and payment is required to enable the new lots to be created.

All Cells and DCP areas have well defined methodologies in DPS2 for calculating landowner’s contribution liabilities, thereby ensuring clarity in the calculation of individual landowner’s obligations, as reported in Attachment 1.

Payment for Cell Works

The Local Structure Plan preparation costs for the East Wanneroo Cells are classified as Cell Work (general) and can therefore be charged to the relevant cell. Stockland Pty Ltd was the major landowner in Cell 9 and prepared the Cell 9 structure plan on behalf of all landowners. In 2015, Council adopted the Cell 9 cost estimates, which included an estimated cost for this work of $862,776. The City has been liaising with Stockland to validate the structure plan preparation costs based on Tax Invoice evidence. In 2017, the City made payment to Stockland of $390,625.54 based on the tax invoices provided and validated by Administration, however the remaining expenditure was not able to be validated, at this time, due to the lack of expenditure evidence. Stockland representatives have subsequently provided the required tax invoice evidence to the City and the total amount of the additional tax invoices equates to $397,733.60. The invoices and calculations have now been reviewed by relevant planning officers, finance officers and have been externally audited by William Buck. The payment of the remaining structure plan preparation costs to Stockland of $397,733.60 has been agreed by Stockland and will finalise their claim for reimbursement, as reflected in Attachment 1. This final payment to Stockland represents a saving of $74,417 to the Cell 9 and is considered acceptable.

Statutory Compliance

The completion of the annual review ensures that contribution payments, compensation and estimated costs are compliant with Council’s statutory obligations in accordance with DPS 2.

Strategic Implications

The proposal aligns with the following objective within the Strategic Community Plan 2017 – 2027:

“4 Civic Leadership

4.2 Good Governance

4.2.1 Provide transparent and accountable governance and leadership”

Risk Management Considerations

|

Risk Title |

Risk Rating |

|

ST-G09 Long Term Financial Plan |

Moderate |

|

Accountability |

Action Planning Option |

|

Director Corporate Strategy & Performance |

Manage |

|

Risk Title |

Risk Rating |

|

ST-S23 Stakeholder Relationships |

Moderate |

|

Accountability |

Action Planning Option |

|

CEO |

Manage |

|

Risk Title |

Risk Rating |

|

CO-O17 Financial Management |

Moderate |

|

Accountability |

Action Planning Option |

|

Director Corporate Strategy and Performance |

Manage |

The above risks relating to the issue contained within this report have been identified and considered within the City’s Strategic and Corporate Risk Registers. The annual review of the DCP assists in addressing the impacts of the strategic risk relating to Long Term Financial Planning as it ensures that appropriate budget monitoring, timing and provisions are considered. The strategic risk relating to stakeholder relationships applies as a key element in the DCP review process to maintain effective engagement with relevant stakeholders. In addition, the Corporate Risk relating to financial management would apply as awareness of financial policies and financial management at unit level will be maintained to promote accountability by business owners and an integrated approach to risk assurance.

Policy Implications

Nil

Financial Implications

The Tax Invoice equates to a net total amount of $102,211.74 and upon receipt of payment by the developer will increase the balances held in the relevant DCP account, as defined in Attachment 1.

The structure plan preparation costs form part of the Cell Works for Cell 9 and the City has validated the pre-funding through internal and external auditing. There are adequate funds currently held in the Cell 9 account to make payment to Stockland and the payment of $397,733.60 has been accepted by Stockland to finalise their claim on this cost, which is less than the estimate structure plan preparation costs approved for the Cell 9 DCP and represents a saving of 74,417 to Cell landowners.

Voting Requirements

Simple Majority

That Council:-

APPROVES the actions in relation to the management of Developer Contribution Arrangements under District Planning Scheme No. 2, as contained in Attachment 1.

|

1⇩. |

Attachment 1 - DCP Actions |

21/5650 |

Minuted |

CITY OF WANNEROO Agenda OF COUNCIL Members' Briefing Session 9 February, 2021 10

Approval Services

3.2 Consideration of Development Application (DA2020/1345) - Amendment to the Operating Hours of an existing Liquor Store - Lot 9031 (104) Kingsbridge Boulevard, Butler

File Ref: DA2020/1345 – 20/578347

Responsible Officer: Director Planning and Sustainability

Disclosure of Interest: Nil

Attachments: 3

Issue

To consider a development application (DA2020/1345) seeking to amend the operating hours of the existing Liquor Store at Lot 9031 (104) Kingsbridge Boulevard, Butler (subject site).

|

Applicant |

Geocath Pty Ltd |

|

Owner |

Connolly Boulevard Pty Ltd |

|

Location |

Lot 9031 (104) Kingsbridge Boulevard, Butler |

|

Site Area |

3,553m2 |

|

DPS 2 Zoning |

Commercial |

Background

On 30 September 2020, the City received a development application seeking to amend Condition 2 of DA2011/845 relating to the operating hours of the existing Liquor Store at Lot 9031 (104) Kingsbridge Boulevard, Butler (subject site). The subject site is bound by residential properties to the east, south and directly adjoining to the west, and a primary school site and a park to the north. A location plan is included in Attachment 1.

At its meeting on 27 July 2010, Council (PS05-07-10) resolved to approve a development application (DA2009/1277) for a shopping centre with a total floor area of 1,255m2 at the subject site. There were no conditions imposed restricting the operating hours of the shopping centre, hence, the current shopping centre operates 24 hours each day.

On 6 March 2012, Council (PS06-03/12) approved a further development application (DA2011/845) for 149m2 of the shopping centre to be converted to a Liquor Store of 114m2, with a coolroom and storage area of 35m2. Condition 2 was imposed to restrict the operating hours of the Liquor Store between 8:00am to 8:30pm Monday to Saturday, and 10:00am to 8:30pm on Sunday. This condition was recommended by Administration and imposed by Council to address the submissions which raised concerns in relation to antisocial behaviour, and the associated noise and traffic impacts given the proximity of the subject site to residential properties.

There are nine existing liquor stores (excluding the subject liquor store) operating within a 2.5 kilometre radius from the subject site. Their operating hours vary greatly between them with many closing between 5:00pm to 10:00pm. A full schedule of the location of these nearby liquor stores and operating hours is included in Attachment 2.

Detail

This development application proposes to modify Condition 2 of DA2011/845 to change the operating hours of the Liquor Store from 8:00am to 10:00pm Monday to Saturday, and 10:00am to 10:00pm on Sunday. Liquor Store is an ‘A’ (discretionary subject to advertising) use within the Commercial zone, and therefore the application was advertised to the surrounding properties for comment.

The site plan and floor plan outlining the location of the Liquor Store is included in Attachment 3.

Consultation

Advertising was undertaken by the City in writing to the surrounding landowners located within a 200 metre radius of the subject site. A notice was placed in the Wanneroo Wrap to notify Council Members of the proposal. Advertising was undertaken for a period of 14 days commencing on 21 October 2020 and closing on 4 November 2020. Three submissions were received during the advertising period, with two objecting to the proposal and one stating they had no objections to the proposal.

A location plan indicating the advertising area and the submitters’ location are included as Attachment 1.

The concerns raised in the submissions include the following:

· Safety issues as a result of antisocial behaviour and littering;

· Incursion of costs to adjoining residents due to having to install additional security measures; and

· Increase in traffic as a result of the widening of Connolly Drive and the proposed operating hours of the Liquor Store.

A more detailed discussion of the concerns raised in the submissions are provided in the Comment section below.

Comment

Administration has conducted an assessment of the proposal against the provisions of DPS 2, Agreed Structure Plan No. 27 Butler-Ridgewood (ASP 27) and Local Planning Policy 2.8 Licensed Premises (LPP 2.8) and all requirements have been satisfactorily addressed. The proposed operating hours are also consistent with the hours permitted under the Liquor Control Act 1988.

Concerns Raised in Submissions

The table below outlines the concerns raised in the letter of objections and Administration’s comments in respect to these.

|

Concerns |

Administration Comments |

|

Safety issues as a result of antisocial behaviour and littering. |

Antisocial behaviour and littering is not a relevant planning consideration. Antisocial behaviour is a matter dealt with by the Western Australian Police. It is noted that the City’s Ranger Services are not aware of any existing concerns or police reports relating to antisocial behaviour at this Liquor Store. |

|

Incursion of costs to adjoining residents due to having to install additional security measures. |

The perception of needing to install additional security measures and associated costs due to extending the Liquor Store trading hours is not a relevant planning consideration. |

|

Increase in traffic as a result of the widening of Connolly Drive and the proposed operating hours of the Liquor Store. |

Increase in traffic as a result of the widening of Connolly Drive is not relevant to this proposal. The increase in traffic as a result of the proposed operating hours of the Liquor Store is discussed in further detail below. |

Previous Council Decision

At its meeting on 20 March 2012 (PS06-03/12), Council approved the Liquor Store subject to a condition that the Liquor Store be closed at 8:30pm every day. The condition restricting the operating hours was imposed to address concerns about antisocial behaviour and associated noise and traffic impacts due to the site being located directly adjacent to residential properties. In response to Council’s previous concerns and reasons for restricting the operating hours to 8:30pm each day, Administration provides the following comments.

Antisocial Behaviour

The City’s LPP 2.8 outlines what matters are considered relevant as part of the development application process and the liquor licence process. As per LPP 2.8, antisocial behaviour and liquor harm are not considered relevant at the development application stage as they are considered in detail as part of the liquor licencing process.

Traffic

The proposed extension of operating hours for the Liquor Store (between 8:30pm to 10:00pm) falls outside of the typical peak periods of the use, meaning there will not be an increase in the number of vehicle trips during peak periods. Any increase in traffic occurring in the modified operating hours is considered to be of a low level and will have a negligible impact. The proposal does not trigger the requirement to provide any supporting traffic information or reports. Furthermore, the Liquor Store is located within an existing shopping centre that currently operates 24 hours a day, seven days a week. The additional increase in operating hours of the Liquor Store is unlikely to result in a large increase in patronage, but rather provides reciprocity for existing customers of the shopping centre to access the Liquor Store for their convenience.

In addition to the above, the City’s Traffic Services has confirmed that the proposal would not result in any traffic concerns. Therefore, the increase in traffic as a result of the modified Liquor Store operating hours is considered minor and acceptable.

Noise

In relation to noise impacts, noise generated from the site is required to comply with the Environmental Protection (Noise) Regulations 1997 at all times. If noise is at a level that becomes a nuisance to local residents, the City will investigate the noise levels and if substantiated, require the property owner to undertake appropriate measures to ensure compliance. The assigned maximum noise levels permitted under the Environmental Protection (Noise) Regulations 1997 are the same from 7:00pm to 10:00pm. Therefore, the Liquor Store’s current operating hours are within the same noise limits as the proposed operating hours.

To date, the City has not received any noise complaints in relation to the operation of the Liquor Store. Furthermore, the shopping centre is operating 24 hours a day. The City has not received any noise complaints in relation to patrons of the shopping centre. It is noted that there have previously been noise complaints relating to truck delivery times that have since been resolved, and no further complaints relating to truck delivery times have occurred since April 2019.

In light of the above, it is considered that the noise levels are unlikely to change as a result of the increased operating hours of the Liquor Store, and where there are any noise issues, it can be sufficiently dealt with through the Environmental Protection (Noise) Regulations 1997.

Conclusion

Administration considers that the concerns raised relating to the operating hours are either not relevant planning considerations or can be sufficiently addressed under separate legislation. As the proposed development is considered to meet the requirements of DPS 2, ASP 27 and LPP 2.8, it is recommended that Council approve the amended operating hours of the existing Liquor Store at Lot 9031 (104) Kingsbridge Boulevard, Butler as proposed.

Statutory Compliance

This application has been assessed in accordance with the City of Wanneroo’s District Planning Scheme No. 2, Agreed Structure Plan No. 27 Butler-Ridgewood, and Local Planning Policy 2.8 Licensed Premises.

Strategic Implications

The proposal aligns with the following objective within the Strategic Community Plan 2017 – 2027:

“2 Economy

2.1 Local Jobs

2.1.2 Build capacity for businesses to grow”

Risk Management Considerations

|

Risk Title |

Risk Rating |

|

ST-S23 Stakeholder Relationships |

Low |

|

Accountability |

Action Planning Option |

|

Chief Executive Officer |

Manage |

|

Risk Title |

Risk Rating |

|

CO-O23 Safety of Community |

Moderate |

|

Accountability |

Action Planning Option |

|

Director Community and Place |

Manage |

The above risks relating to the issues contained within this report have been identified and considered within the City’s Corporate risk register. Action plans have been developed to accept this risk to support existing management systems. This proposal aligns with the Economic objective of the existing Strategic Community Plan, Council should therefore consider the following risk appetite statement: 2.1 Local Jobs.

The City is keen to develop strong economic hubs for growth and employment within the region. This would involve exploring opportunities which will attract and promote investment for local businesses and job creation. The City’s Strategic Community Plan acknowledges that development initiatives (for example, in Yanchep and Neerabup) requires planning, due diligence, consultation and funding. The City acknowledges that to achieve the growth that will lead to jobs, the City needs to work strategically with partners including investors and to promote a clear vision. Therefore the City is prepared to accept a high level of financial risk provided that the City implements a risk management strategy to manage any risk exposure.

Policy Implications

Nil

Financial Implications

Nil

Voting Requirements

Simple Majority

That Council:-

1. Pursuant to Clause 68(2)(b) of the Deemed Provisions of the District Planning Scheme No. 2, APPROVES the Development Application (DA2020/1345) to amend Condition 2 of the original development approval (DA2011/845) issued by Council on 20 March 2012. This Development Approval is still subject to compliance with the plans and conditions contained within the original notice of approval to commence development dated 20 March 2012 (DA2011/845), with exception to Condition 2 which is replaced by the following condition:

a) Operating hours shall be limited to 8:00am to 10:00pm Monday to Saturday, and 10.00am to 10:00pm on Sundays.

2. ADVISES the submitters of its decision.

|

1⇩. |

Attachment 1 - Location Plan - Liquor Store Amendment - 104 Kingsbridge Boulevard BUTLER |

20/533384 |

|

|

2⇩. |

Attachment 2 - Surrounding liquor stores within a 2.5km radius ~ 104 Kingsbridge Boulevard, Butler |

21/41493 |

|

|

3⇩. |

Attachment 3 - Site plan and floor plan - Application to Extend Opening Hours (Liquor Store) 104 Kingsbridge Boulevard BUTLER |

20/533393 |

|

CITY OF WANNEROO Agenda OF council Members' Briefing Session 9 February, 2021 22

File Ref: 39272 – 20/541439

Responsible Officer: Director Planning and Sustainability

Disclosure of Interest: Nil

Attachments: 5

Issue

To consider the submissions received during the public advertising of Amendment No. 182 to District Planning Scheme No.2 (DPS 2).

|

Applicant |

Roberts Day Town Planning |

|

Owner |

Bridgeleigh Investments Pty Ltd |

|

Location |

Lot 23 (198) Mary Street, Wanneroo |

|

Site Area |

4 hectares |

|

MRS Zoning |

Urban Deferred |

|

DPS 2 Zoning |

Rural Resource |

Background

On 4 November 2019, Roberts Day Town Planning, on behalf of the land owner submitted the proposed amendment to allow the land uses Retirement Village, Reception Centre, Aged and Dependent Persons’ Dwelling at Lot 23 (198) Mary Street, Wanneroo as additional uses. The site contains a Reception Centre and is currently zoned Urban Deferred under the Metropolitan Region Scheme (MRS) and Rural Resource under the DPS2.

Council, at its meeting of 28 July 2020, considered Amendment No.182 to DPS2 to allow land uses Retirement Village, Reception Centre, Aged and Dependent Persons’ Dwelling at Lot 23 (198) Mary Street, Wanneroo as additional uses and resolved as follows (refer Item PS03-07/20):

That Council:-

1. Pursuant to Section 75 of Planning and Development Act 2005 ADOPTS Amendment No. 182 to District Planning Scheme No. 2 to allow Retirement Village, Reception Centre, Aged and Dependent Persons’ Dwelling as additional uses at Lot 23 (198) Mary Street, Wanneroo and Amends Schedule 2 of District Planning Scheme No. 2 as follows:

|

NO |

STREET/ LOCALITY |

PARTICULARS OF LAND |

ADDITIONAL USE AND CONDITIONS (WHERE APPLICABLE) |

|

|

A40 |

1-40 |

198 Mary Street, Wanneroo |

Lot 23 |

Retirement Village, Reception Centre, Aged and Dependent Persons’ Dwelling

Condition: Development is to be in accordance with an approved Local Development Plan for the site. |

and the Scheme Map accordingly;

2. Pursuant to Section 35(2) of Planning and Development (Local Planning Schemes) Regulations 2015 RESOLVES that Amendment No. 182 to District Planning Scheme No. 2 is a Standard Amendment for the following reason:

a) an amendment that does not result in any significant environmental, social, economic or governance impacts on land in the scheme area;

3. Pursuant to Section 81 of the Planning and Development Act 2005 REFERS Amendment No. 182 to District Planning Scheme No. 2 to the Environmental Protection Authority; and

4. Subject to approval from the Environmental Protection Authority, ADVERTISES Amendment No. 182 to District Planning Scheme No. 2 for a period of not less than 42 days pursuant to sub-regulations 47(2) and 47(4) of the Planning and Development (Local Planning Schemes) Regulations 2015.

Attachment 1 is the location plan of the site and Attachment 2 contains the proposed Scheme Amendment maps.

The Reception Centre has been operating since 1985 and currently benefits from Non-Conforming Use rights as the property was rezoned in 2001 to Rural Resource in DPS2 wherein Reception Centre is a Not permitted (X) use.

The site is located within the East Wanneroo District Structure Plan (EWDSP) area and is identified for future residential development. The EWDSP was considered by the Western Australian Planning Commission at its meeting of 25 November 2020. It was resolved not to publish the EWDSP in its final form until the District Water Management Strategy was formally approved by the Department of Water and Environmental Regulation (DWER).

Detail

The proposed amendment will facilitate the development of the site for approximately 140 Aged and Dependent Persons residential dwellings. The existing Reception Centre building will be adapted for the administrative purposes of the aged care facility and a portion of the buildings will become a community facility and a café. The development will provide 10% of the site as public open space (POS), which will be ceded to the Crown and be developed in accordance with the City’s standards for POS. Attachment 3 contains a concept plan of the site which will inform further planning for development of the site.

Consultation

In accordance with the Council’s decision, the amendment was referred to the Environmental Protection Authority (EPA) for comment. On 23 September 2020, the EPA advised the City that the scheme amendment did not warrant formal environmental assessment by the EPA and made recommendations in its advice (Attachment 5). The WAPC’s consent to initiate public consultation was therefore not required, as the EPA did not determine that a formal environmental assessment should be undertaken.

Prior to EPA’s decision, officers from the Department of Water and Environmental Regulation (DWER) the state agency which supports the EPA, inspected the site and identified a number of species worthy of retention. Based on this survey, the EPA in its advice recommended that a Local Development Plan be prepared for the site that identifies areas of consolidated remnant native vegetation in the south east and/or north east of lot 23 for conservation.

The EPA advice also noted that the clearing of land within the proposal area may require referral to the Commonwealth Department of Agriculture, Water and the Environment (DAWE) due to the potential presence of the Banksia Woodlands of the Swan Coastal Plain Threatened Ecological Community which is protected under the Commonwealth Environment Protection and Biodiversity Conservation Act 1999 (the EPBC Act).

A 42-day public consultation period was then carried out between 8 October and 19 November 2020 by way of on-site signs, advertisement in a local newspaper, a notice was displayed at the Council offices and on the City’s website, and letters were sent to nearby landowners. Due to a delay in installing the on-site sign, the public consultation period was extended to 27 November 2020. The City received four submissions all from government agencies. ATCO Gas Australia Pty Ltd supported and Water Corporation of WA had no objection to the amendment proposal.

The Western Australian Department of Biodiversity, Conservation and Attraction (DBCA) advised that consideration should be given for the assessment of future proposals in accordance with the Commonwealth Environment Protection and Biodiversity Conservation Act (1999) (EPBC Act) which is consistent with the advice from the EPA.

The Commonwealth Department of Agriculture, Water and the Environment (DAWE) was also consulted and advised that:

“any action or activity likely to impact on a matter of national environmental significance under the EPBC Act must be referred to the Department for assessment.”

The advice provided by DBCA and DAWE are discussed in the Comment section.

Attachment 4 contains the schedule of submissions and Administration’s comments below.

Comment

The environmental agencies (i.e. Commonwealth and State) who have made submissions have statutory responsibilities under their various legislations for diverse environmental protection categories. The subject site does feature remnant vegetation and the submissions point to the potential for flora and fauna to be present that are covered by their respective state and federal legislation.

In considering the submissions Council Members should be reassured that the proponents have now been provided clear advice by these agencies on the need to protect environmental values that exist on the site. On this basis the proponent is required to satisfy those agencies that endeavours to protect specific fauna or flora present will be in compliance with the ‘environmental protection’ requirements. It is not for the City to determine the adequacy of conservation measures made in the context of these various state and federal legislative requirements.

The EPA determined that formal assessment under section 48A(1)(a) of the Environmental Protection Act 1986 was not required. However, the advice attached to the decision noted that there are environmental values of significance present on the site. The EPA advice concluded that:

“…the scheme amendment can be managed to meet the EPA’s environmental objectives through existing planning controls. The EPA recommends that the scheme text be modified to require the future local development plan to identify consolidated areas of remnant native vegetation for retention.”

The comments provided by DBCA and DAWE are noted below.

DBCA Advice

The DBCA advised that:

The Amendment area contains vegetation which has been identified as ‘Banksia woodlands of the Swan Coastal Plain’ threatened ecological communities (TEC). This TEC is included by the Australian Government on the list of threatened ecological communities under the EPBC Act. The subject area was also identified in the Environmental Assessment Study conducted as part of the Department of Planning, Lands and Heritage EWDSP process as potentially containing vegetation which may be commensurate with State listed TEC ‘Banksia attenuata woodland over species rich dense shrublands’ (SCP 20a). Detailed vegetation assessments, including the provision of the statistical analysis of floristic community types (FCT), are required to confirm all likely TEC occurrences and mapped extent prior to future planning stages. Confirmed occurrences of SCP20a should be considered for retention and retained for conservation wherever possible.

DBCA supported EPA’s recommendation to identify values of retention in an LDP and advised that consideration should therefore be given to the obligations for assessment of future proposals in accordance with the EPBC Act.

DAWE Advice

The Commonwealth DAWE provided the following comments:

1. The site may contain habitat for—or include—the following threatened species and communities that are listed under the EPBC Act, but are not limited to them:

a. critically endangered Tuart (Eucalyptus gomphocephala) Woodlands and Forests of the Swan Coastal Plain ecological community

b. endangered Banksia Woodlands of the Swan Coastal Plain ecological community

c. endangered Carnaby’s Black Cockatoo (Calyptorhynchus latirostris)

d. vulnerable Forest Red-tailed Black Cockatoo (Calyptorhynchus banksii naso)

e. vulnerable Chuditch/Western Quoll (Dasyurus geoffroii)

f. endangered Glossy-leafed Hammer Orchid (Drakaea elastica)

g. vulnerable Malleefowl (Leipoa ocellata)

h. endangered Australian Painted Snipe (Rostratula australis)

2. Any action or activity likely to impact on a matter of national environmental significance under the EPBC Act must be referred to the Department for assessment.

DAWE clarified that the above comments do not preclude the City from determining the amendment proposal. However, before developing the site, the proponent will be required to undertake a self-assessment of the site against the EPBC Significant Impact Guidelines.

In this regard it is noted that the proposed amendment includes a condition requiring future development to be in accordance with an approved Local Development Plan for the site. Considering the comments made by DAWE and DBCA, it is recommended that the following additional provision be inserted under the column:

ADDITIONAL USE AND CONDITIONS (WHERE APPLICABLE) of Schedule 2 of DPS 2:

Insert:

The LDP shall include provisions on the retention of threatened species and communities in consultation with the Commonwealth Department of Agriculture, Water and the Environment.

It should be noted that the concept plan (Attachment 3) is not a statutory document and not an LDP. When an LDP is approved for the site any future development will be required to comply with that LDP. If at a later time, an amendment is proposed to the LDP by the owner, it will have to be prepared in consultation with DAWE.

Conclusion

As this proposal to amend DPS2 is proceeding ahead of the normal MRS/DPS2 rezoning and structure planning processes there are a wide range of environmental agencies involved in determining that development of the site will properly address and respond to identified environmental values on the land.

All of the various environmental agencies require the developer to take action to ensure they comply with the relevant environmental legislation and regulations. This will be done through the preparation and completion of reports and analysis by the developer which will then be submitted to the relevant environmental agencies. That information will then feed into the creation of a local development plan, subdivision and development application processes should the proposed amendment be granted final approval by the Minister for Planning.

As the proposed amendment has been supported by all agencies which have responded, the application is recommended for approval subject to modifications.

Statutory Compliance

Amendment No. 182 has been processed in accordance with the Planning and Development (Local Planning Schemes) Regulations 2015.

Strategic Implications

The proposal aligns with the following objective within the Strategic Community Plan 2017 – 2027:

“1 Society

1.1 Healthy and Active People

1.1.1 Create opportunities that encourage community wellbeing and active and healthy lifestyles”

Risk Management Considerations

|

Risk Title |

Risk Rating |

|

ST-G09 Long Term Financial Planning |

Moderate |

|

Accountability |

Action Planning Option |

|

Director Corporate Strategy & Performance |

Manage |

|

Risk Title |

Risk Rating |

|

ST-S04 Integrated Infrastructure & Utility Planning |

Moderate |

|

Accountability |

Action Planning Option |

|

Director P&S and Director Assets |

Manage |

|

Risk Title |

Risk Rating |

|

CO-O22 Environmental Management |

Moderate |

|

Accountability |

Action Planning Option |

|

Director Planning & Sustainability |

Manage |

|

Risk Title |

Risk Rating |

|

CO-O26 Heritage |

High |

|

Accountability |

Action Planning Option |

|

Director Community and Place |

Manage |

The above risks relating to the issue contained within this report have been identified and considered within the City’s Strategic and Corporate risk register. Action plans have been developed to accept this risk to support existing management systems. As detailed within the Consultation and Comment sections of this report, the Environmental Protection Authority (EPA) has advised that the clearing of land within the proposal area may require referral to the Commonwealth Department of Agriculture, Water and the Environment (DAWE) due to the potential presence of the Banksia Woodlands of the Swan Coastal Plain Threatened Ecological Community which is protected under the Commonwealth Environment Protection and Biodiversity Conservation Act 1999 (the EPBC Act) and protecting the flora/fauna heritage is required.

This proposal aligns with the Society objective of the existing Strategic Community Plan, Council should therefore consider the following risk appetite statement. The City’s defined risk appetite for 1.3 Distinctive Places is articulated through the risk appetite statement as – The City’s Strategic Community Plan acknowledges that a fundamental emerging need in the community is to create accessible, local, place-based services to maintain and improve our commitment to providing Distinctive Places. The City is aware that this would require ongoing financial cost and capital expenditure which is accepted at a moderate level through a demonstrated approach subject to a robust cost benefit analysis being undertaken to mitigate any potential financial loss. The City also acknowledges that segments of the community will resist change and hence have a negative impact on its reputation. In view of this, the City is prepared to accept risk which can be mitigated by sharing risk and appropriate community consultation and engagement through partnering with appropriate agencies. The City acknowledges that it needs to manage the change to a place-based approach and the impact this may have on the current way of doing business. Therefore the City will accept a moderate amount of reputational and financial risk in order to meet these changing community service expectations.

This proposal aligns with the Society objective of the existing Strategic Community Plan, Council should therefore consider the following risk appetite statement. The City’s defined risk appetite for 1.1 Healthy and Active People is articulated through the risk appetite statement as – All sporting activities in which local governments are involved have the potential to cause injury and/or ill health to participants, spectators and third parties. However, the City believes the health benefits for the community outweigh these impacts, and will continue to plan, deliver, fund and permit events and activities which support a healthy and active population – subject to robust risk assessment and management that can be evidenced. The City provides facilities that are for leisure and general recreation activities and as a facility provider; ensures facility design and support the community to utilise the facilities. Therefore the City will accept a low to moderate level of risk to ensure health and safety impacts are reduced to ‘as low as reasonable practicable’ (ALARP) and reputation risk is restricted to low.

Policy Implications

This proposal is assessed under the provisions of the City’s Local Planning Policy 5.3: East Wanneroo.

Financial Implications

The owners have entered into a voluntary and binding legal agreement with the City that secures the respective landowners’ future obligations to pay development contributions on terms that are satisfactory to the City.

The voluntary agreement provides for the payment by the owners to the City a sum of money the City has estimated to be sufficient to address the proportional costs of providing a range of infrastructure to support urban development of the land in the future.

The voluntary payment will be required to be made prior to the issue of new land titles created through subdivision or prior to development of the land under the terms of a development approval.

Voting Requirements

Simple Majority

That Council:-

1. Pursuant to Regulation 50(3)(b) of the Planning and Development (Local Planning Schemes) Regulations 2015 SUPPORTS WITH MODIFICATION Amendment No. 182 to District Planning Scheme No. 2 to allow Retirement Village, Reception Centre, Aged and Dependent Persons’ Dwelling as additional uses at Lot 23 (198) Mary Street, Wanneroo and amends Schedule 2 of District Planning Scheme No. 2 as follows:

|

NO |

STREET/ LOCALITY |

PARTICULARS OF LAND |

ADDITIONAL USE AND CONDITIONS (WHERE APPLICABLE) |

|

|

A40 |

1-40 |

198 Mary Street, Wanneroo |

Lot 23 |

Retirement Village, Reception Centre, Aged and Dependent Persons’ Dwelling

Condition: Development is to be in accordance with an approved Local Development Plan (LDP) for the site. The LDP shall include provisions on the retention of threatened species and communities in consultation with the Commonwealth Department of Agriculture, Water and the Environment.” |

and the Scheme Map accordingly;

2. AUTHORISES the Mayor and the Chief Executive Officer to Sign and Seal Amendment No.182 to the District Planning Scheme No.2 documents in accordance with the City’s Execution of Documents Policy; and

3. FORWARDS the amendment documentation to the Western Australian Planning Commission for its consideration REQUESTING the Minister for Planning to grant final approval of the amendment.

|

1⇩. |

Attachment 1 - Location Plan |

20/115300 |

|

|

2⇩. |

Attachment 2 - Amendment document |

20/115319 |

|

|

3⇩. |

Attachment 3 - Development Concept Plan |

20/196860 |

|

|

4⇩. |

Attachment 4 - Schedule of submissions |

21/5503 |

|

|

5⇩. |

Attachment 5 - EPA Advice - Amendment No. 182 to District Planning Scheme No. 2 |

20/424741 |

|

CITY OF WANNEROO Agenda OF council Members' Briefing Session 9 February, 2021 41

3.4 Consideration of Development Application DA2020/1087 - Single House Addition (Wind Turbine) at 10 Reigate Way Butler

File Ref: DA2020/1087 – 20/575593

Responsible Officer: Director Planning and Sustainability

Disclosure of Interest: Nil

Attachments: 5

Issue

To consider a development application (DA2020/1087) for a Single House Addition (Wind Turbine) at Lot 1265 (10) Reigate Way, Butler (subject site).

|

Applicant |

Wynand van Niekerk |

|

Owner |

Wynand and Estelle van Niekerk |

|

Location |

Lot 1265 (10) Reigate Way Butler |

|

Site Area |

608m2 |

|

DPS 2 Zoning |

Urban Development |

|

ASP 27 Zoning |

Residential |

Background

On 20 August 2020 the City received a development application for a Single House Addition (Wind Turbine) at the subject site. A location plan of the subject site is included in Attachment 1.

The wind turbine was constructed on 8 February 2020, and on 10 February 2020 a neighbour adjoining the subject site raised a query with the City’s Compliance Services unit as to the approvals necessary for such a structure. The neighbour also expressed concerns regarding the visual impact, noise impact, and potential safety issues associated with the wind turbine. Upon investigation by the City’s Compliance Services, it was found that the necessary approvals had not been sought. The applicant then removed the structure prior to seeking approval, and therefore this is not considered a retrospective application.

Detail

The development application proposes the addition of a Wind Turbine to the existing Single House which is a “P” (Permissible) use in the Residential zone. The details of the original development application are as follows:

· A 5.4 metre high wind turbine comprising of a barrel-shaped turbine atop a steel pole.

· The wind turbine is located behind the dwelling and is setback as follows:

o Western boundary: 4.9 metres

o Eastern boundary: 10.9 metres

o Southern boundary: 7.8 metres

Plans of the proposal are included as Attachment 2.

Upon assessment of the development application, it was determined that the proposal incorporated the following departures from the Deemed to Comply provisions of the Residential Design Codes (R-Codes):

· External fixtures which are visible from the primary street.

The proposal also raises concerns with regard to Clause 67 – ‘Matters to be considered by local government’ - of Schedule 2 of the Planning and Development (Local Planning Schemes) Regulations 2015 (‘Clause 67’), particularly with respect to Cl.67(m) and 67(n) which read as follows:

67(m) the compatibility of the development with its setting including the relationship of the development to development on adjoining land or on other land in the locality including, but not limited to, the likely effect of the height, bulk, scale, orientation and appearance of the development;

67(n) the amenity of the locality including the following –

(i) environmental impacts of the development;

(ii) the character of the locality;

(iii) social impacts of the development

These matters are discussed further in the Comment section below.

Consultation

Advertising of the proposal was undertaken by the City in writing to the affected landowners adjoining the subject site, as shown in Attachment 1. Advertising was undertaken for a period of 21 days commencing on 23 October 2020 and closing on 3 November 2020.

Five submissions were received objecting to the proposal, and one in support. A submission summary with Administration’s responses is included in Attachment 3.

The key objections raised in the submissions were in regard to:

· Visual impact of the proposed structure; and

· Noise likely to be generated.

The height of the structure as advertised was a total of 5.4 metres in height. In light of the submissions received and the City’s assessment of the application, the applicant in discussion with Administration agreed to reduce the total height of the structure to 5 metres and submitted amended plans.

The applicant has advised that any further reduction in the height of the structure would prevent the effective operation of the wind turbine. Wind turbines do not operate efficiently where airflow is disrupted by roofs, trees and other structures.

A more detailed discussion on these matters is provided in the Comment section below.

Comment

A wind turbine is not a structure typically associated with single residential dwellings. The City’s records indicate that this may be the first application of its kind within the City of Wanneroo. There are no specific guidance or standards for the assessment of residential scale wind turbines under the current planning framework. However, the wind turbine has been assessed as an External Fixture under the R-Codes.

The R-Codes under section 5.4.4 sets Deemed to Comply standards for External Fixtures as follows:

C4.3 Other external fixtures provided they are:

i. Not visible from the primary street;

ii. Are designed to integrate with the building; or

iii. Are located so as to not be visually obtrusive.

C4.4 Antennas, satellite dishes and the like are not visible from any primary and secondary street.

With respect to provision C4.4 it is arguable that the proposed turbine is alike to an antenna or satellite dish; however, the City considers that these are generally static structures of a different nature to a wind turbine. The City’s assessment has therefore taken the view that the proposed wind turbine should be assessed against provision C4.3 as it establishes a set of criteria more relevant to the form of development.

Visibility of the proposed Wind Turbine from the Primary Street

The proposed wind turbine is located to the rear of the dwelling and sits at a height similar to the top of the roof. The roof of the dwelling also accommodates a solar hot water unit on a raised frame and an evaporative air conditioner. These external fixtures are of a similar height and visual impact to the turbine as viewed from the street. As the top of the turbine will be partially visible from the primary street it therefore requires assessment under the relevant R-Codes Design Principle.

Integration with the existing dwelling

The proposed wind turbine is constructed of dark grey metal which matches the roof of the dwelling, and incorporates a steel pole for its base. The supporting structure is proposed to be set against the rear wall of the dwelling central to the lot. In this regard the structure is designed to integrate with the dwelling and complies with C4.3(ii).

Located so as to not be visually obtrusive

The proposed wind turbine is prominently visible above the roofline of the subject dwelling from the rear and sides. It will be visible from the Outdoor Living Areas of several adjoining dwellings, several of whom have objected to the proposal. Due to its height, appearance and moving nature of the wind turbine, there are multiple objections regarding the appearance of the wind turbine from their properties. Administration notes that these objections have been made after having seen the original structure installed and operational before it was dismantled (as shown in Attachment 4). Administration further notes that the only submission received in support of the proposal was from a property on the opposite side of Reigate Way to the subject site.

In response to the concerns raised, the applicant has agreed to reduce the height of the structure to a maximum of 5 metres in order to reduce the visual impact of the proposal. This is significantly shorter than the wall of a typical two storey house which is permitted in the Residential zone. The wind turbine is similar in height to a typical single storey house which characterises the immediate locality. It is considered that further height reduction or screening would likely prevent the effective function of the device. In light of this, the City considers that appropriate measures have been taken to minimise the visual obtrusiveness of the structure and that it therefore complies with C4.3(iii).

R-Codes Design Principle Assessment

In accordance with Part 2 of the R-Codes, if a proposal does not meet the Deemed to Comply provisions, the City is to exercise its judgement by considering the merits of the proposal having regard to the relevant Design Principles.

Due to being visible from the primary street, the proposed wind turbine does not meet the Deemed to Comply provisions of Clause 5.4.4 – External Fixtures, Utilities and Facilities of the R-Codes C4.3; it has therefore been assessed against the corresponding Design Principle which reads as follows:

P4.1 - Solar collectors, aerials, antennas, satellite dishes, pipes and external fixtures integrated into the design of the building to not be visually obtrusive when viewed from the street and to protect the visual amenity of surrounding properties.

These concerns are also to be considered against Clause 67(m) of the Planning and Development (Local Planning Schemes) Regulations 2015, which encourages all development to be compatible with its locality by way of height, bulk, appearance etc. as outlined above.

While the wind turbine will be visible from the primary street, its visibility

will not impact on the streetscape. Notably the existing fixtures on the roof

of the dwelling (solar hot water and air conditioner) have a similar level of

visibility from the primary street and these fixtures do not raise any concerns

regarding their impact on the streetscape.

Further to this, the modified proposal is significantly shorter than the height of a typical two storey house which is around a 6m wall height and up to 9m to the top of the roof. The wind turbine is similar in overall height to a typical single storey house which characterises the immediate locality. Further height reduction or screening would compromise the functionality of the technology. In light of this, the City considers that appropriate measures have been taken to minimise visual obtrusiveness of the structure and to bring it to a scale compatible with the surrounding development. The wind turbine is therefore considered to satisfy Clause 67(m).

Setbacks

Concern was also raised by a neighbour regarding to the proximity of the wind turbine to their boundary. There are no specific setbacks for a wind turbine as the R-Codes setback requirements pertain only to walls to buildings. The R-codes anticipate that external fixtures are “integrated with the dwelling”, the setbacks of fixtures would then be determined by the setback required for the dwelling to which the fixture is attached.

The proposed wind turbine cannot be assessed as a “Wall” for the purposes of determining a suitable setback under the R-Codes. Administration considered that there may be other local authorities that may have adopted a planning policy regarding wind turbines which could provide some guidance in the consideration of the proposal. The City of Cockburn has adopted Local Planning Policy 5.9 – Renewable Energy Systems, and the City of Joondalup a policy titled Non-Residential Development in the Residential Zone. Both policies specifically allow for pole-mounted small-scale wind turbine systems such as the proposed development. In both cases the policies require that wind turbines be setback from the lot boundaries at least as far as they are tall. In this case the proposed structure is 5 metres high and is setback from all boundaries a greater distance, except the western side boundary where it is setback 4.9 metres. Therefore the proposal would only comprise a minor variation from those policy standards if they were applicable within the City of Wanneroo.

In light of the above, Administration considers that the proposed wind turbine will not unduly impact on the visual amenity of the adjoining properties and therefore satisfies the R-Codes Design Principle and Clause 67 (m) of the Regulations due to its setback and reduced height.

Noise

A number of submissions raised concerns regarding noise generated from the wind turbine, including the level of noise likely to be generated; the disturbing frequency or sustained periods in which the noise would operate; and the likelihood of the noise to compromise sleep and quiet enjoyment of neighbours’ Outdoor Living Areas. These concerns are assessed against Clause 67(m) and (n) of the Planning and Development (Local Planning Schemes) Regulations 2015, which requires consideration of compatibility of the development with the locality, and the amenity and character of the locality.

In light of the concerns raised, the City’s Health Services reviewed the proposal and advised that an Acoustic Assessment against the Environmental Protection (Noise) Regulations 1997 (‘Noise Regulations’) was not required for the proposed wind turbine as the device is similar to other fixtures such as air conditioners. Administration investigated and obtained the manufacturers specification for the proposed wind turbine and this demonstrates that the proposed structure will produce a compliant level of noise. As shown in Attachment 5, the proposed turbine (identified as the ‘Power Tree 1000w’) is expected to generate 30dBA under normal circumstances where the threshold for compliance at night time is 35dBA.

The 30 dBA noise level is a very low level of noise. According to the Federal Government Safework Australia website 30 dBA is equivalent to whispering.

It is also noted that the proposed wind turbine includes a brake which can be employed to turn the turbine off if noise threshold was exceeded for any reason, such as due to a worn or damaged bearing needing repair.

The above information demonstrates that the device will operate well within the limits under the Noise Regulations. In this respect the wind turbine is similar to other, more common noise-generating residential fixtures such as air conditioning units and pool pumps, and is therefore consistent with residential development. The imposition of any noise-related condition imposing further restrictions would therefore not be serving a planning purpose to protect the amenity of nearby residents and is therefore not recommended, nor is it considered necessary to satisfy the requirements of Clause 67(m) and (n) of the Planning and Development (Local Planning Schemes) Regulations 2015 with respect to potential noise impacts.

Conclusion

In light of the above, the application as amended is recommended for approval subject to the following condition. In its modified form, and given that it complies with the Environmental Protection (Noise) Regulations 1997, the proposal satisfies the R-Codes Clause 5.4.4 Design Principles, and Clause 67(m) and (n) of the Planning and Development (Local Planning Schemes) Regulations 2015.

Further to this, Administration notes the environmental benefits of the provision of renewable energy technology such as wind and solar as part of residential development. It is considered that there may be further applications for residential scale wind turbines as community support and desire for renewable energy systems continues to increase. On this basis, Administration is proposing to prepare a policy on residential scale renewable energy systems (such as wind and solar) to provide greater guidance to the community and the City in their assessment and determination.

Statutory Compliance

This application has been assessed in accordance with the Residential Design Codes and the Planning and Development (Local Planning Schemes) Regulations 2015.

Strategic Implications

The proposal aligns with the following objective within the Strategic Community Plan 2017 – 2027:

“3 Environment (Natural)

3.1 Resource Management

3.1.2 Seek alternative ways to improve energy efficiency”

Risk Management Considerations

There are no existing Strategic or Corporate risks within the City's existing risk registers which relate to the issues contained in this report.

Policy Implications

This application has been assessed against the relevant provisions of the following:

· State Planning Policy 7.3 – Residential Design Codes – Volume 2; and,

· Planning and Development (Local Planning Schemes) Regulations 2015.

Financial Implications

Nil

Voting Requirements

Simple Majority

That Council:-

1. Pursuant to Clause 68(2)(c) of the Deemed Provisions of District Planning Scheme No. 2, SUPPORTS the Development Application (DA2020/1087), as shown in Attachment 2, for a Single House Addition (Wind Turbine) at Lot 1265 (10) Reigate Way, Butler, subject to the following condition:

a) This approval relates only to the proposed Single House Addition (Wind Turbine) as shown on the attached plans and does not relate to any other development on the lot.

2. ADVISES the submitters of its decision; and

3. INSTRUCTS Administration to prepare a policy to guide the assessment of development applications relating to small-scale renewable energy systems to support the use of these technologies whilst ensuring that the amenity of the relevant locality is maintained.

|

1⇩. |

Attachment 1 - Location Plan |

21/1839 |

|

|

2⇩. |

Attachment 2 - Plans |

21/1889 |

Minuted |

|

3⇩. |

Attachment 3 - Schedule of Submissions |

21/3854 |

|

|

4⇩. |

Attachment 4 - Photos |

21/3505 |

|

|

5⇩. |

Attachment 5 - Noise Specifications of Turbine Model |

21/43058 |

|

CITY OF WANNEROO Agenda OF council Members' Briefing Session 9 February, 2021 56

Assets

3.5 Response to Petition PT02-06/20 Address the Problems of Volume and Speed of Traffic on Ashley Road & Waldburg Drive, Tapping

File Ref: 3125V05 – 21/14477

Responsible Officer: Acting Director Assets

Disclosure of Interest: Nil

Attachments: 1

Issue

For Council to consider a Petition to address the problem of the volume and speed of traffic on Ashley Road and Waldburg Drive in Tapping.

Background

At the Ordinary Council Meeting on 28 July 2020, (UP02-07/20) Council received a Petition, which was signed by 62 residents representing 50 properties from the Tapping area and reads as follows:

“We the rate payers of Ashley and Waldburg Roads area petition the Council to address the problem of the volume and speed of traffic on these roads.”

Of the 50 properties represented by the signatures on this petition, 26 were from residents along Ashley Road, 10 on Waldburg Drive, six from Titian Way, two from Kandinsky Approach, two from Cozens Road, one from Veronese Pass, one from Atra Avenue, one from Elion Link and one was from a resident on Dowitcher Turn.

Refer to Attachment 1 for a locality map showing the extent of the section of Ashley Road and Waldburg Drive in question.

Detail

Ashley Drive and Waldburg Drive are classified within the City's Functional Road Hierarchy as Local Distributor Roads and have been constructed within road reserve widths varying from 27m to 20m. Currently, both roads operate under the default ‘built-up area’ speed limit of 50km/h.

Ashley Road comprises of a two lane bi-directional Boulevard between Wanneroo Road and Spring Hill, after which, it reduces to a single carriageway through to its eastern end at Pinjar Road. Waldburg Drive is also constructed as a two lane bi-directional Boulevard between Joondalup Drive and Spring Hill/ Galileo Avenue, after which it reduces to a single carriageway to its southern end at Ashley Road.

As Local Distributor roads, both roads provide a link to a number of Local Access Roads and the arterial road network with connections to Wanneroo Road, Pinjar Road and Joondalup Drive.

The majority of properties fronting these roads are residential, however Tapping Primary School and Waldburg Park abuts the northern end of Waldburg Drive and Alvarez Park abuts the central section. Spring Hill Primary School and Jimbub Swamp Park lie on the North West corner of the Ashley Road/Waldburg Drive intersection and there is a retirement village located at the western end of Ashley Road. On-street parking bays and footpaths are provided along both of these roads to cater for school parents, visitors and pedestrians, including children from local schools.

A Transperth bus route (service 467) runs along Waldburg Drive, Ashley Road and Carosa Road, terminating at the Whitfords train station in Kingsley.

Both Ashley Road and Waldburg Drive are identified as local cycling routes in the City’s Cycling Network Plan

In listing the function and characteristics of these types of roads, Liveable Neighbourhoods gives the indicative traffic carrying capacity of a Local Distributor Road as up to 7,000 vehicles per day (vpd).

Consultation

No community consultation has been undertaken in preparing this report.

Comment

In response to concerns raised in the petition from residents relating to speeding and hoon driving on Ashley Road and Waldburg Drive, and following discussion with the petition organiser, traffic counts were carried out in two locations on Ashley Road and one on Waldburg Drive in November 2020. Data was collected to investigate the traffic volumes and vehicle speeds. The results are shown in the table below:

|

Road |

Date |

Location |

Volumes – Average Weekday Traffic (AWT) |

85th Percentile Speed (Speed at which or below 85% of the motorists are driving) |

|

Ashley Road |

November 2020 |

East of Watkins Loop |

3680 |

60.4 km/h |

|

West of Carosa Road |

3646 |

57.1 km/h |

||

|

Waldburg Drive |

South of Elion Link |

1874 |

55.8 km/h |

A detailed analysis of the vehicle travel speeds is summarised below:

|

|

%age of vehicles |

||

|

Speed (kph) |

Ashley Road |

Waldburg Drive |

|

|

East of Watkins Loop |

West of Carosa Road |

South of Elion Link |

|

|

<20 |

0.0 |

0.3 |

0.4 |

|

20-30 |

0.3 |

1.1 |

1.5 |

|

30-40 |

1.9 |

7.4 |

9.4 |

|

40-50 |

27.7 |

43.3 |

45.9 |

|

50-60 |

53.8 |

40.0 |

37.1 |

|

60-70 |

14.8 |

7.3 |

5.1 |

|

70-80 |

1.3 |

0.5 |

0.4 |

|

>80 |

0.2 |

0.1 |

0.2 |

Further analysis of the traffic count results identified that:

· Traffic volumes are at the lower end of the accepted capacity range for the functionality of the roads;

· For Ashley Road, East of Watkins Loop:

o 70% of vehicles are travelling above the default 50km/hr built up area speed limit, with the majority of vehicles travelling between 50 and 60kph;

o Westbound traffic has an 85%ile speed of 61.6 kph, with vehicle speeds in excess of 80kph throughout the day.

o Eastbound traffic has an 85%ile speed of 58.7 kph, with vehicle speeds in excess of 80kph throughout the day.

o An average of 0.15% of all vehicles, or 17 vehicles per day are exceeding 80kph

· For Ashley Road, West of Carosa Road:

o 48% of vehicles are travelling above the default 50km/hr built up area speed limit, with the majority of vehicles travelling between 40 and 50kph;

o Westbound (Downhill) traffic has an 85%ile speed of 58.5 kph, with vehicle speeds in excess of 80kph throughout the day.

o Eastbound (Uphill) traffic has an 85%ile speed of 54.9 kph, with vehicle speeds in excess of 70kph throughout the day.

o An average of 0.08% of all vehicles, or 8 vehicles per day are exceeding 80kph

· For Waldburg Drive:

o 43% of vehicles are travelling above the default 50km/hr built up area speed limit, with the majority of vehicles travelling between 40 and 50kph.

o Northbound (Uphill) traffic has an 85%ile speed of 54.4 kph, with vehicle speeds in excess of 70kph throughout the day.

o Southbound (Downhill) traffic has an 85%ile speed of 56.7 kph, with vehicle speeds in excess of 80kph throughout the day.

o An average of 0.20% of all vehicles, or 4 vehicles per day are exceeding 80kph

The above data analysis shows that a small percentage of drivers were travelling well above the built up area speed limit. Speeding and hooning such as this are unfortunately common on roads throughout the City and are primarily related to poor driver behaviour. The City does not have the authority to legislate the law in this regard, with the WA Police being the responsible authority to ensure that motorists comply with the provisions of the Road Traffic Act 1974 and associated Road Traffic Code 2000.

Administration has completed the assessment of Ashley Road from Watkins Loop to Pinjar Road and Waldburg Drive from Galileo Avenue to Ashley Road in accordance with the City's Local Area Traffic Management Policy, the Policy guiding the decision making process to determine whether roads require infrastructure changes or increased policing. The assessment considers a range of factors including:

· Speed data;

· Traffic volume including commercial vehicle volume;

· Crash history;

· Road design and topography;

· Presence of vulnerable road users such as pedestrian/ cyclists; and

· Activity generators such as schools/ retail/ train stations, etc.

A review of the Main Roads crash history database for reported crashes between 2015 to 2019 identified 1 crash on Ashley Road between Wanneroo Road and Waldburg Drive, 4 crashes on Ashley Road between Waldburg Drive and Pinjar Road and 3 on Waldburg Drive between Spring Hill and Ashley Road. Three of the crashes on Ashley Road occurred at intersections with none identified as being potentially due to speed. The crashes on Waldburg Drive all occurred in wet weather, each with a single vehicle involved.

The Traffic Management Policy requires a score of over 60 to qualify for traffic management treatments to ensure that funding is allocated to the projects that will achieve the most road safety benefits, while scores between 30 and 60 points warrant attention to law enforcement and driver education to reduce inadvertent non-compliance.

The results of the Traffic Management Scheme Assessment for each road is:

|

Road |

Location |

TMS Score |

|

Ashley Road |

East of Watkins Loop |

37 |

|

|

West of Carosa Road |

41 |

|

Waldburg Drive |

South of Elion Link |

19 |

While these roads all score points in the assessment for the 85%ile speed, the topography (steep hill) and their use as a local bicycle route, the low traffic volume for this category of road, low crash record and absence of activity generators all serve to indicate that the allocation of the limited funding available for the construction of traffic management treatments cannot be justified at this time.

Whilst the construction of traffic treatments is not supported in this instance, it is recognised that there is a requirement for driver education on Ashley Road to address the high incidence of vehicles driving above the 50kph built up area speed limit. Therefore, Administration proposes to:

· Deploy the Speed Advisory Trailer on Ashley Road and Waldburg Drive to help educate motorists on the default built up area speed limit of 50km/hr;